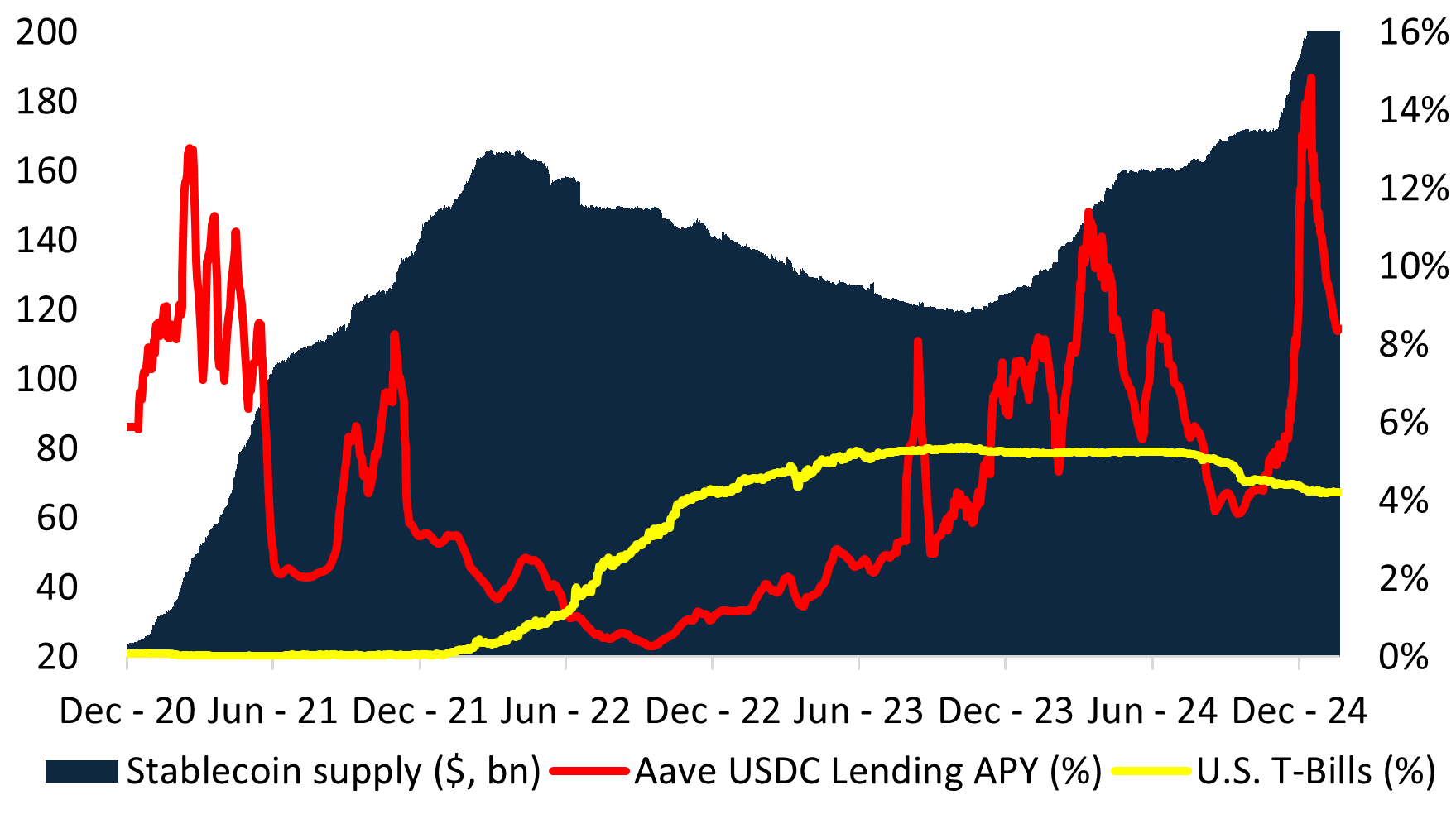

Stablecoins are hailed as the cornerstone of the crypto ecosystem, offering stability in a volatile market and promising to overhaul payment rails. However, underneath the surface, stablecoin supply is fundamentally driven by on-chain yield.

