There is no denying Apple has had an incredible run.

Steve Jobs’ return and the Mac’s resurgence

After a number of strategic and execution mistakes, the company almost went bankrupt in 1996. It was greatly helped in 1997 when Steve Jobs returned as CEO and announced that Microsoft invested $150 million and made a five-year commitment to develop Office for the Mac. Steve Jobs slashed Apple’s 15 product lines to just 4 categories: desktop and notebook Macs for consumers and professionals. Jobs halted the Macintosh licensing program. In 1998, he hired Tim Cook as COO. Cook had worked at Compaq and IBM and was tasked to “clean up the atrocious state of Apple’s manufacturing, distribution and supply apparatus”. He hired Taiwanese contract assemblers to manufacture Mac products. He revamped Apple’s distribution system from smaller outlets to national chains and also launched a website to offer direct sales for the first time. Apple’s inventory fell from months to a few days! In 1998, the company posted a $309 million profit, reversing the 1997 $1 billion loss allowing Steve Jobs to increase R&D spending.

Under Tim Cook operations are now smoothly oiled. According to Fortune Magazine “Apple routinely pulls off the miraculous: unveiling revolutionary products that have been kept completely secret until they appear in stores all over the world. The iPhone, the iPod, any number of iMacs and MacBooks – the consistently seamless orchestration of Apple’s product introduction and delivery is nothing short of remarkable. … In 2006 Apple transitioned its entire computer line to running on processors made by Intel. … Cook’s team … made sure there was nary a blip in sales.”

The transition to Intel CPUs allowed Apple to build chips that were faster and less power hungry, essential now that notebooks account for the vast majority of Mac sales. This also allowed Macs to run Windows applications if the user so chose, thus offsetting one of the longstanding disadvantage to choosing a Mac – the relative lack of Macintosh software.

The move into direct retail distribution also proved revolutionary. The first Apple retail store opened in McLean, Virginia in 2001. The Apple retail experience gave many consumers their first exposure to the Macintosh product line. By 2009, Apple estimated that half of all retail Mac sales were to “new to Mac” customers. The retail division with more than 280 stores in 10 countries grew to account 16% of Apple’s total revenue. The company also entered into a partnership with Best Buy, the world’s largest electronics retailer.

Moving Beyond the Macintosh

While it was essential for Apple to fix its Mac business, it’s the new product lines that really put Apple on its explosive growth path. Apple introduced the iPod in 2001. With its sleek design, simple user interface and large storage, it put other MP3 players to shame. Apple had the foresight of allowing the iPod to work with both Macs and Windows machines. The distance only grew wider when Apple introduced the iTunes Music Store starting in April 2003 which was the first legal site that allowed music downloads on a pay-per-song basis. With its large catalogue and ease of use, it allowed Apple to capture the MP3 market. By 2010, Apple was estimated to have around 70% of the US MP3 player market.

In 2007, Apple introduced the iPhone. While the product was revolutionary in many ways, it was not a huge success. Apple actually only sold 6 million of the first iPhone because it was sold for $499 without a subsidy and AT&T gave a revenue share back to Apple. In 2008, when Apple released the second iPhone which ran on the faster 3G network, it smartly revamped its pricing model. AT&T provided a subsidy in exchange for dropping the revenue share agreement. Consumers could now buy an iPhone for $199. With the 3G model, iPhone revenues exploded to $13 billion by the end of 2009. When the 3GS went on sale in June 2009, the subsidized 8Gb iPhone price dropped to $99.

The recent very successful launch of the iPad further extends Apple beyond its Mac roots and diversifies its revenue base.

Near Term Winner

Apple is currently on top of the world. It has the highest market cap of any tech company, recently surpassing Microsoft’s and dwarfing Google’s. It also seems perfectly positioned for the future given its strength in smartphones.

