How FJ Labs uses a VC lens to make capital allocation decisions in the liquid crypto market.

As discussed in a previous post, FJ Labs has allocated $30m of the core fund to a liquid crypto strategy. Throughout this post we will elaborate on these unique elements and discuss how we adapt a traditional VC investment approach to allocate to this emerging asset class.

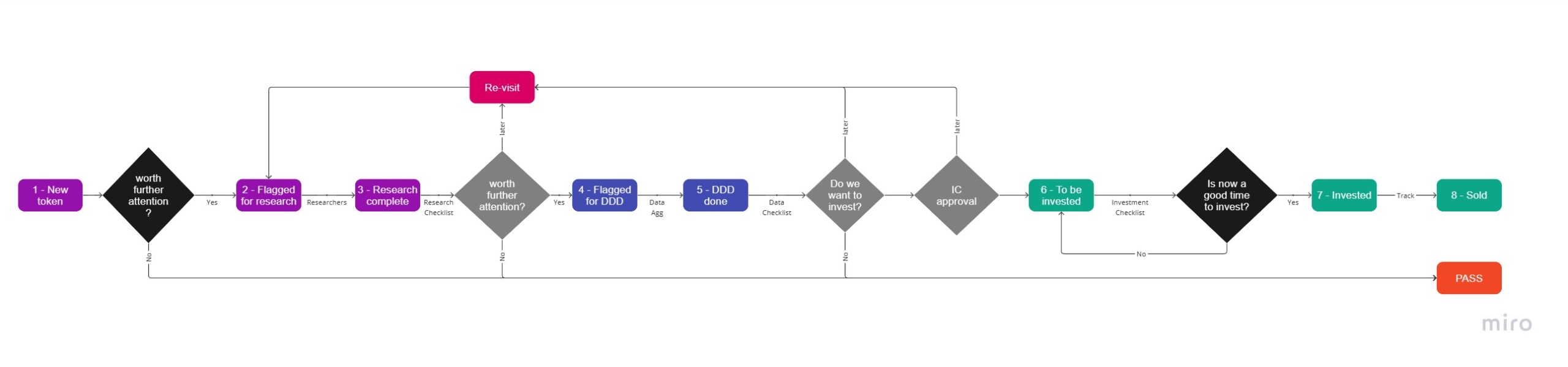

The Liquid Crypto Evaluation Process

The goal of our process is to take in the total investable landscape of crypto assets and output the best possible diversified portfolio of high quality, early-stage crypto projects and protocols. Once we make an investment, we monitor these projects real-time through a suite of proprietary dashboards and make changes to our portfolio based on persistent growth or contraction in theses underlying metrics.

This consists of three distinct phases:

- Research (purple)

- Data Due Diligence (blue)

- Investment (green)

Filter

Currently there are 22,932 unique crypto assets, 99% of which are (or should be) entirely worthless. To reduce this total investable landscape, we first apply a coarse filter that truncates the list based on quantitative metrics such as market cap, fully diluted value, token issuance, trading volume, and token distribution. We then qualitatively backfill this list with compelling early-stage tokens that might have been removed by our coarse quantitative filter.

Vertical Segmentation

We then segment the token landscape into distinct verticals, around which we have an internal thesis. For example, if we are interested in exposure to DeFi DEXs, we will aggregate projects such as Uniswap, Curve, Sushiswap, Orca, Pancakeswap, and Balancer, amongst others. This delineation accomplishes a few goals:

- It lets us look at a vertical in aggregate, and select the most compelling projects in each vertical.

- It provides the competitive landscape against which we can track growth of specific projects, intra-vertical.

- It provides the basis of our regression analysis and data dashboarding (more on this later).

Research

At this point, we have a rough idea of which projects warrant a deep dive for each unique vertical, and we proceed with thorough diligence. For each token, we conduct a 10-20 page writeup that follows a formulaic template to comprehensively asses the project. To date we have done 97 10-20 page token writeups.

Investment Committee

After we conduct all writeups on a certain vertical, we organize them and pitch the most compelling projects to the FJ Labs Token Investment Committee. Since we assess all projects for a certain vertical together, we can more easily compare the merits of each. After debating the team, product, traction, value accrual mechanism, and token economics of these projects, we move toward a final decision:

- Should we invest in this vertical?

- If yes, which project(s) in this vertical are most compelling?

- What are the unknowns and what further research (if any) must be done?

- What are the key metrics we should focus on to track the evolving dynamics for each vertical?

- What is a reasonable fair price for this asset (from both top down and bottom up)?

- Where should we be a buyer?

- Where should we be a seller?

In the next post, we will outline how we add a layer of data insights to our evaluation process to both stress-test our investment decision and to manage our liquid portfolio.