When Dennis and I conceived of Midas, crypto was in the middle of its bear market. Our first product, mTBILL, a yield bearing stablecoin backed by US Treasuries, was the perfect product for that environment. With mTBILL you earn near the US Feds Fund rate of over 5% completely safely without needing to off-ramp. In addition, in bear markets you can borrow USDC for less than you earn in treasuries, creating a safe opportunity to earn high yield by borrowing USDC against mTBILL on our Morpho Vault and doing a looping trade. Depending on the spread between the USDC and Treasuries you can safely earn upwards of 20%.

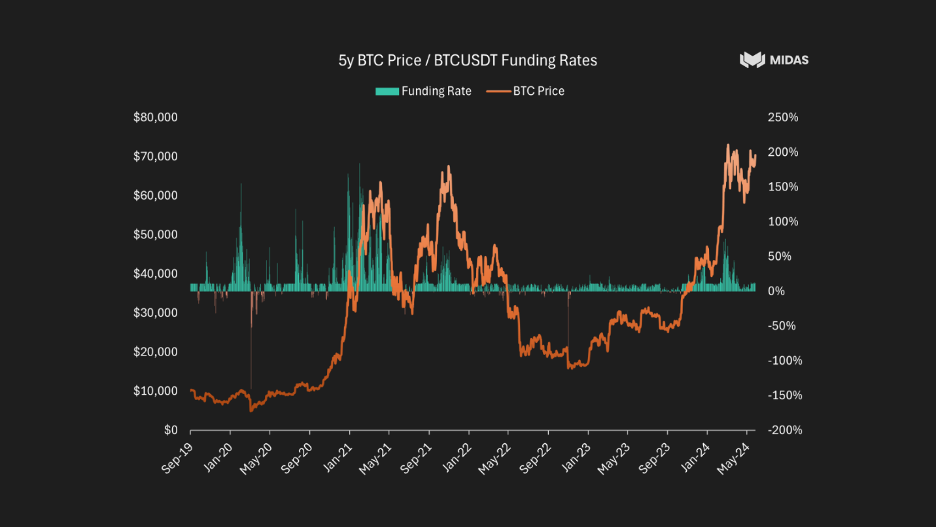

In bull markets, DeFi borrowing rates rise above the yield on treasuries invalidating the trade. In general, in bull markets people seek yield beyond the risk-free rate. Last fall, Dennis and I posited that we could create a safe and higher yielding product in bull market environments by taking advantage of the basis trade. In these environments, people expect the price of BTC and ETH to rise in the future. You can generate yield by buying the spot and shorting futures. When the market is extraordinarily frothy as it was in March this generated annual returns upwards of 50%.

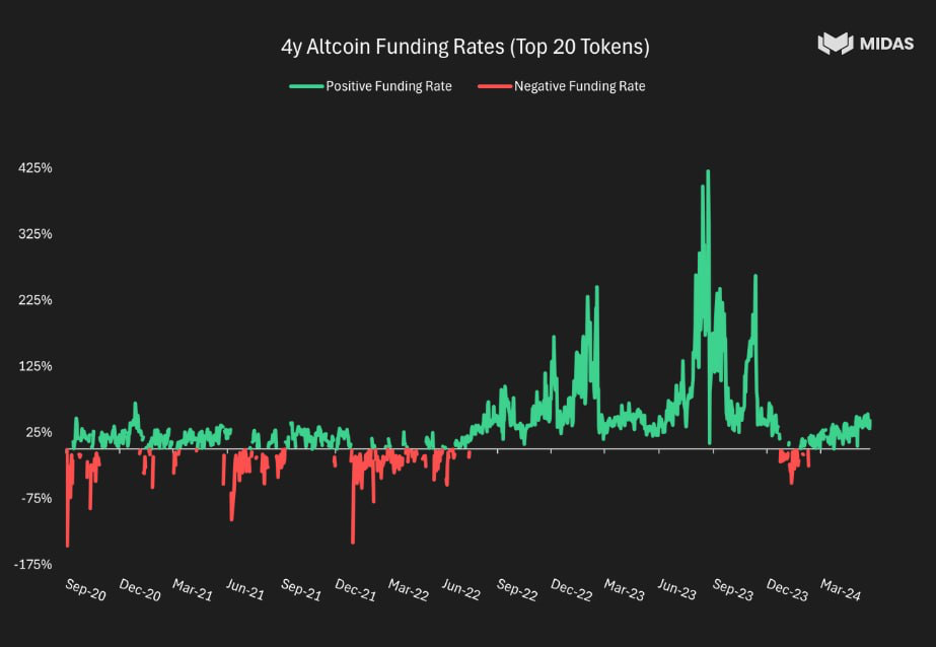

This trade is what led Ethena to grow so quickly over the last 12 months reaching $3 billion in TVL. We felt we could build a better product than Ethena which is why we launched mBASIS. Midas’s mBASIS sets itself apart from Ethena’s offering through its robust, institutional-grade management and attractive APYs. Unlike Ethena’s product, mBASIS is managed by a leading, licensed asset manager who operates under fiduciary duty, ensuring that the investment process aligns with the best interests of investors. The risk mandate allows the asset manager to dynamically allocate to basis position in major large-caps (BTC & ETH), while also incorporating yield from the top 20 altcoins, which meaningfully increase the return potential.

One of the standout features of mBASIS is its “All Weather” design. While basis trading strategies typically perform well in bull markets due to positive funding rates, mBASIS’s design allows it to adapt to bear markets by reverse basis trading or trading into complementary investment options such as mTBILL. This flexibility ensures mBASIS remains an attractive investment under various market conditions.

Moreover, mBASIS offers a straightforward, yield-bearing token that is fully compliant with European securities regulations. This compliance ensures investor protection and legal certainty without the complications of token restrictions, making mBASIS a simpler and more transparent option compared to Ethena’s product. Additionally, mBASIS provides bankruptcy protection, adding a layer of security for investors’ assets.

We are launching mBASIS today and are excited to see it grow!

Disclosure

The mBASIS token is not available to US persons and entities, or those from sanctioned jurisdictions.

The minimum investment amount is EUR 100,000. Certain investors, such as Qualified Investors, may be able to invest at lower minimum amounts.