Apple is now essentially a mobile company. As of the last quarter, Mac sales accounted for $4.4 billion of revenues (with 31% growth year to year), iPod sales for $1.5 billion (4% growth), iPhone sales for $5.3 billion (74% growth) and iPad sales $2.1 billion out of a total of $15.7 billion. Apple is arguably in the perfect business. US smartphone penetration just crossed the 20% mark and global smartphone penetration is around 10%. Undoubtedly at some point in the next 5 years the majority of phones will be smartphones and eventually almost all phones will be. Market growth alone should buoy Apple.

Moreover, Apple still has two low hanging fruits to massively increase its iPhone revenues:

- Expanding the number of carriers that carry the iPhone in countries it has released the iPhone.

- Releasing the iPhone in more countries.

However, Apple and Steve Jobs seem to be repeating a number of strategic mistakes that seem destined to relegate it to a niche player.

Long Term Loser

In 1984, when Apple introduced the Mac in 1984, it was revolutionary. It was elegant, simple to use, had the first mass market mouse and graphical interface and became a huge success. Apple seemed destined for greatness. However, Steve Jobs’ vertical integration driven by his desire to only have beautiful machines and software limited both innovation and the availability of software. On the DOS, then Windows side, the constant competition between PC makers, processor makers, and software developers, while less elegant and functional at the beginning, given enough time led to a plethora of offerings and innovation that not only copied many of the Mac’s best features but extended them. The competition also drove prices much below Mac prices. The combination of faster PCs with more software at lower prices eventually completely marginalized the Macintosh.

Steve Jobs seems to be repeating the same mistake all over again. The elegant integration between the iPhone, iTunes and the App Store is definitely a current source of comparative advantage. It is easier to offer a better user experience at the beginning when you limit the form factor and completely control the hardware and software. The iPhone 4 is clearly the best smartphone on the market. The apps in the Apple App Store are clearly the best apps on the market.

However, Apple’s insistence on having a single form factor, on being a premium player at a premium price point (to carriers at least), and its arbitrary decisions with regards to what apps make it in the App Store will eventually make Apple a niche player. Even if Apple keeps innovating and has the best phone on the market, it won’t matter.

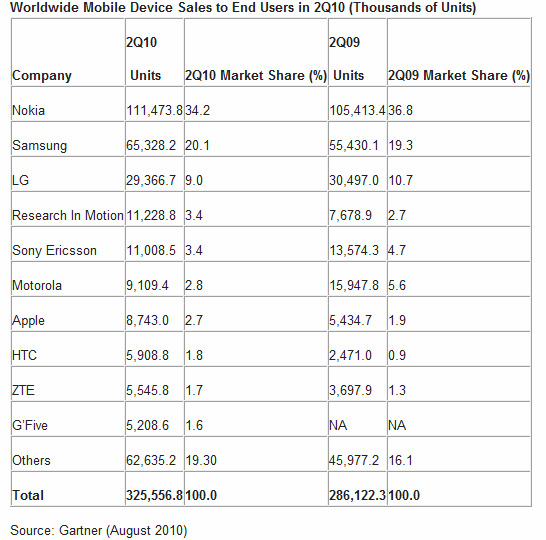

Android, with its relative openness, seems to be playing the role Windows played for the Mac. We are already seeing a plethora of Android phones which cover all segments of the market – from the very low end to the very high end. There are phones with keyboards or without, Amoled screens, huge screens, small screens… There is already seems to be an Android phone for every taste and the choice is only going to get larger. In only one year Android’s smartphone market share catapulted from 1.8% to 17.2% overtaking Apple’s iPhone which grew from 13% to 14.2% of the market. Moreover Android is now activating more phones in the all-important US market, despite the iPhone 4’s recent launch.

