FJ Labs’ purpose is to improve the human condition through technology.

Technology led growth

Technology has been the primary driver of the extraordinary transformation in quality of life over the past 200 years. Until 200 years ago, the history of the human condition was one of struggle and stagnation. Most people were farmers working over 60 hours a week to barely make ends meet, going hungry multiple times per year.

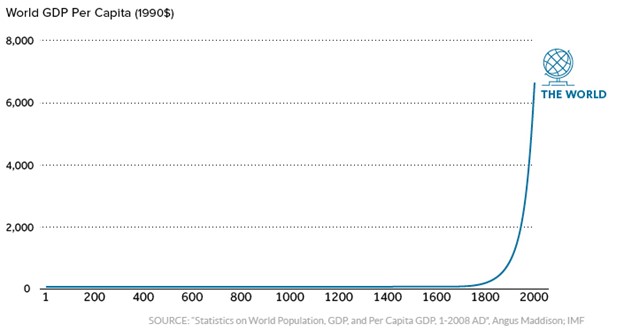

Starting with the first industrial revolution, we saw an explosion in technology-led human productivity fundamentally changing quality of life for the better. For each key invention like the steam engine, the light bulb, cars, planes, instant photography, or the transistor, entrepreneurs like Cornelius Vanderbilt, Thomas Edison, Henry Ford, Herb Kelleher, Edwin Land, Bill Gates and Steve Jobs commercialized it transforming human life as we know it. As a result, GDP per capita exploded.

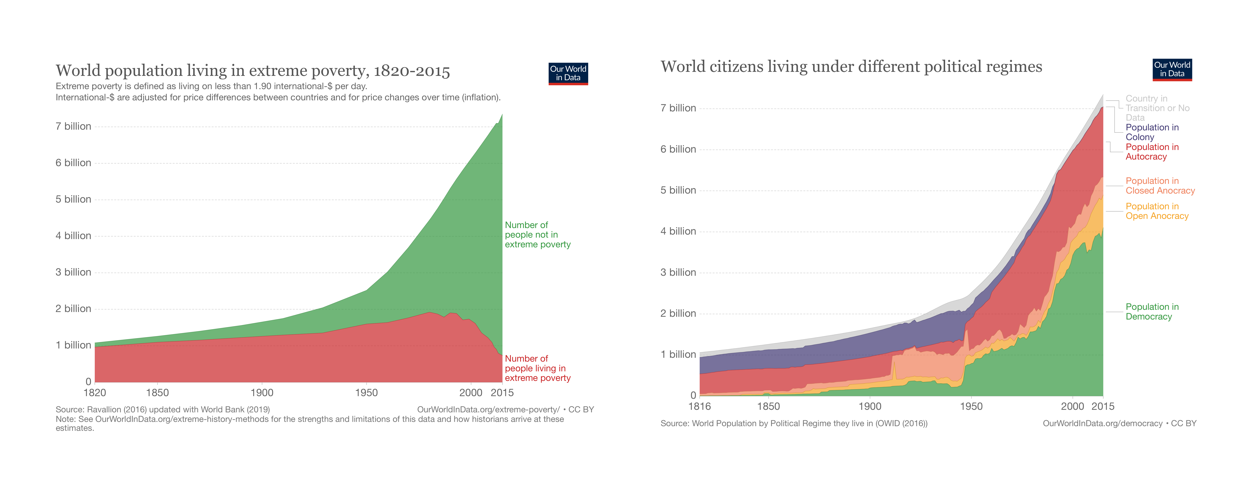

In 1820, 89% of the world lived in extreme poverty. Today it’s 10%. Over a billion people came out of poverty in China and India alone in the last 40 years. Most people now live in democracy.

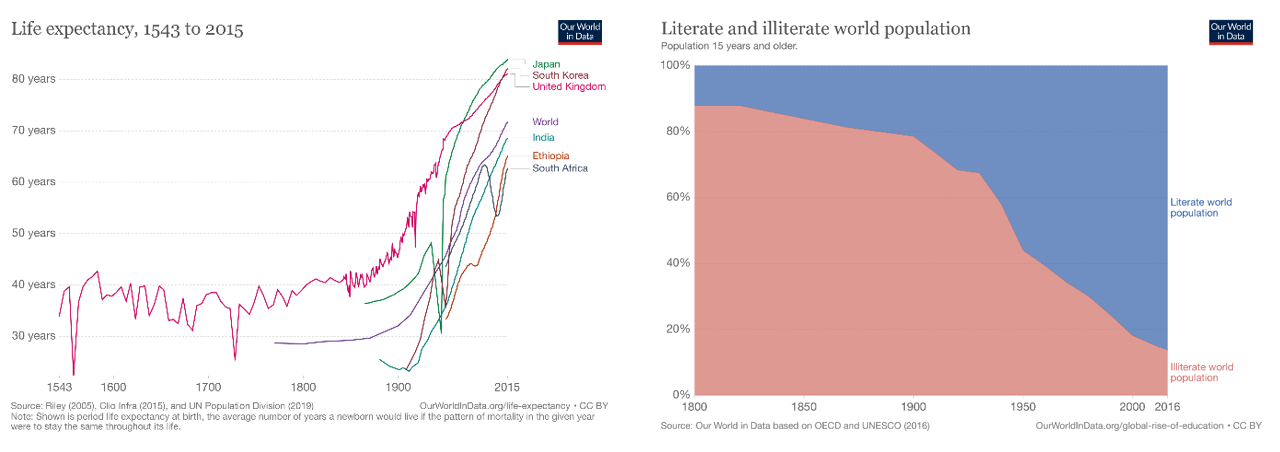

In 1820, live expectancy was 29, today it is 72. In 1820, the world literacy rate was at 12%, today it is 86%.

