By Fabrice Grinda and Matias Barbero

As we covered in FJ Labs’ Crypto Credentials, we’ve been putting a lot of thought into crypto marketplaces, especially on how traditional marketplace dynamics can change through the use of token incentives.

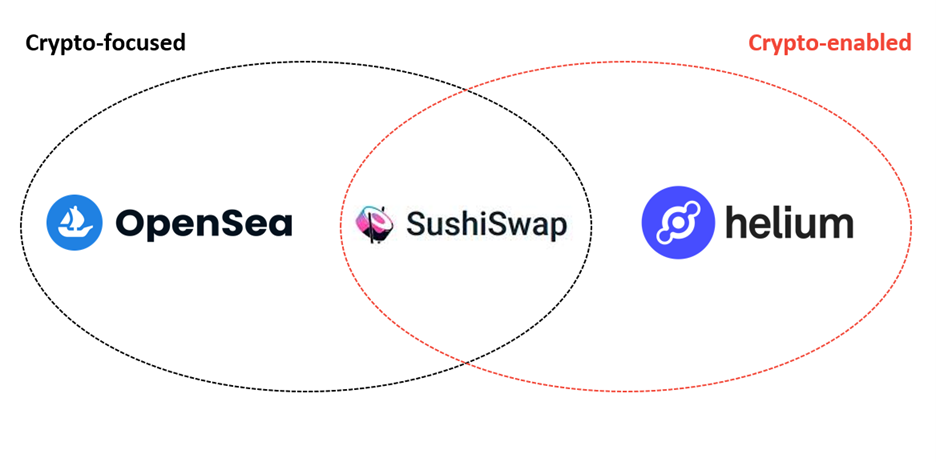

There are crypto-focused and crypto-enabled marketplaces, which may or may not overlap. The former is a marketplace for crypto assets, while the latter is usually a non-crypto marketplace (all offline marketplaces for instance) that uses crypto mechanics. Crypto-enabled marketplaces do not require users to buy tokens to use the platform. The crypto elements are typically abstracted from the use of the platform to maximize adoption.

Opensea, one of the largest NFT marketplaces, falls into the first camp. Users trade crypto assets, NFTs, but its underlying mechanics are not that different from, say, eBay, a centralized C2C marketplace. By comparison, Helium, is a two-sided marketplace connecting providers of wireless networks with buyers interested in using it to power different IoT devices. It deals with physical telecom equipment, not crypto assets, however, it uses token incentives making it crypto-enabled. At the intersection of this Venn diagram, we find projects such as Sushiswap or Opyn, a token exchange and defi derivatives platform, respectively, which use crypto mechanics to operate crypto-focused marketplaces.

Today crypto-focused marketplaces are more common, but over time crypto-enabled marketplaces should become the far larger segment.

In this post, we’re going to focus on crypto-enabled marketplaces and talk about how token incentives and crypto ecosystems can be very powerful tools for entrepreneurs building marketplaces. We will also highlight that using crypto mechanics should not be an end in itself and that token incentives have varying degrees of success based on the specifics of the marketplace.

Much has been written about the marketplace´s chicken and egg problem, or how to bootstrap liquidity at inception when there are barely any users on either side. There are plenty of tactics and playbooks to kick-start feedback loops: spend lots of money on marketing, build a sales team, build a SaaS tool and give it away for free, focus relentlessly on the “hard side,” subsidize through coupons, referrals, among other things. Token incentives are one of the most interesting and unexplored options in today´s toolkit.

Tokens to attract talent and have lower operating costs

In traditional marketplaces, startups must hire many richly compensated people in cash and equity to cover all of the functions of the company: product, development, sales, marketing, finance, customer care, etc.

Crypto-enabled marketplaces can behave like open-source projects, outsourcing high-impact work to the community. You can end up with much larger virtual teams and scale a lot faster while having much lower fixed costs as you use the unsalaried community to do a lot of the heavy lifting.