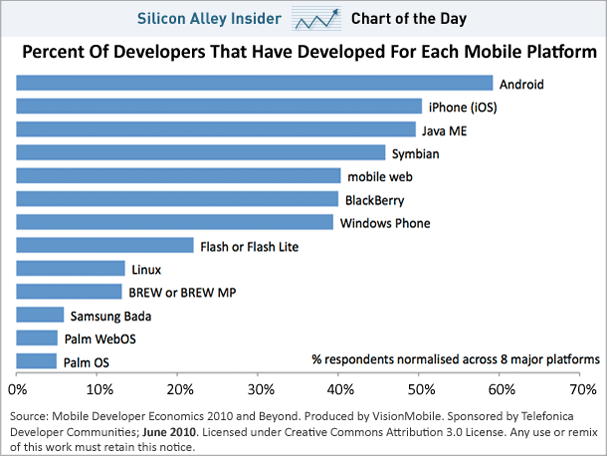

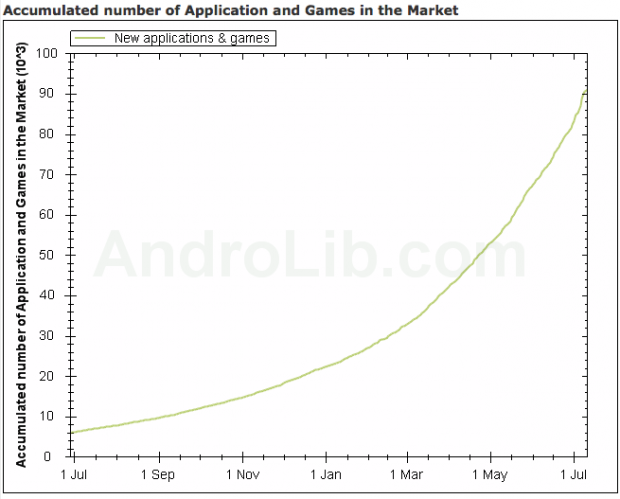

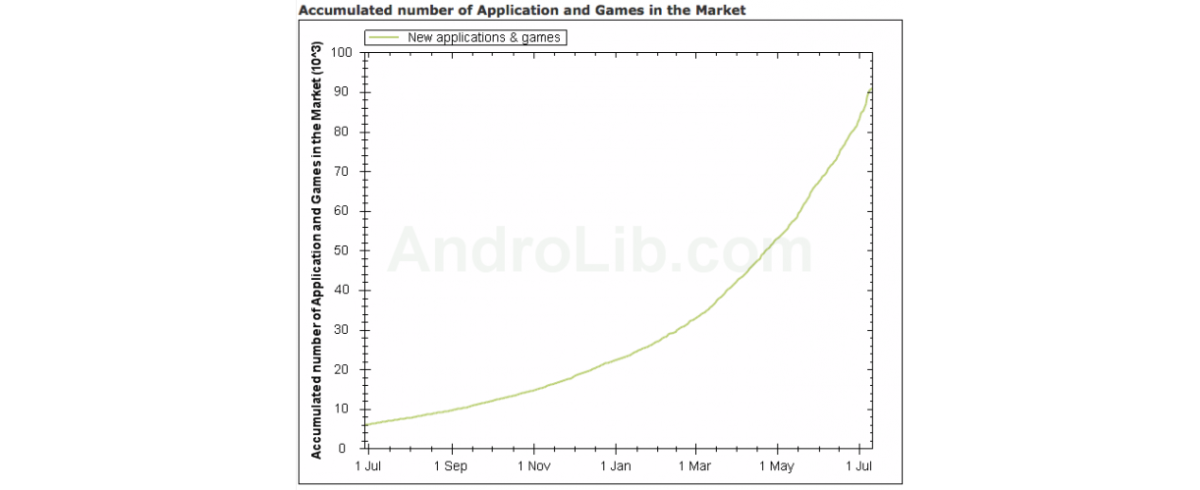

It’s unclear to what extent the number apps offered is relevant. Regardless of the answer, it won’t play in Apple’s favor. It could be that the top 30 apps are all that matter (e.g.; Maps, Facebook, Email and a few games), in which case the current better quality of Apple apps will eventually be matched by the apps on Android. Alternatively, and arguably worse for Apple, if it’s the diversity of apps that matters, the relative openness of Android will mean that there will eventually be many more apps for Android phones than for Apple given its desire to only have “pretty” and “elegant” apps. This will only get worse as Android’s market share will increasingly exceed Apple’s and many developers will first build for Android and the guarantee of appearing in the Android App Store versus taking a risk with Apple’s fickle App Store approval process. More developers are already developing for Android than the iPhone and the number of Android apps is rapidly approaching the number of iPhone apps.