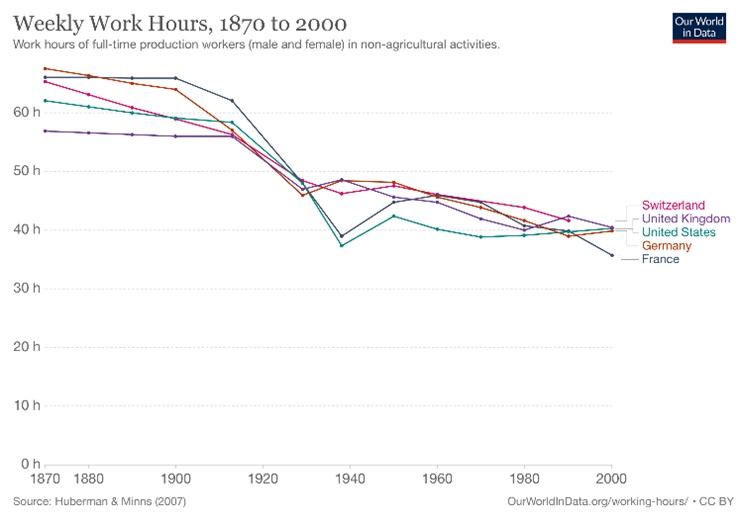

In 1870, the average workweek was over 60 hours, today it is 38.