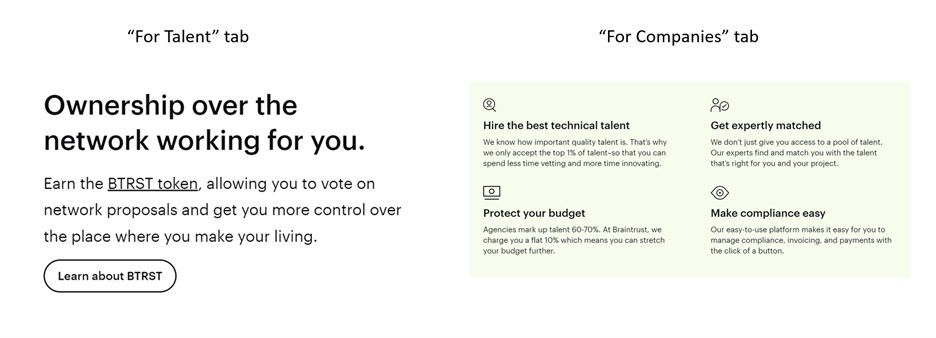

Given this lower cost structure, crypto-enabled marketplaces can often undercut traditional marketplaces in terms of take rate. For example, Braintrust, a crypto-enabled tech talent staffing marketplace, can charge clients an industry-low 10% fee. In fact, it actually pays their talent a negative take rate by rewarding them with tokens. Note that crypto elements are hidden form the demand side and there’s no mention of tokens or anything crypto focused: it’s all about hiring top quality talent.

For contributors, the rewards are also more immediate than if they were employees in traditional companies. Tokens can vest sooner, and the liquidity event is much faster than with traditional tech companies which are taking longer and longer to go public.

Users and contributors can not only be owners in an economic sense, but also from a voting and governance perspective. This decentralization of decision making, further aligns incentives and creates a setup of constant innovation that’s effectively managed by the community.