Furthermore, with the iPhone Apple has taken vertical integration one step further. It acquired PA Semi for $278 million in April 2008 and Intrinsity in 2010 and now designs its own chips. Both the iPad and the iPhone 4 run on the A4 chip it designed. This means that in addition to competing with Google, all the handset manufacturers in the world and many app makers, it now has to compete with the likes of ARM! It’s extremely hard to be world class in so many product categories and arguably Apple has just made its job of having the best smartphone on the market that much harder. In a few years it might end up with underpowered phones relative to the Android phones very much like the Macs used to be underpowered (and overly power hungry) before Apple made the switch to Intel!

None of this will matter in the short run. Globally increasing smart phone sales and extending sales to new carriers will buoy growth for some time to come, especially since Apple still has a better phone and better apps. However, this growth will bely the fact that Apple is losing market share rapidly to Android. Fast forward 5 to 10 years and it’s not hard to imagine seeing Apple with a small (but probably very profitable) share of the smartphone market. It will be a niche player in the market it revolutionized and could have dominated. History seems bound to repeat itself!

Does being the #1 seller in terms of installed base matter, or does generating large revenues, fat margins with low customer acquisition costs matter? Apple makes more money (by a gigantic margin) for each iPhone in comparison to Google for each Android phone. Maybe 50:1 lifetime.

You conflate “winner” with “#1 sales rank”. I don’t think that’s an obvious leap.

-Gabe

I believe the single biggest factor that will be Apple’s eventual downfall is their “walled garden” insistence

I fully agree with Gabe.

I think another point you are missing is that iPhone developpers are marking money because iPhone consumers are used to pay when Android developpers don’t do a lot of money, so far. The revenues generated by iPhone or Android will do a real difference for the developpers.

The fact is Apple constantly plays on new technology. Each new product (in fact all coming from the same original product technology based on *BSD, check iPhone, iPod, iPad, all the same thing) is mostly an new idea opening a new market… enforced with $$$ marketing strategy… While Apple will keep a such dynamism, I guess it can survive. How far being the question 😉

Fabrice, this is by far and away the very best analysis I have read about Apple. Thank you for your clarity.

Fantastic essay! You should look at getting a version of this published.

No. Steve Jobs has repeatedly said: We want to get these(iPhones) to as many ppl as possible. iPad was dirt cheap. He is going for mass sales.

Where WinPhone 7 go? Microsoft, by the way, make the ‘most advanced OS’. Windows(mp Mr. Jobs. It’s not the Mac OS X). Does anyone think they will just leave the market? What a huge mistake…

(They now for once really want to make a good smarphone, touch-based OS).

Remember PS2?

Isn’t it true that making big money is always about volume not about quality, regardless of industry? Case in point: Walmart!

As Gabe mentions unit sales take a back seat to profit, Apple doesn’t appear to be too interested in “the race to the bottom”.

Also just to clarify Apple does not “compete with the likes of ARM!”, Apple is an ARM licensee and the Apple A4 includes an ARM Cortex-A8 (plus a Power VR GPU) and is manufactured by Samsung.

It’s not in Apple’s DNA to pursue the low end of the market. Their goal is not to level the playing field of information by organizing it and making it free (GOOG). Instead, they want to see their aesthetic vision realized on as large a scale as possible while not compromising their ideals. And just like Apple said: If you don’t like the iPhone 4, return it, Apple is content with being hugely profitable but ultimately a niche player. Apple values the control and self-actualization more than the domination of the market.. But, if Apple were to license the iPhone and give up control, arguably, they would lose what makes them special and able to command a premium.