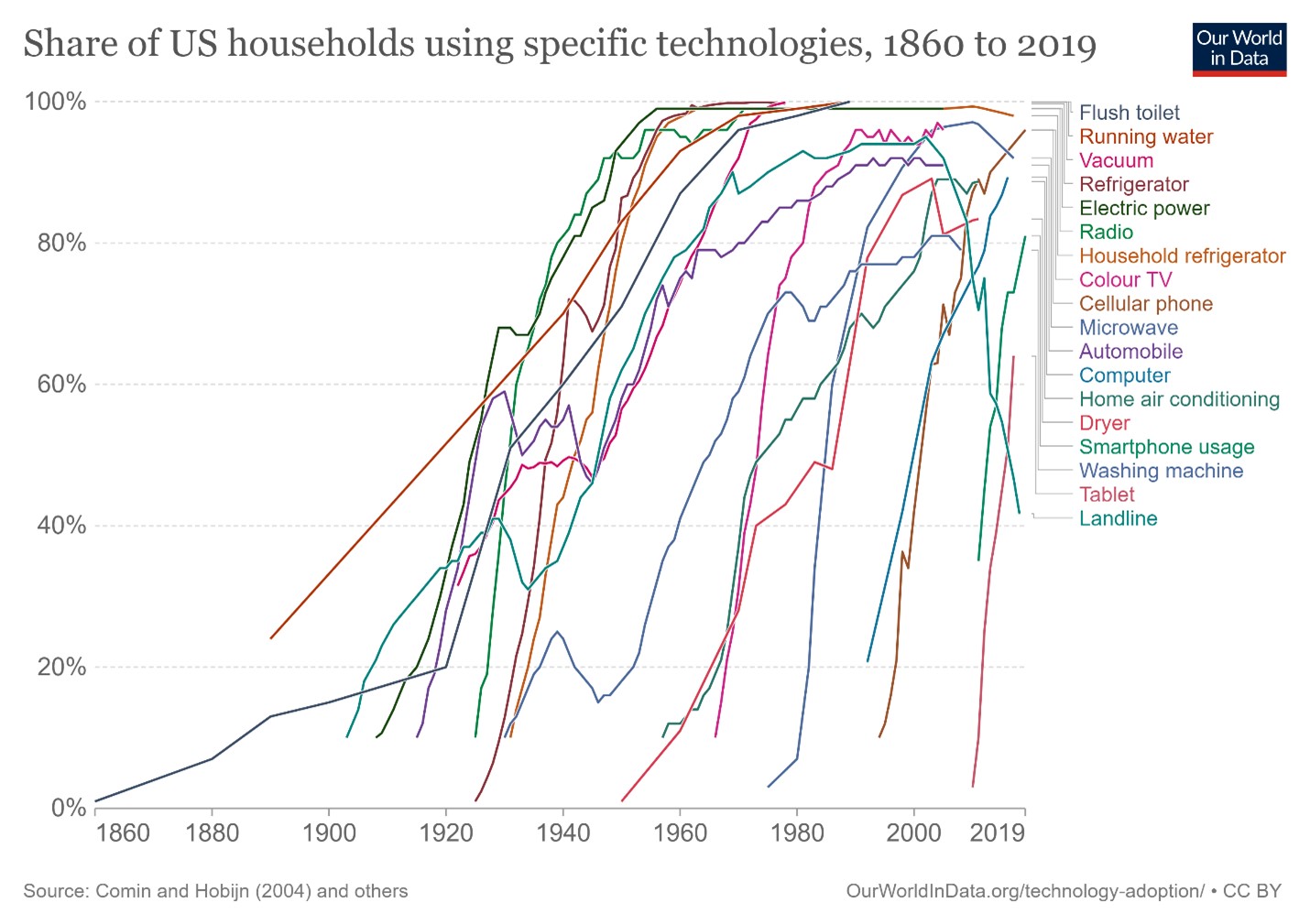

Because of technology the average household in the West has a quality of life unimaginable to the kings of yesteryear. For each new technology, there is a short period during which only the Gordon Gekkos of the world have access to it. Multi thousand-dollar cell phone from the late 1980s are such an example with their enormous form factor, 30 minutes of battery life, awful voice quality, while costing several dollars per minute of talk time. However, because of economies of scale, network effects, positive feedback loops in knowledge and manufacturing (also referred to as learning curves), and entrepreneurs’ desire to address the largest possible market and impact the world as massively as possible, these new technologies rapidly democratize.

This has led to a massive increase in equality of outcomes. 100 years ago, only the rich went on vacation, had a means of transportation, indoor plumbing, or electricity. Today in the West almost everyone has electricity, a car, a computer, and a smartphone. Almost everyone goes on vacation and can afford to fly. We take for granted that we can travel to the other side of the world in hours and that we have access to the sum total of humanity’s knowledge in our pockets in addition to having free global video communications. A poor farmer in India with a smartphone has more access to information and communications than the president of the United States had a mere 30 years ago. These are remarkable feats.

Challenges Remain

Despite all this progress, we still face tremendous challenges. Three fundamental problems come to mind:

- Inequality of opportunity

- The mental and physical wellbeing crisis

- Climate change

Inequality of Opportunity

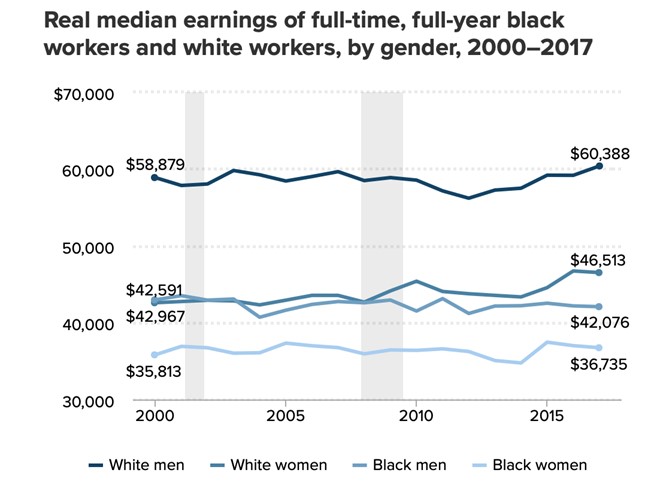

We still have miles to go on equality. In the US white men make 23% more than white women, 30% more than black men, and 39% more than black women, a difference that persists even when accounting for education differences.

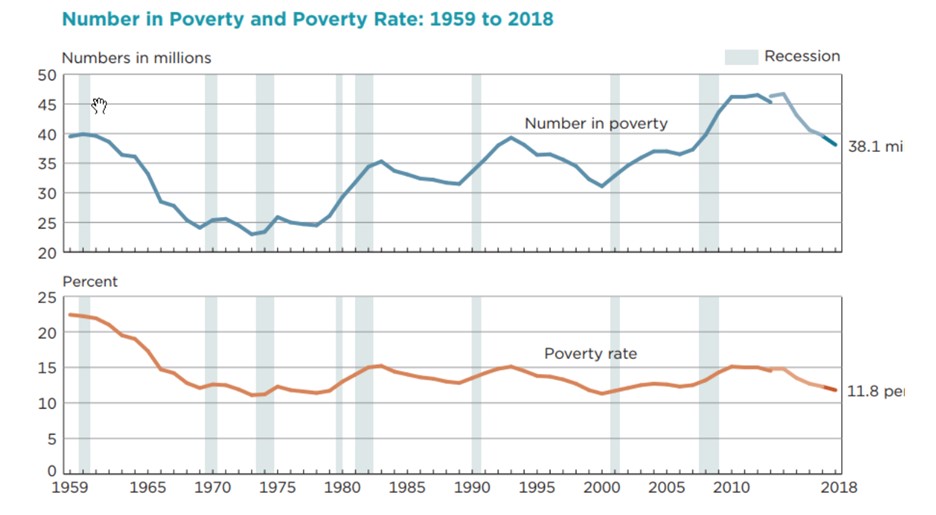

12% of Americans still live in poverty.

