I covered FJ Labs’ investment strategy in the past which covers the type of companies we want to invest in. Today, I wanted to cover specifically how we evaluate startups.

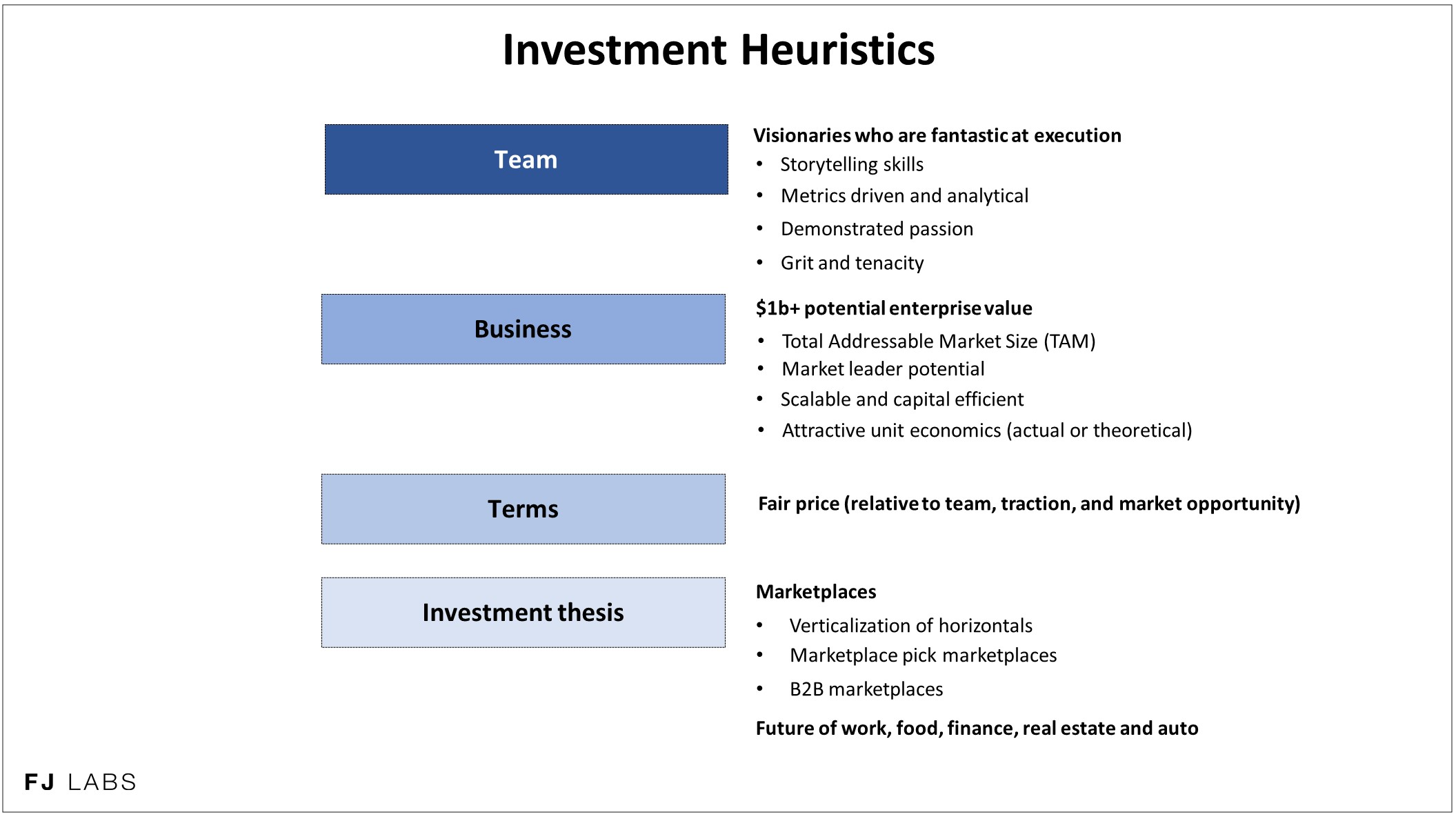

We use four criteria:

- Do we like the team?

- Do we like the business?

- Are the deal terms fair?

- Is the business in line with our thesis of where the world is going?