Andrew:

The argument I am making is that they probably should:

1. Create a few phones with a few form factors – maybe have a phone with a keyboard for the corporate email market for instance.

2. Basically let all apps go up and let the market fight it out. The App store actually sucks. Discovery is a pain – which is why I invested in Appsfire.com.

First, you should install disqus on this blog. It’s pretty good.

I think apple is already spread thin enough and to create a phone with a keyboard would be a bit of a distraction. And I think they are right: touch screens are the better choice for cell-phone form factor devices. People just need to get used to them.

As for the App store, Apple has managed to ensure a high degree of quality and avoid malware though their fairly benign review process, which, if my calculations are correct, has them reviewing each app for a mere 11 minutes (2 reviewer’s 5.5 minutes each). But developers live in fear and everybody toes the line.

In return for that review, Apple is able to let natively compiled apps run pretty much without any security restrictions within the phone. Meanwhile, Android requires that apps be written in Java, interpreted at runtime (slower) by the Dalvic interpreter. Apps on Google must request specific permissions when installing themselves, but consumers don’t know what the right answer is so always answer yes. Nearly all apps ask for more permissions than they need.

But more than that, I think that Apple gets that consumers need appliances, not general purpose computers. The car analogy is useful here. I can’t mod my car easily and I don’t care. It’s transportation. People who race need cars they can mod. Knowledge workers may need smartphones they can mod. For the rest of us, appliances are the better choice.

I agree with you that Android will dominate in terms of market share, but not because of the more open app store. Android will dominate because of all the hardware vendors and carriers that will compete to promote it. The handset vendors are without any alternative. They realize smartphones are the future and they need an OS, even if getting on board with that OS destroys their ability to innovate. The carriers don’t want to become dumb pipes and Android allows them to continue to try to add value by pre-installing apps, offering over-the-top services and branding the devices.

The real winner with Android is going to be Google, which will be guaranteed a platform for mobile advertising for a generation to come.

Jerome:

There are some benefits to being single with no kids 😉 Besides one has to keep intellectually challenged 🙂 I miss Princeton 🙂

After reading this analysis one thing really stood out. You’ve got way to much time on your hands:)

Poorly thought out analysis. Are you talking market share or profits? And why do you equate the PC world of 1992-5 to today’s wireless/smartphone world? Aren’t they so different? Isn’t Apple & Co. watching this carefully as well?

nice to see your article show up in the Silicon Alley Reporter. Congrats.

So much of this piece is insightful and spot-on. I disagree with the conclusion, however.

The conclusion as stated makes two false assumptions:

1. That (despite a number of similarities) the current market is similar enough to the early days of the PC industry to use as the basis for reaching a conclusion about what’s going to happen in the future.

2. That Apple would be completely blind to such a situation were it to play out again.

However, I think there’s a more fundamental issue that illustrates why things are different than before. Steve Jobs has repeatedly emphasized his belief in the power of software to create revolutionary devices. For the current and medium term generations of computing devices, Jobs is betting that having full control over all aspects of the product will enable Apple to create software that will in turn give it the true competitive advantage it will need to remain highly profitable in an industry that always trends toward commoditization.

The current landscape includes a number of factors that branch off in different directions, such as media/content distribution and wireless infrastructure, to name a few.

Apple’s decisions about how it relates to, and attempts to steer, these industries is to me where the really interesting strategic decisions are playing out this time around.

Hey, selling more doesn’t mean better.

Bigger is not better: better is better.

Just look at the car industry. Selling more GMs, Fords and Chryslers do not mean they did well… weren’t all those in debt up to their eyes?

Yes.

Now, get your head out of Ballmer’s and Schmidt’s ass and face the numbers accurately by comparing apples to apples.

If a ten-year run of success is what you call luck… you are a moron.