It’s expensive to be poor and you often end up paying more than the middle class and the rich. The poor can’t afford a security deposit on rent and often must rent by the night. They can’t afford transportation, storage or the upfront commitment so pay more for food as bodegas are up to 37% more expensive than Costco. The poor are penalized by the financial system for being poor with fees such as $12 / month if your account balance is below $1,500. As a result, 25% of US households are unbanked or underbanked, further shutting them out of wealth generation systems like the stock market.

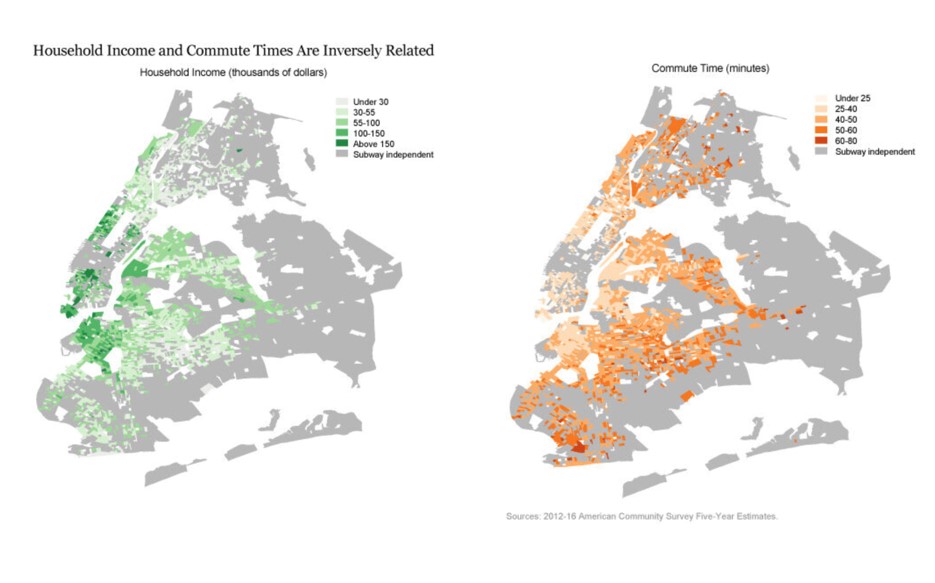

The poor attend bad public schools and are treated in bad hospitals and must commute hours every day via unreliable public transportation.

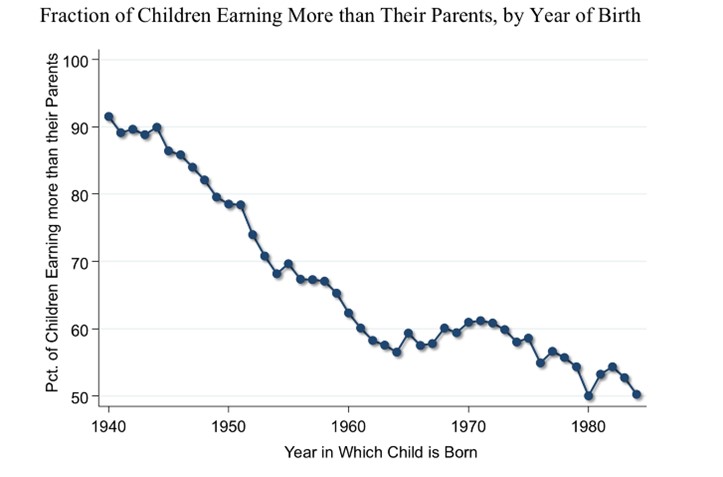

Social mobility has declined. Whereas 90% of children born after World War 2 could expect to earn more than their parents this has declined to 50% for children born in the 1980s.

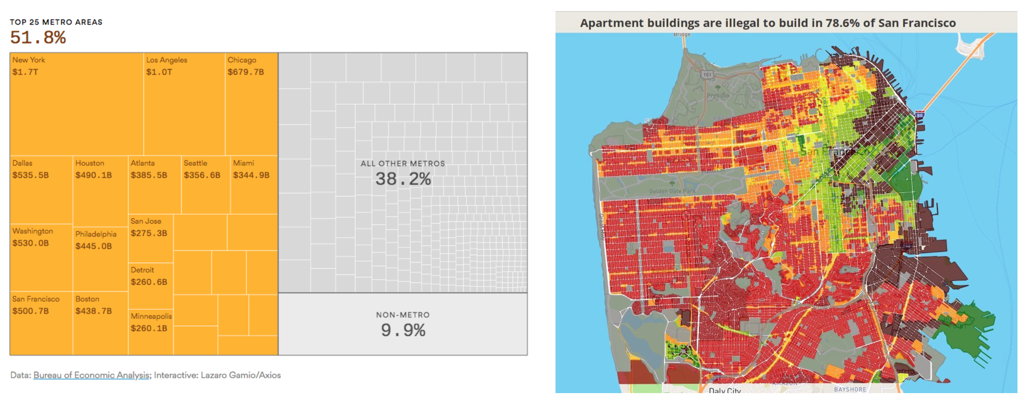

This is caused by locally concentrated growth where a few cities have captured much of the newly created wealth. However, those cities have overly restrictive zoning laws preventing an increase in supply. For instance, in 80% of San Francisco it’s illegal to build apartment buildings.