Tokens as a customer acquisition strategy

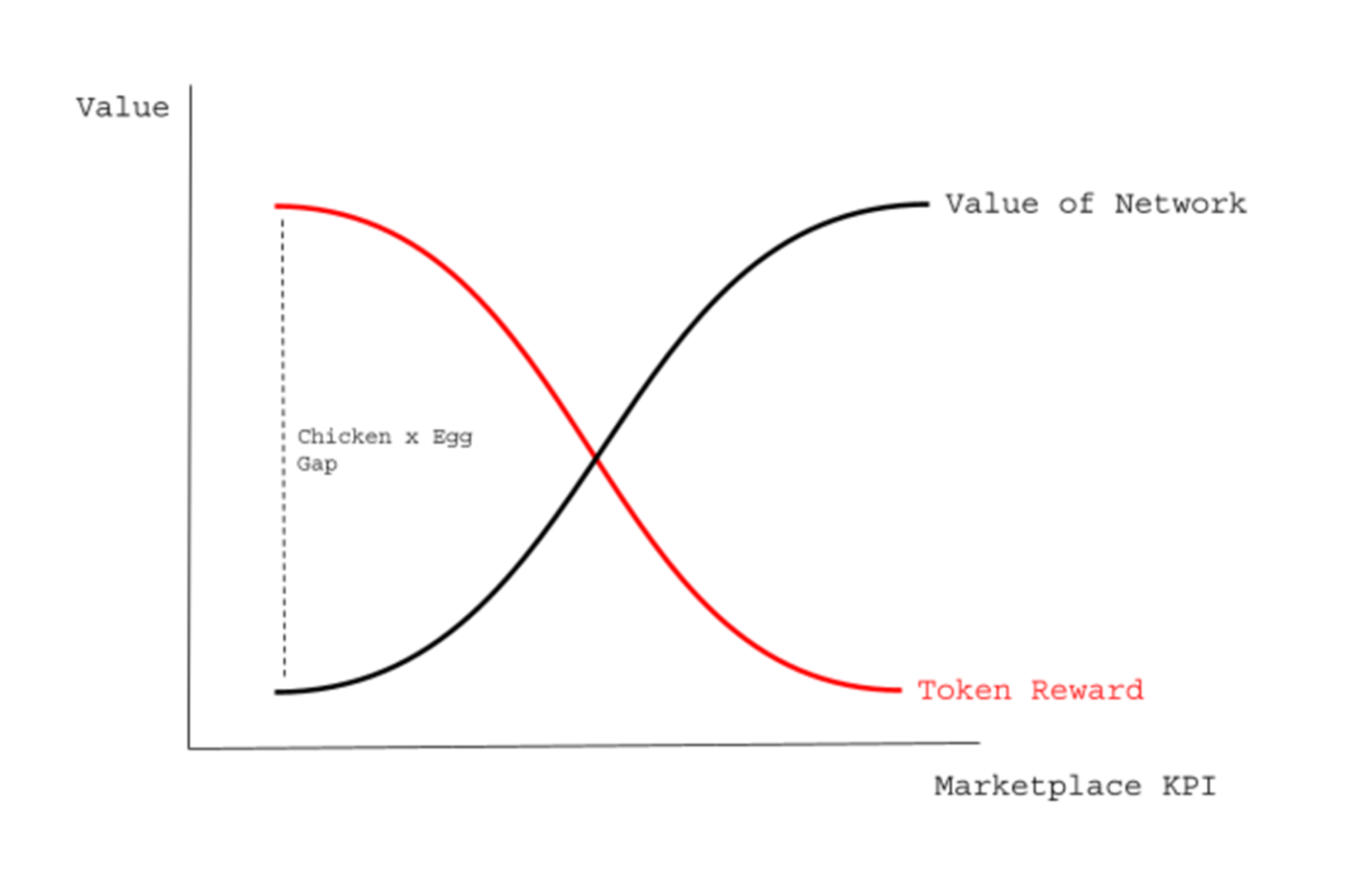

Think about a traditional listing marketplace that’s just getting started. Buyers will not go to the platform as there are no items on sale, and sellers are not incentivized to participate as no one is there to purchase. As a result, startups often spend a large percentage of the funds they raise on sales and marketing to scale. Giving high token rewards early in the life of a marketplace can be a viable alternative. Note that token rewards should be highest when the overall value of the network is lowest; they come in to fill the ‘chicken and egg gap’ from the get-go and should be tapered as the network effects kick in.

With token incentives, marketplaces can bootstrap one or both sides of a marketplace without appealing to heavy discounts or exorbitant marketing expenses, achieving better unit economics through a lower CAC further allowing them to undercut traditional marketplaces with lower take rates.

Instead of spending money in sales and marketing, you can provide rewards directly to the supply and demand sides of the marketplace. For instance, you can design the equivalent of giving stock options to early Uber drivers for joining the network, and for bringing other drivers and passengers.

Tokens to hyperscale

In certain cases, you can use token rewards to hyperscale the marketplace. Common wisdom in Web2 marketplaces calls for focus on “atomic networks”, very specific and niche networks as opposed to broad and all-encompassing rollouts. Andrew Chen provides great examples in his Cold Start Problem book. He mentions Uber using a hyper-narrow atomic network in the beginning to create enough density before focusing on larger regions; something like “5pm at the Caltrain Station at 5th and King Street”. Through a bottom-up approach, crypto marketplaces can be expansive and borderless while also reaching atomic networks at scale.