In the last two market cycles, stablecoin supply has expanded and contracted in direct response to yield. When on-chain yields exceeded U.S. Treasury Bills (T-Bills), demand for stablecoins soared – most notably following DeFi Summer, when total supply skyrocketed from less than $10 billion to over $150 billion in just two years. By contrast, when on-chain yields fell below the U.S. dollar risk-free rate, stablecoin supply contracted just as quickly as shown by the decline between 1Q22 to 3Q23. Recent growth is explained by the high on-chain yields due to contango crypto markets.

The Problem: Stablecoins Aren’t Stable

In the search for yield, stablecoins have evolved into on-chain hedge fund strategies (‘yield-bearing’ stablecoins’), as shown by the growth of Ethena and others. In this structure, the yield is distributed via two tokens – a conventional stablecoin, which can be staked into a second token to earn the revenue of the underlying collateral. This structure has emerged because issuing a “stable” coin avoids classification as a security or a collective investment scheme, which would require regulatory approval.

By framing these products as “quasi stablecoins”, issuers navigate regulatory loopholes – however this comes at the cost of introducing systemic risks, including:

- De-Peg Events – If the portfolio underperforms, liquidity runs force issuers into fire sales, destabilizing the entire ecosystem.

- Misaligned Incentives – Issuers chase higher yields to attract TVL, often pushing portfolios into riskier assets.

- Regulatory Uncertainty – Wrapping hedge fund strategies into «quasi-stablecoins» creates compliance risks, leaving investors without legally defined claims on underlying assets.

As Steakhouse Financial notes in its Stablecoin Manual:

«Stablecoins are subject to liquidity and solvency constraints. To function, a stablecoin must meet both of these hard constraints.»

However, yield-bearing stablecoins inherently stress these constraints. The competition to attract TVL leads to two systemic consequences:

- Crowding into the same yield opportunities, reducing returns

- Increasing systemic fragility, heightening de-peg risks

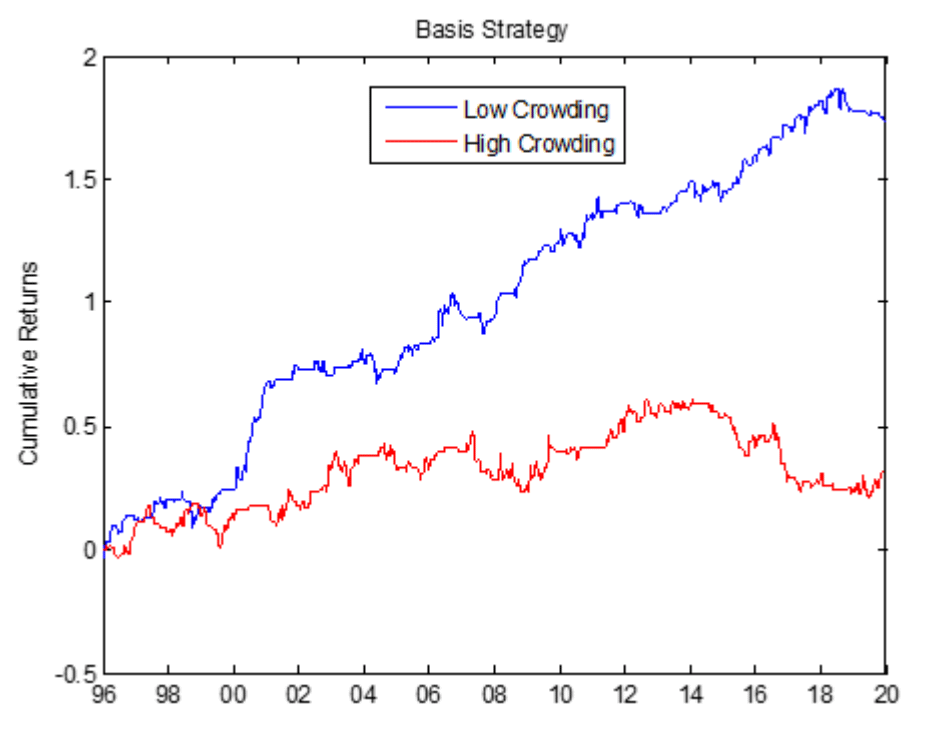

The Consequences: Lower Returns & Increased Systemic Risk

By setting a $1 liability, the investable universe of yield-bearing stablecoins are technically restricted to zero-duration collateral. This funnels assets across all issuers into the same trades, leading to diminishing returns. Historically, crowded trades, such as basis trades in commodities markets, have consistently underperformed. The effects of market crowding have extensively been studied in academia to result in in lower returns at higher risk. For instance, the basis-trade in commodities market has resulted in consistently in lower returns over a 24-year period.