You should probably stick to reviewing Shrek and making terrible header graphics.

Fabrice,

Here are the problems with supporting many form factors:

1) It immediately causes developers problems. An iphone with a keyboard or a smaller screen means re-writing and supporting that phone. The MAJOR reason why developers choose to write for the iphone is that it is one phone and just one phone which you need to port too. Look at Java, BREW, even RIM, there are numerous phones and porting is a big nightmare.

2) One of the biggest problems Google is going to have with Android is handset makers creating variations and additional APIs for their phones. Motorola wants a better droid phone than LG who wants a better phone than Samsung and so on. Thus to differentiate themselves, handset manufacturers will create some new API, sensor, etc into their phone which now developer A supports with his App but it isn’t supported on phone B and so again there are problems. Google has done a good job so far but the job gets harder as handset makers compete against each other’s android phones.

A nice piece of revisionist history.

– Nokias sells phones with an average price of 62$. Apple sells phones with a price ten times higher than that, so it is clear that Nokia sells more phones.

– Apple makes a huge profit with every phone. Probably almost the same or more than all other “smartphone” companies together. (I don’t have the current numbers but they have been there.)

– The installed user base of iOS 4 is huge compared to all other smartphones (which one can count as smartphones – this means no 20 different versions of Symbian phones). Concerning platform capability, stability and and development tools Apple is the cream of the crop.

– In contrast a developer for Android has to pray that his app (especially games) runs on different devices with different capabilities. And how many Android devices are running v2.2? There are still huge numbers of 1.6 and 2.1 Androids out there! Even the most current devices have to wait until the end of this year.

– In the long term Android manufaturers will rip the platform apart to differentiate themselves as already stated above. They are doing this now and this is the reason why it takes forever to upgrade a phone to the next version of Android. And they have to do it. This is the reason why Samsung is creating Bada.

– Apples ecosystem is without competition, seriously. It’s not the devices alone. People tend to forget this.

I agree, that Apple needs to create more different mobile devices, (two versions/sizes of iPhone and iPad) but i am very sure this will happen in the near future.

The long term will be interesting either way, also because i think Android will only be a near-term winner and will definitely struggle in the long term.

But i cannot see how Apple would fail in the long term.

The only thing that is sure to be irrelevant is your column.

Also fully agree to Gabe’s comment.

Apple has a differentiated strategy, if it ends up for them to be #1, great, otherwise, fine as long as they maintain their margin & growth.

To me, they have a “virus like” market approach: they enter new market with a killer app, they dominate the market by introducing progressively full range of product and once market starts to saturate, they look for a new one.

They did it with the Ipod (5 product range, products progressively having every possible function: e.g. Ipod nano with camera). When they understood that ipod market will saturate, they started developing the iphone, etc with ipad and so on.

I’m quite sure Apple market share will start eroding in phone market sooner or later, but they’ll keep good margins on their products, just like for Macbooks in Notebook market.

Last but not least, their approach on microprocessor IP is geared to get the best application processor for a minimal cost while keeping it differentiated and ARM is the best choice to them in that domain. You can’t compare this situation to PC history and Intel/Power PC, it’s a new context and new rules apply.

Indeed unlike Intel, ARM allows lots of customization. It’s damn smart: Apple don’t have to invest into a new architecture but they can make it unique & performing for a low price. Many people just didn’t understand that Apple doesn’t develop new chips (they want you to believe it), they customize ARM cores! Great result for low cost.

Interesting analysis. I think there are a couple more data points that you can look at.

1. Apple has demonstrated experience and ability in porting their OS to new silicon. If Apple ARM customizations become uncompetitive, Apple would probably just switch to other ARM designs or even Atom.

