Friends of FJ Labs,

We started off 2025 with a bang, with several exciting developments, markups, and exits in the portfolio. Ultimately, we believe the recent market turbulence has little to do with the startup ecosystem and the idiosyncratic nature of innovation and continue to think that 2025/6 will be tremendous vintages for those investing in the asset class!

Clutch: 12X markup in 15 months

FJ Labs Venture Partner Joins as CFO

We are thrilled to share that our portfolio company, Clutch, the leading used car marketplace for Canada, raised an oversubscribed C$50M Series D led by our friends at Altos Ventures. In a testament to Dan and team’s entrepreneurial grit, the company pivoted spectacularly from growth to profitability, achieving all-time highs of $400M+ revenue run-rate (Bloomberg).

This round represents a 12X markup in just over a year for FJ Labs, and they’re just getting started! We have other reasons for excitement: FJ Venture Partner and one of the smartest minds in the Canadian tech ecosystem, Anshul Ruparell, is joining Clutch as CFO.

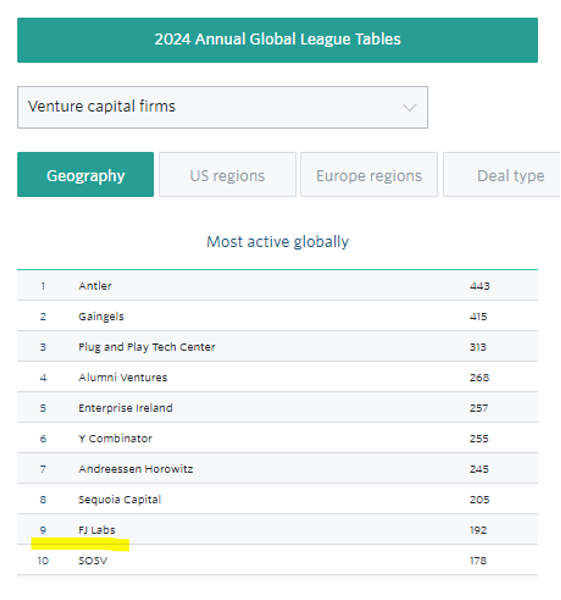

For another consecutive year, FJ Labs was named among the most active venture investors globally according to Pitchbook’s 2024 annual global league tables. We were also ranked #6 most active at early-stage, #4 at Series A & B, #13 for investments made in the U.S and #12 in Europe.

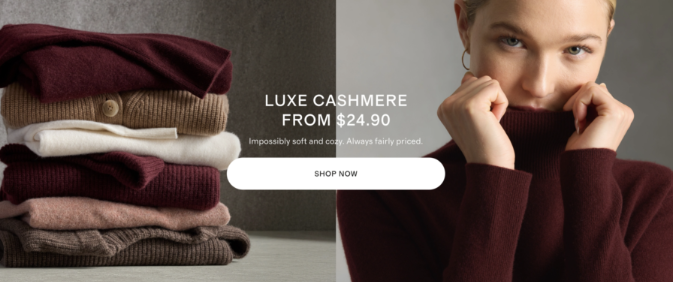

Manufacturer-to-consumer luxury brand, Quince, announced a $120M Series C co-led by Notable Capital and Wellington with participation from DST Global and 8VC. By challenging the long-held belief that “high-quality products must be expensive,” the company has seen explosive growth and is on track to attack every category of luxury. We are thrilled to double-down in Quince, one of our largest Fund II positions by carrying value. (OuiSpeakFashion)

Pickle, a leading P2P marketplace that makes items from your community’s closets available for rent, raised a $12M Series A co-led by FirstMark and Craft Ventures. We haven’t seen this sort of growth and network effects in a long time and are eager to see what’s next! (ShopOnPickle)

CollX, an app that allows users to take photos of cards and find their value as well as engage in its marketplace, raised a $10M Series A led by MLB star Bobby Witt Jr. Since its founding in 2022, CollX boasts over 500 million cards on the platform and roughly 50,000 buyers and sellers. (Cllct)

Baton aims to solve one of the biggest problems facing SMB owners: figuring out how to step away. The company raised a $10M Series A round led by Obvious Ventures which it will use to hire more engineers and boost marketing with the goal of reaching even more owners and buyers. (Fortune)

French “AI for Pharmacies’“ platform, Faks raised a €6M round to help streamline pharmacy-supplier interactions, led by Speedinvest. Since its founding in 2020, Faks has become the leading B2B tool in the pharmaceutical sector. Today, 85% of French pharmacies use Faks. (TechFundingNews)

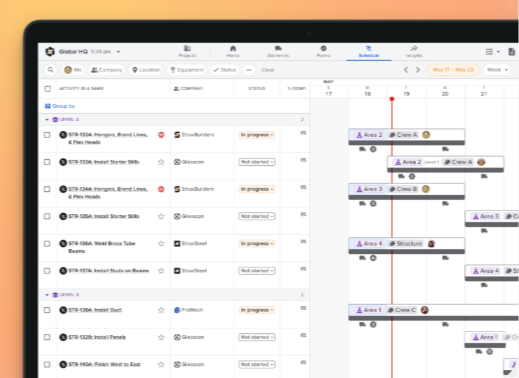

Construction operations software startup StruxHub raised a $4M seed round led by Brick and Mortar Ventures. The company’s software aims to simplify the day-to-day operations of construction projects of any size and counts seven of the top twenty contractors in the U.S as its customers. (SiliconAngle)

We are delighted to share Matias Barbero’s promotion to Partner. Since joining FJ in 2021, Matias has led more than 85 of our investments, helping us fortify our standing as a leading marketplace powerhouse. With unique insights from a decade working in finance, Matias has leveled-up our fintech and growth-stage investment practice, and as a proud Argentine, has been instrumental in continuing to develop our LatAm thesis.

We are thrilled to welcome Matias into the partnership at FJ Labs!

In case you missed it, make sure to check out FJ Labs’ 2024 investment year in review. All told, we made 189 investments last year (100 new + 89 follow-ons) across 23 countries! Life to date, we have backed over 1,100 startups with over 350 exits.

Fabrice sat down with LionTree’s Antal Runnebom where he shared his wide-ranging perspectives on verticalized marketplaces, why humanoid robots are coming faster than we realize, and a vision for future energy abundance.

On the VNTR Podcast, Fabrice shared his journey from launching startups to becoming one of the world’s most active angel investors, FJ Labs’ approach to early-stage investing, the importance of pattern recognition, and our overall philosophy when evaluating investment opportunities.

Copyright (C) 2025 FJ Labs. All rights reserved.

Absolutely love the clarity and consistency of your investment thesis, Fabrice. Marketplaces are still the most powerful models when they solve deep, everyday friction, especially in overlooked verticals.

At Dinely, we’re tackling one of the biggest inefficiencies in hospitality: the restaurant experience. Our QR-based platform lets guests instantly browse menus, order, split bills, and pay. No app, no wait, no language barrier. We’re building the Shopify of dining, and we’d love to connect with like-minded marketplace investors like FJ Labs.

Looking forward to crossing paths.

Sounds good. Shooting you an email…

Thanks Fabrice, excited to keep the conversation going. Sent everything your way. Thanks again for the quick response!