The relentless pursuit of yield pushes stablecoin issuers further up the risk curve. In doing so, they introduce systemic fragility, where a single weak link in the collateral pool can cause a cascading failure.

Additionally, stablecoin issuers rely on leverage and rehypothecation to fuel adoption. This creates a system where stress in one part of the collateral structure can trigger cascading failures. The 2022 stETH discount, the collapse of UST, and the recent de-pegs of USD0++ and USDz all reflect this vulnerability.

The Solution: Liquid Yield Tokens (LYT)

At Midas, we’ve built a fundamentally new approach to tokenized yield – Liquid Yield Tokens (LYT).

Instead of forcing yield into fragile stablecoin wrappers, LYT introduces a dedicated framework for on-chain investment strategies:

- Floating Reference Value – Unlike stablecoins, LYTs do not have a fixed $1 peg. Their value fluctuates based on performance, eliminating de-peg risks.

- Expanded Investment Universe – Removing the $1 liability constraint unlocks access to a broader range of yield-bearing assets, optimizing risk-adjusted returns.

- Professional Risk Management – Each LYT is actively managed by institutional-grade risk curators, dynamically adjusting to market conditions.

- Shared Liquidity & Atomic Redemptions – LYTs share a common liquidity pool, removing the need for fragmented LPs and enabling seamless DeFi integration.

- Reward Farming at Scale – LYT holders benefit from additional incentives across protocols like Plume, Etherlink, and TAC.

How Liquid Yield Tokens (LYT) Work

Liquid Yield Tokens (LYT) are issued through Midas’ open and composable infrastructure. This approach separates the roles of issuer and risk manager, allowing users to benefit from customised risk curation.

The collateral of each token is managed by dedicated risk managers who operate under specific mandates and reported transparently on-chain. The risk manager dynamically allocates collateral to the best opportunities, adapting to changing market conditions to capture alpha while managing risks.

LYTs are issued through Midas’ open, composable infrastructure. Unlike stablecoins, LYT tokens clearly separate the roles of issuers and risk managers. Each LYT is managed by dedicated risk curators who dynamically allocate collateral to the best risk-reward strategies.

Every LYT is issued as a permissionless ERC-20 token, making it fully composable with the broader DeFi ecosystem.

Across all LYTs, Midas has implemented shared liquidity pools for instant redemptions. Instead of requiring liquidity mining incentives, LYTs are designed for capital-efficient scaling and deep DeFi integration. Protocols like Morpho, Euler, and Anja already support LYTs.

Introducing Three New LYTs

Today, we’re launching mRE7YIELD, mEDGE, and mMEV, each risk-curated by top-tier firms.

mRE7YIELD – Risk-Managed by RE7 Capital

RE7 Capital is a research-driven digital asset investment firm focused on DeFi yield and liquid alpha strategies. With a proven institutional-grade approach, mRE7YIELD delivers actively managed exposure to structured yield products.

- Current APY: 20.83%

- Institutional-grade structured yield strategies

- Actively managed to capture market inefficiencies

mEDGE – Risk-Managed by Edge Capital

Edge Capital is a leading digital asset hedge fund and DeFi liquidity provider, managing capital for institutional investors and crypto foundations. Their market-neutral strategies are designed to generate consistent, high-risk-adjusted returns.

- Current APY: 20.12%

- $230M+ AUM

- Four-year audited track record with a 3.5 Sharpe ratio

mMEV – Risk-Managed by MEV Capital

MEV Capital is an investment firm specializing in risk-managed, DeFi-native yield extraction strategies. With expertise in liquidity provisioning and structured yield products, it provides access to high-yield opportunities in decentralized markets.

- Current APY: 17.53%

- $350M+ AUM

- 10+ curated public vaults across multiple chains

You can also find a concise overview of how Liquid Yield Tokens (LYTs) work in our Twitter thread and LinkedIn post.

For media coverage, check out the press releases on The Block & Coindesk.

We welcome any questions or feedback you may have.