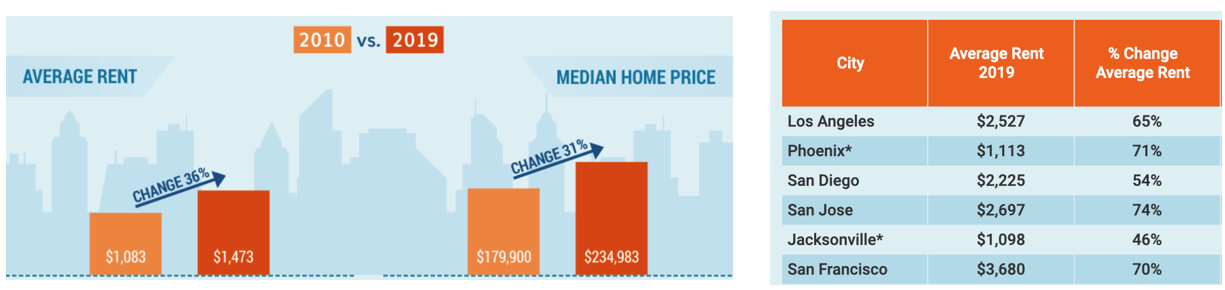

This has led to dramatic increase in rent in these cities.

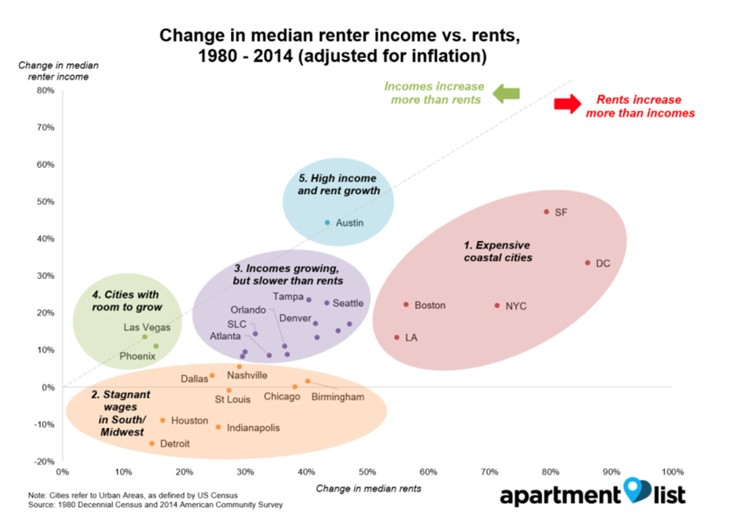

This is to the point it has become unaffordable to live there as rent increased significantly more than income.

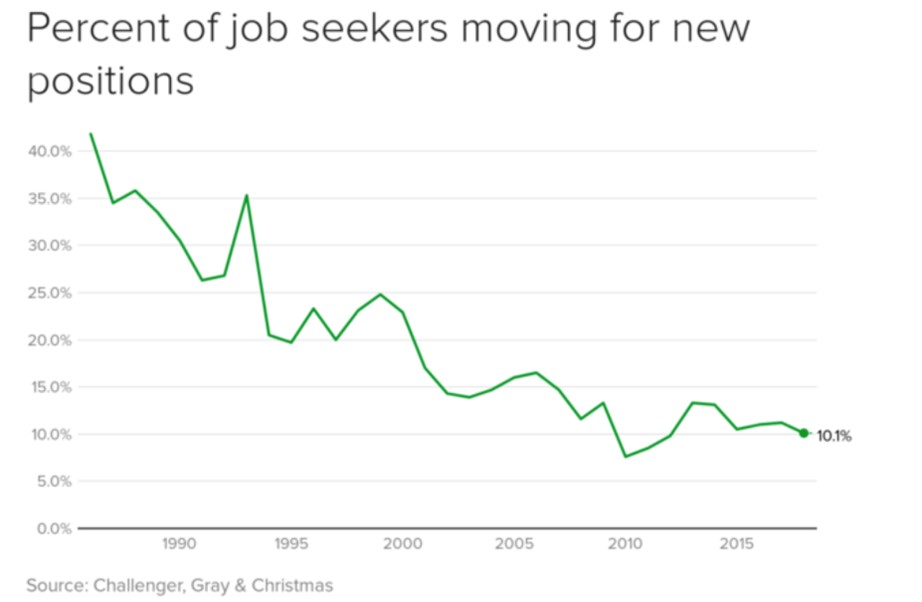

As a result, only 10% of workers are moving for new positions, down from 40% in the 1980s preventing workers from moving from low growth areas to high growth areas.