2. Apple had many moves in getting iPod dominance. The first iPods were Mac only. When the MP3 market started to take off, a lot of companies started to offer their own solutions. Once Apple provided support for the PC market and also offered lower cost/lower feature iPods, Apple effectively squeezed out the competition. I believe we haven’t seen all of Apple’s moves yet. Droid had the largest marketshare this last quarter, but did those numbers include the iPhone 4? Did Droid do just as well on AT&T? If not, then there is still a stronger preference for iPhone by customers. What happens if the rumors are true and the iPhone is released for CDMA? Will CDMA customers stop buying Droid?

I think it’s too early to bet that Apple will be a long term loser…

Gabe:

It depends on what Apple aspires to be. I am not sure Steve Jobs wants them to be a highly profitable niche player, especially after their 70% market share in the MP3 player market.

Also, I am worried that their long term profitability is as risk if the relentless competition between the Android phone makers both drives innovation while pushing down margins and prices. Granted those phone makers won’t make any money (the way most PC makers made no money and all the profits went to Wintel and may now go to Google/ARM), but that’s not my argument.

My argument is that in the long run they will be a marginal player with lower margins than they enjoy today.

BTW I am sure Apple will do well for the next few years. My worries are more 2013 onwards…

I assume that the investors in OLX gave you money before you wrote this? The analysis is flawed in that your comparisons are flawed. WHiel you did a lot of work on this if it was a term paper, an A. As a business analysis, an OK first daft.

It is has enough holes in it, that no matter what, you will be able to point to a success. Was that your goal?

Well, author apparently never reads the MarketWatch:

http://blogs.marketwatch.com/cody/2010/09/02/why-apples-headed-to-350-by-year-end/

What make you think, Apple wants to spread over all markets

God, if FG thinks this is his best blog post for 2010, I shudder to think how awful the others must be. A lot of things he got wrong but here is the biggest one.

Openness leads to market domination. By whatever nebulous means he measures market domination.

And exhibit A to support this assertion is Microsoft and Windows.

I am sorry to say but it was not openness that gave DOS & Windows the guaranteed win. Three letters gave DOS-Windows a guaranteed win: I, B & M. The moment IBM tapped DOS back in 1981 it was game over. Microsoft won, no corporation in 1981 was going to buy a microcomputer that did not have the letters I, B & M stamped on it. Apple was just a cute little company with a frivolous name that was run by what seemed to be a pair of stoners. If IBM had exclusive rights, or bought DOS outright, IBM would still be dominating the PC industry right now and we would not be talking about openness.

Now openness did something for Microsoft though, because IBM did not have exclusivity on DOS, the IBM clone industry sprouted and grew. And Bill Gates, to his credit, saw that if he cultivated the clone industry, then these lean and hungry clone builders could very well overwhelm IBM’s PC division which means control of the PC industry will transfer from IBM to Microsoft. By encouraging cut throat price competition among PC hardware manufacturers, Microsoft can siphon off most of the profits in the PC industry and dictate terms to the hardware mfrs as well.

So there, that should finally put to rest this openness-is-the-key-to-victory canard that unintelligent tech industry pundits keep trotting out. And think about it. What other industry that sells complex consumer products is open? Automobiles? No. Video games? No. Hi Fi audio? No. PCs really are the exception and as I explained openness wasn’t even the key to DOS-Windows’ domination.

Oh and by the way, if openness is really king, what personal computer is right now exhibiting the fastest sales growth? The number I heard recently was 24% growth while the rest of the industry was plodding along at 3%. What’s the name of that company again? Ap- what? Oh, Apple. You mean closed, proprietary OS, no-clone Apple?

Hmm, wonder why? Has to do with the type of customer that predominates now. And whether they prefer a device they can tinker with endlessly or an appliance that just works. Some commenters above talked about it already.

Aardman,

Best is subjective. This post is definitely the most read and commented on of the year.

Also, I am not arguing that it’s all about openness. One of the main arguments is that the diversity of phone formats, screen sizes, price points, etc. with broader global distribution will ultimately trump the single format and price point of the iPhone.

In other words “openness” does not just refer to the app store, but also to the willingness to work with various carrier partners, let third parties build their own phones, etc.