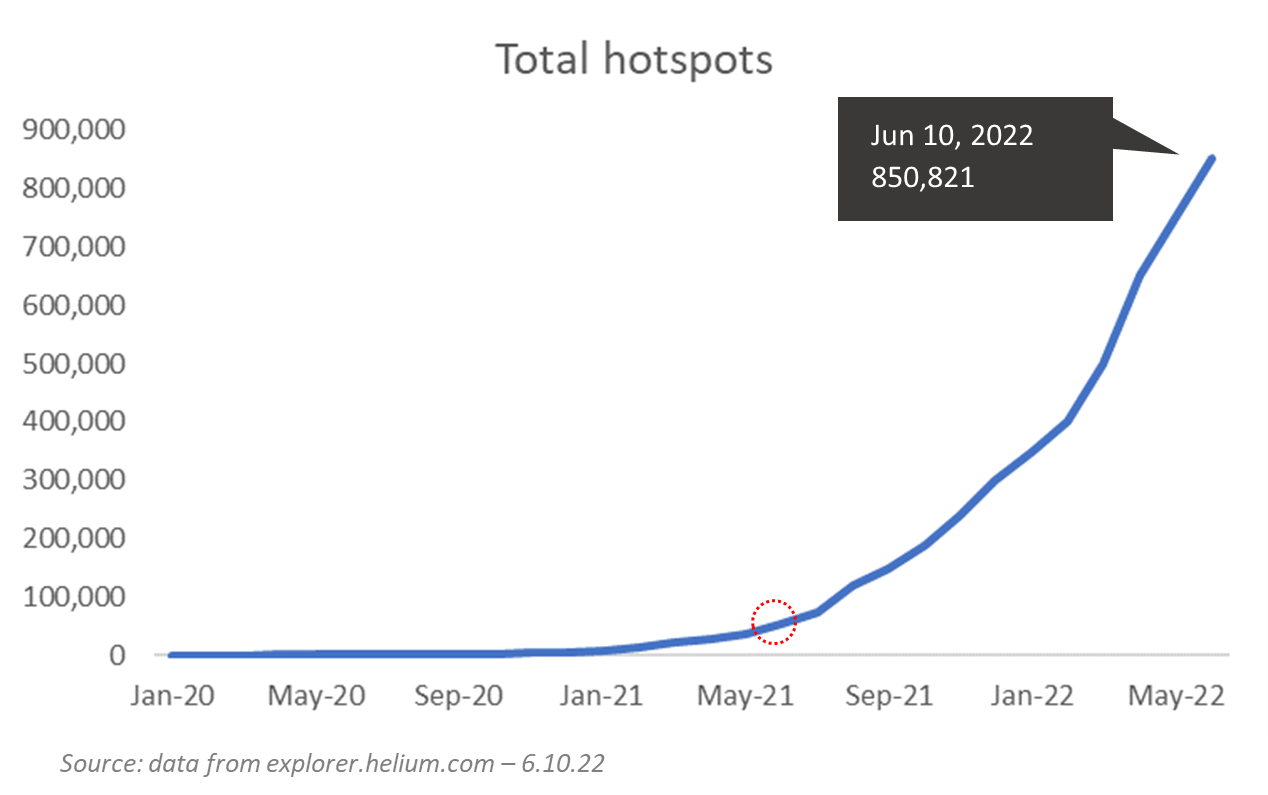

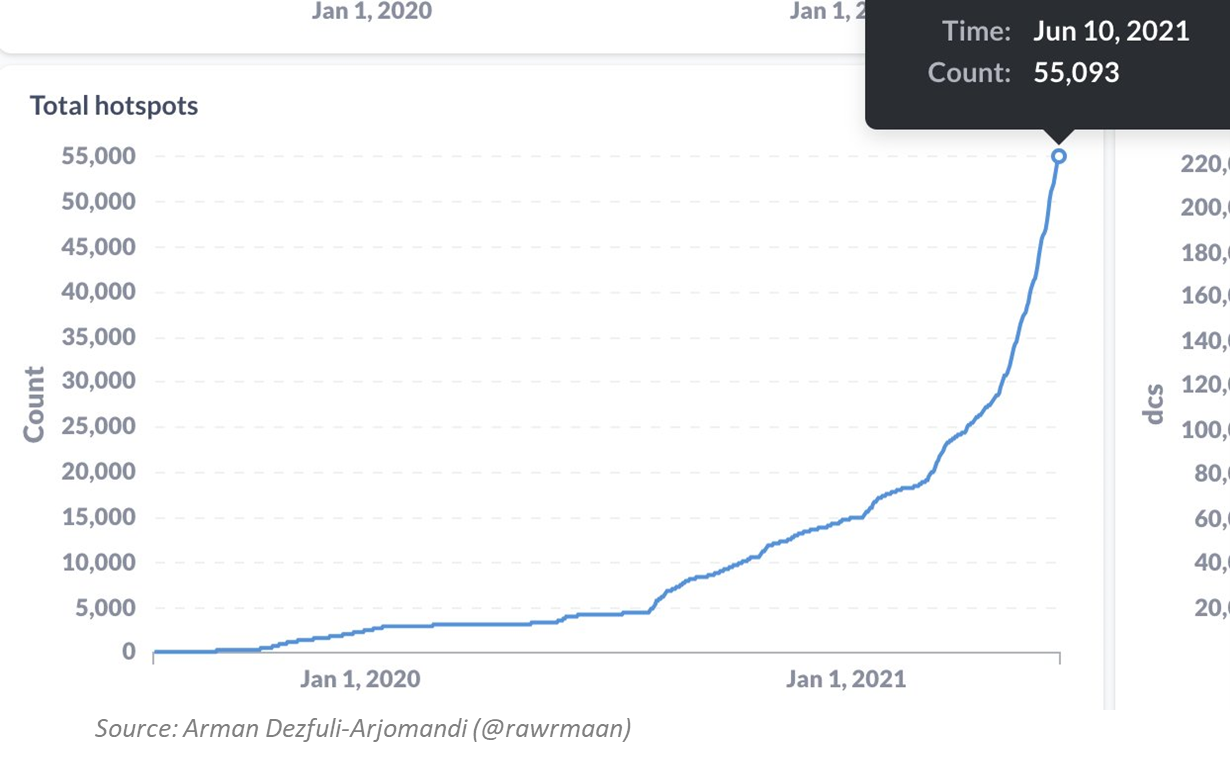

Helium had been around for a while before it introduced token incentives in 2020. Its main premise is to deploy hotspots in people’s homes to create a wireless network in a decentralized manner. This feat would otherwise require billions of dollars in capex from a telecom company. The graph to the left shows the exponential growth in total hotspots installed to date driven by a token incentive mechanism. Nodes went from zero at the start of 2020 to 55k+ just 18 months later.