The mental and physical wellbeing crisis

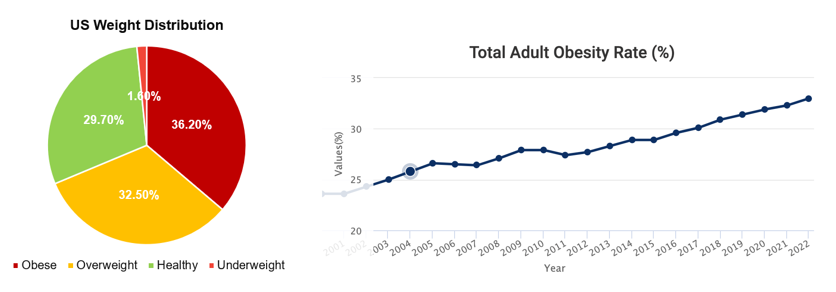

Most of the US population is overweight and 33% is obese.

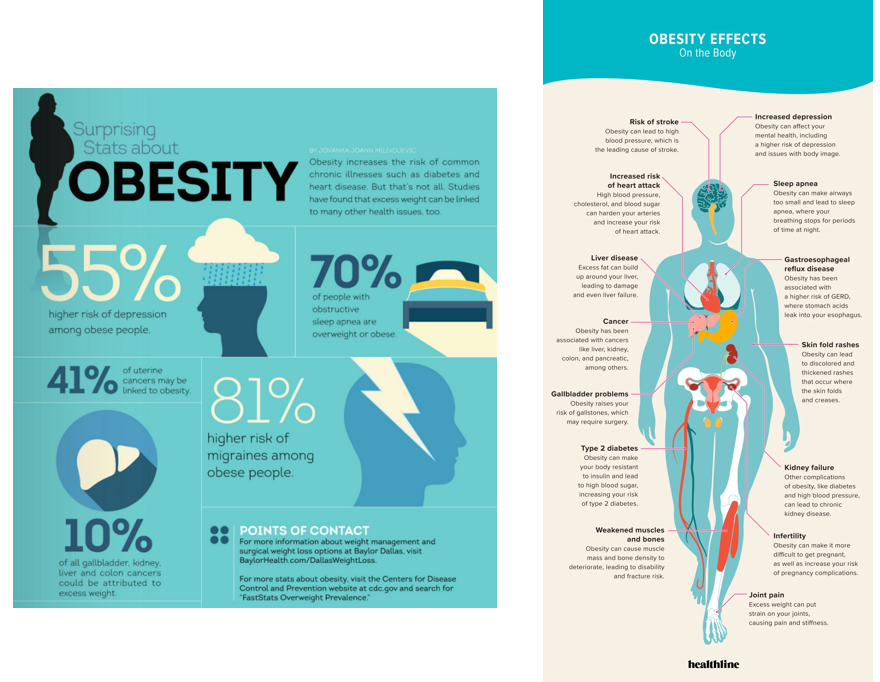

In turn obesity increases risk factors for most diseases.

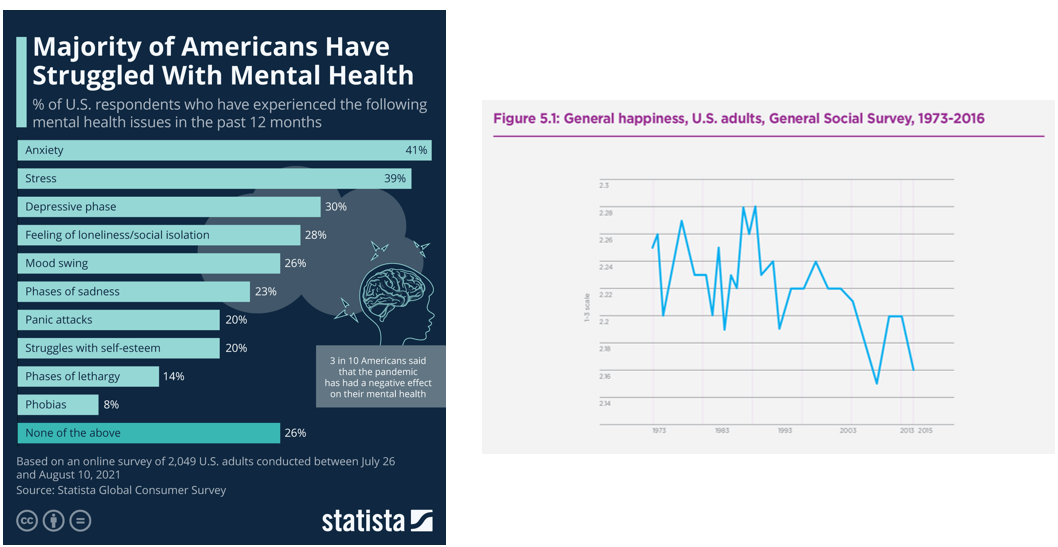

On top of that Americans struggle with mental health and are reporting declining happiness.

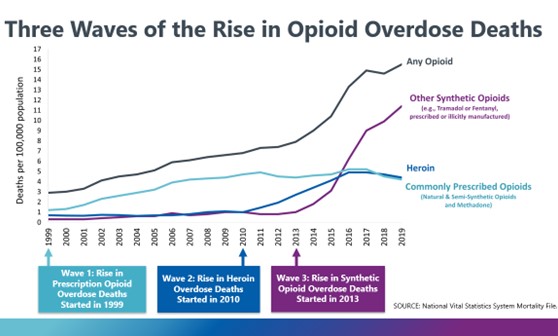

There has also been a massive increase in opioid addiction and deaths.

