Friends of FJ Labs,

It was another active quarter at FJ Labs with investing, events, and team content in full swing following the summer months. Please see below for our latest investment highlights and happenings. Wishing everyone a safe and warm start to Fall!

“Fabrice AI is a digital representation of my thoughts based on all the content of my blog. It is meant to be an interactive, intelligent assistant capable of understanding and responding to complex queries with nuance and accuracy.”

Read more about Fabrice’s full-circle journey to creating Fabrice AI including the early stages of the project, technical nuances, and current implementation.

We also recently uploaded the FJ Labs Portfolio to Fabrice AI. You can now ask whether a company is part of the portfolio and Fabrice AI answers with a short company description and a link to its website 🙂

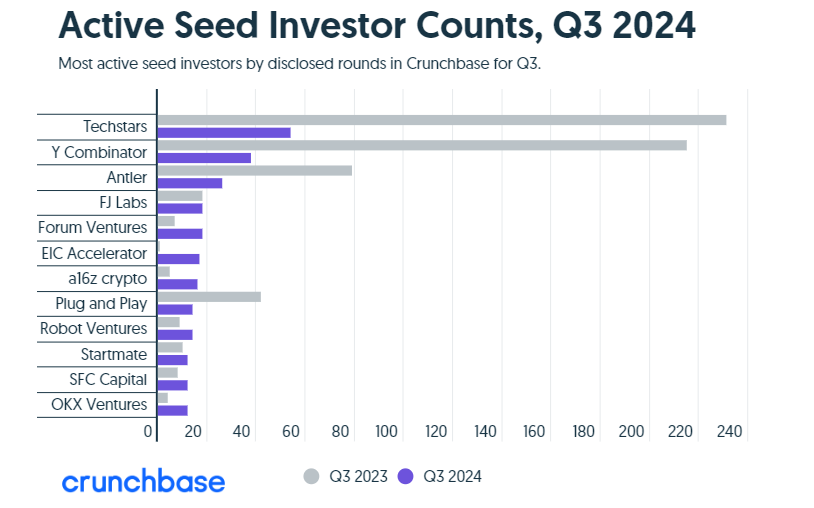

FJ Labs was recently named one of the most active investors in U.S seed deals in Q3!

Cents, an all-in-one business management platform for the laundry industry, raised a $40M Series B led by Camber Creek with participation from existing investors Bessemer Venture Partners and Tiger Global, as well as execs from Toast, Squarespace, and Stripe. (PR Newswire)

AI translation startup, Smartcat, raised a $43M Series C led by Left Lane Capital. Founded in 2016, Smartcat now boasts over 1,000 enterprise and government clients. (TechCrunch)

Comun, a neobank serving Latinos in in the U.S, raised $21.5M in Series A funding led by Redpoint Ventures. This is the second raise from the company in less than a year, underscoring its impressive revenue growth and traction. (TechCrunch)

B2B payments platform, Slope, secured JP Morgan Payments as the lead in a new $65M strategic equity and debt financing round in which YC and Jack Altman also participated. New funding will be used to scale and serve additional large enterprises. (TechCrunch)

The Rounds, a startup delivering recurring grocery and household essentials in reusable packaging, raised a $24M Series B round. Currently available in select U.S. cities such as Atlanta, D.C. and Philadelphia, the company is looking to bring its stocking services to new markets. (TechCrunch)

Dubai-based Ziina, which now counts 50,000 retail and business customers after expanding its P2P offerings to meet the needs of businesses in the UAE, raised $22M in Series A funding led by Altos Ventures. (TechCrunch)

FJ Labs incubation, Midas, recently announced that following regulatory approval, its products are now accessible to retail investors without minimums. Midas tokenizes real-world assets like TBills, and allows users to invest with just one click. (blog.Midas.app)

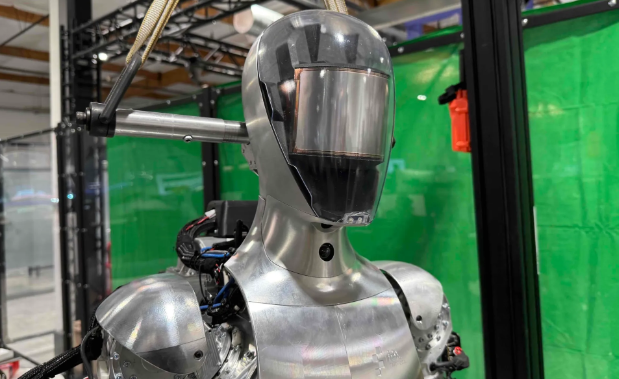

And lastly… meet Figure 2.0, the second-generation humanoid robot from Figure, our exciting portco from serial entrepreneur Brett Adcock that recently raised at a $2.6B valuation from Microsoft, OpenAI, NVIDIA, Jeff Bezos and others. (TechCrunch)

Alongside our friends at Speedinvest, FJ Labs proudly co-sponsored this year’s Marketplace Conference in Berlin. Jose gave the keynote on marketplaces in the modern era including our thoughts on recent trends and advice for founders.

Jose later took the stage at the Bits & Pretzels Investors Summit in Munich where he spoke on a panel about the current state of European VC. Bits & Pretzels is an annual three-day event that brings together over 7,500 founders, investors, and startup enthusiasts.

At a Kauffman Fellows event in Montreal, Canada, FJ Labs partner Jeff Weinstein spoke on a panel about VC portfolio construction alongside investors from Ulu Ventures and Luge Capital. As investors in over 200 companies each year, FJ’s approach to portfolio construction is certainly non-traditional (but it works!).

Earlier this Fall, Fabrice was invited to guest lecture at Harvard Business School where he presented FJ Labs’ AI thesis to students studying GenAI and entrepreneurial management under prolific HBS professor and author of “Why Startups Fail”, Thomas Eisenmann.

At our most recent offsite, Fabrice hosted the FJ team and a select group of entrepreneurs, limited partners, and investors at his home in Turks & Caicos. These events serve as invaluable time to discuss the latest in marketplace trends with our peers and founder network.

Please join us in welcoming our latest cohort of investment analysts!

Danny Browne previously worked on the investment team at Blisce and Nasdaq Ventures. Originally from Manchester, UK, Danny studied finance at NYU Stern and played intramural soccer (“football”).

Mehul Kumar previously worked on the venture relations team at AngelList and as a consultant at Bain & Company. He graduated from Duke University where he studied computer science and finance.

Fabrice shares his blueprint for navigating the startup ecosystem as an “accidental VC” on NeuralZen VC’s recent podcast. Fabrice discusses falling in love with tech at the age of 10, going from McKinsey consultant to serial entrepreneur, and his journey to becoming one of the world’s most active angel investors.