A word of caution

Incentive mechanisms within a crypto ecosystem need to be well thought through to avoid attracting the wrong customers who are in it just for the rewards. Tokenomics can make or break a project. Web2 marketplaces also suffer from this practice when they rely too heavily on discounts to attract early customers. That said, with a robust design you can reward sticky behavior and benefit from healthier cohorts; those receiving the token incentives are enticed to let their rewards compound as they keep contributing towards an increasingly valuable network.

Also consider a potential “endowment effect” at play. Through economic and voting power, tokens could imbue users and contributors with a sense of belonging, attributing more value to the network than what it would otherwise have.

Centralized, decentralized or hybrid?

Crypto ecosystems are a powerful tool that could have varying degrees of effectiveness in different settings. Centralized marketplaces play an important role in verifying the quality of suppliers and consumers, providing customer service, improving the product, investing in alternative marketing channels, to name a few. Some (or even all) could be decentralized but that doesn’t mean there’s always a good reason to do so.

Some entrepreneurs might choose to go fully decentralized, while others might remain centralized (and could co-exist with crypto equivalents). They could also go with a hybrid model: using token incentives for certain aspects of the business while running the rest in a centralized fashion and on Web2 rails. Taking it further, we shouldn’t expect only mere transitions from Web2 to Web3 marketplaces as crypto ecosystems will unleash new, unseen models that still cannot be mapped using today’s lens.

An example of a hybrid model is our portfolio company Delphia, a mobile investment platform that uses customer data to better caliber its algorithm. In essence, Delphia is both a traditional fintech company, allowing retail investors to invest their money in an easy manner, and a conventional hedge fund, using data to power their predictive models. There is nothing decentralized or crypto in that.

However, hedge funds typically buy data from data providers (not consumers directly), and this data quality doesn’t even come close to that of companies such as Facebook or Google. So, Delphia turned to tokens to incentivize their users to contribute personal data in exchange of token rewards. There’s an additional benefit: the larger the number of contributors, the better the algorithm will get, and the superior the investment returns of Delphia users will be. In this example, Delphia chose to use a crypto ecosystem only for sourcing data.

Factors to consider

We can think of the degree of effectiveness of a crypto ecosystem, and more precisely, of token incentives along several spectra. Each spectrum can be looked at in a vacuum but, all these variables will all interact with each other which is why it’s hard to predict in which settings tokens could be more successful.

Is your marketplaces demand or supply constrained?

Most marketplaces are demand constrained. Supply is usually easier to acquire because it’s financially motivated to be on the platform. Even if there is no liquidity, if there is no cost to being on the platform, why not join? On top of that, acquiring the demand side typically involves paying the Google and Facebook “tax” of online marketing.

However, there are many exceptions. Rebag, one of our portfolio companies selling high end designer handbags, was famously supply constrained for most of its early history with 100% of the supply on the site selling out.

Whichever case you fall into, figure out the more constrained part of your marketplace and focus incentives on that side.

Are your users tech savvy?

Given the technical complexity of the crypto space, to date the most successful crypto-enabled marketplaces have worked at incentivizing tech savvy contributors. Braintrust for instance uses tokens for its technically savvy developers (their supply side), but hides all mention of crypto from its demand side clients. In this case, the supply side is more likely to know how to handle and value the token incentives than the more traditional enterprise clients on the demand side.

What’s the nature of the marketplace’s transaction / what’s being asked from the participants?

On one side of the spectrum, we might have a very easy ask, like in Helium (“hey just buy a hotspot, install it, and forget about it while you earn tokens”). On the other side, you may have something like Masterclass, where celebrities need to put on a ton of effort to create and film the courses, so even if they get tokens in return, they may not bother. All else equal, tokens should become less effective as the effort required to participate in the marketplace increases.

How homogeneous is the target supply/demand you want to attract?

You could succeed at attracting hosts for your, say, crypto-enabled Airbnb, but what type of properties are they bringing on-line? There’s a wide dispersion of types of listings they could bring but not all will be useful for your target demand, which will result in no transactions, and churn on both sides.

What’s next for crypto-enabled marketplaces?

Marketplaces have been FJ Labs’ bread and butter since inception. Even though we started investing in crypto years ago, the industry’s maturity was such that we focused our efforts on other areas such the infrastructure layer, knowing it would take require some cycles before the timing was right for greater adoption of crypto-enabled marketplaces.

However, we feel the time has finally come. There are several projects in this category already, and we are about to witness an explosion in the use of this model. We are beyond excited to see what entrepreneurs will build in this space!