Climate Change

Climate change is an existential threat. The amount of energy accumulating in the oceans is equivalent to detonating five Hiroshima-sized atomic bombs per second, every second over the past 25 years. If aliens showed up and started dropping 5 nukes a second on Earth, we would drop everything to deal with it. However, because this process is largely invisible, we have been complacent.

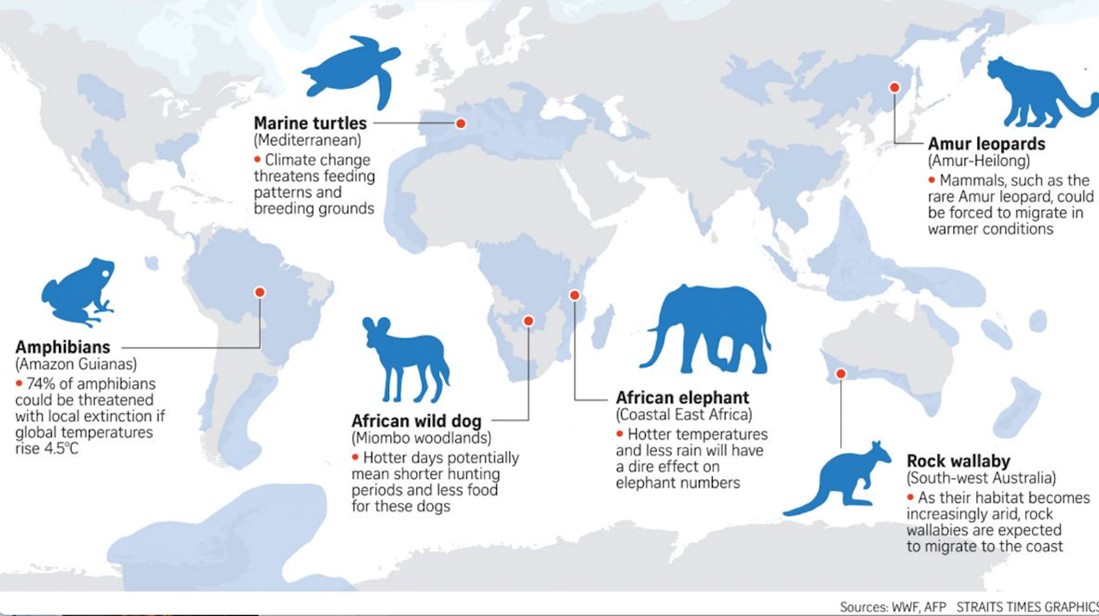

As a result, more than 1 million species are at risk of extinction by climate change.

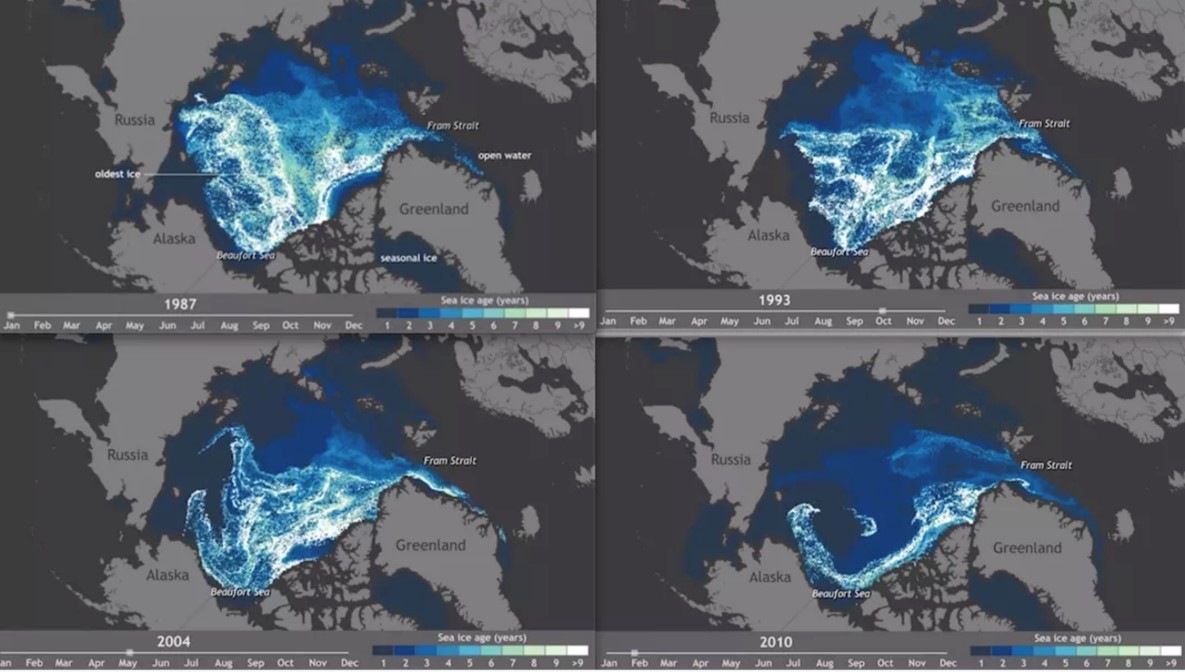

If greenhouse gasses continue to get pumped into the atmosphere at the current rate, most of the Arctic basin will be ice-free in September by 2040.

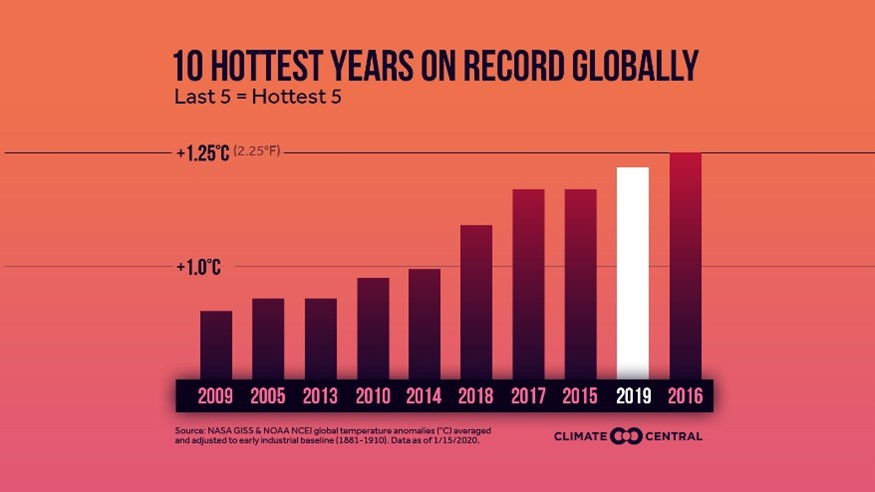

The 20 warmest years on record have been in the past 22 years.

Entrepreneurs and VCs are solutionists

Governments are structurally incapable of addressing the challenges of our time. It’s up to entrepreneurs and venture capitalists to rise to the challenge. We are solutionists. We see broken user experiences and extractive business models and attack them with all our grit and tenacity, harnessing the deflationary and transformational power of technology to succeed.

At FJ Labs, we believe in human ingenuity and back it with the full weight of our resources and knowhow. There are countless problems to solve, and we want to back all the founders attacking these problems. It’s the reason we invest in so many startups. I suppose it’s also reflection of our personality as entrepreneurs and investors. We are eternally curious and want to play a role in enacting all the positive transformations we can.

Note that because we mostly invest in marketplaces, people mistakenly assume that our purpose is to invest in marketplaces. That is not the case. Marketplaces are the tool by which we achieve our purpose, the means to our end.

The reason we invest in marketplaces is that they are a particularly effective tool for finding solutions to the world’s problems. They are capital efficient, winner takes most, highly scalable and work well within the established venture capital structure and timing with defined round sizes and time horizons in the context of 10-year funds with 3-year deployment periods. In addition to that, I studied market design in college and have been building and investing in marketplaces for 24 years giving us deep knowledge and pattern recognition of the model.

Other business models can be successful, but we find them less compelling. Hardware is capital intensive and tends to see compressing margins as competitors enter the space. Infrastructure and deep tech are extraordinarily capital intensive and have long time horizons making it harder to learn from experience. They also don’t resonate with us nearly as much.

Historically, FJ Labs mostly tackled inequality of opportunity by investing in startups that make things cheaper, which is inclusionary. For instance, B2B marketplaces, our current bread and butter, digitize legacy industries and make them more efficient. Flexport, which digitizes supply chains, Chiper, which helps corner stores source more efficiently, and Reibus, a marketplace for buying and selling steel and other metals, are all great examples of this.

We also back startups that address broken user experiences and underserved markets. Rhino, which offers an alternative to security deposits for renters, or Comun, the neobank for Hispanics, are good examples of this.

Of late, we’ve been privileged to be able to expand our mandate to cover the mental and physical wellbeing crisis with investments in the likes of ATAI.

The biggest change covers the climate crisis. Historically, you needed hundreds of millions of dollars in investments to attack the issue. However, as solar and storage have become increasingly inexpensive, software is starting to play an ever-larger role allowing the venture capital model with its $1M pre-seed rounds, followed by $3M seed rounds 18 months later, $10M Series A rounds 18 months later and $20M Series B rounds 18 months later to be sufficient to build large companies. As a result, climate now falls within the purview of most venture capitalists.

Moreover, the scale of the problem is only dwarfed by the size of the opportunity and our desire to make a dent. This has led us to make investments in the likes of Leap, a distributed energy exchange platform, and Pachama, a carbon capture analytics company.

In addition to directly tacking inequality of opportunity, the mental and physical wellbeing crisis, and climate change, we invest in companies that help support that mission. For instance, we support no-code and low-code startups that abstract the complexity of building and deploying software such as Peerboard, a low code solution to add community solutions to websites.

Conclusion

Overall, I am confident that we are going to rise to the challenges of our time. At FJ Labs, we are extremely privileged to be in position to help build a better world of tomorrow, a world of equality of opportunity and of plenty that is socially conscious and environmentally sustainable.