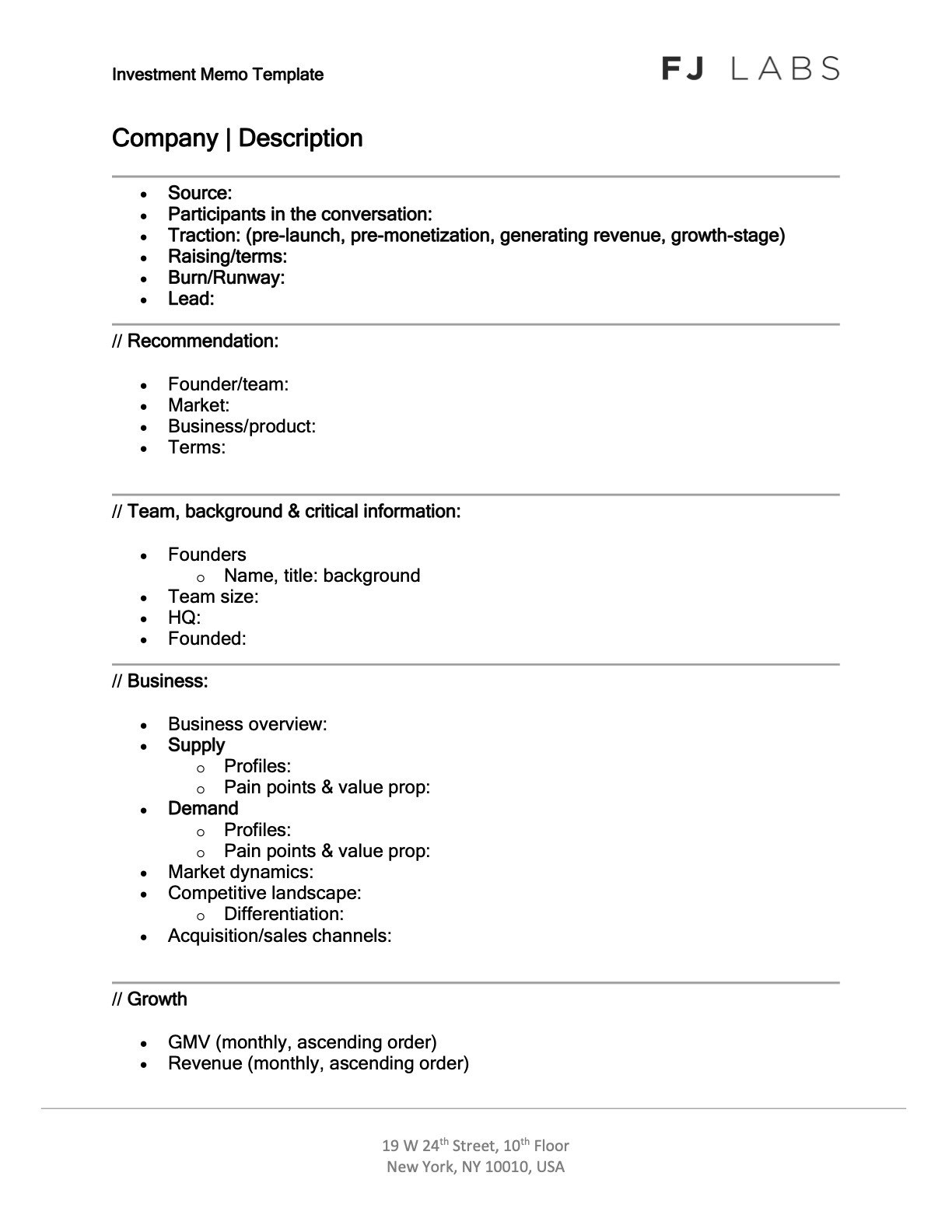

The investment team member taking our first evaluation call fills in a standardized deal memo over the course of one hour, evaluating the business along these four criteria. He or she then adds a recommendation. Every week on Tuesday, during our two-hour investment committee meeting, we review the deal recommendations from the prior week. Jose or I then take a second call with the most compelling businesses where we dig deeper in areas of interest.

You can find our deal memo below.

After these two 1 hour calls over the course of a week or two, we decide whether to invest. We also share our thinking with the startup. Should we decide not to invest, we tell them what would need to see from them to change our mind.

1. Do we like the team?

Every venture capitalist in the world tells you: “I invest in extraordinary people.” That is extremely subjective. The issue with that underlying subjectivity is that it can lead to cognitive biases.

To try to be more objective we assessed which founder skills lead to startup success. Based on our analysis we want visionary founders who are fantastic at execution. Over the years, we noticed that good proxies for those are storytelling skills and analytical skills. Storytelling skills are key because someone who can weave a compelling story has an easier time attracting capital, can raise money at a higher valuation, builds a better team with better talent, signs extraordinary business development deals to grow the company faster, and gets a lot of free press.

Imagine you come to pitch FJ Labs and you tell us: “I did an in-depth market analysis. The market is large and attractive. The incumbents are slow moving, and my approach is differentiated and better.” It is factual and seemingly compelling, but that is not a story. A story sounds more like the following: “This is a problem I faced my entire life. I hate the current user experience. It is grating to me to the point that I am dedicating the rest of my life to solving this problem. Because I experienced it so much, I know exactly what the solution is.” That passion, and that intersection between your story and the company you are building, is very compelling. This is not a specific example, but it gives you a sense of what we are looking for.

If you only have extraordinary storytelling skills, it is not enough. Perhaps you can build a large business, but it may not be well-run or capital efficient. You might build a company like Fab.com, where you get hundreds of millions in revenues, but never get to unit economics that work, and the company does not make money. Or maybe you build a company like Theranos, where you sell a fantastic story that everyone wants to believe in but is ultimately not true.

As a result, the second thing we look for is that the founder / CEO must also be metrics-driven, analytical and know how to execute on his or her vision. They really need to understand the business they are in. They need to be able to articulate their unit economics. Even if their business is pre-launch, they need to understand their theoretical unit economics based on industry averages and landing page tests they did. However, those skills on their own are also not enough. Absent storytelling skills these founders will build small, profitable businesses, but not industry-defining ones.

We also look for demonstrated passion, but it typically comes across during our evaluation of storytelling skills. Likewise, we also look for grit and tenacity. Perhaps you experienced hardship in getting to where you are, but it need not be there. We are privileged enough in the West that many do not really face adversity. You can go to a good school, get good grades, get great jobs, and never really fail in your life. Yet we really want to get a sense for how you will react to the myriad challenges you will face along the way, especially as a first-time entrepreneur.

Our approach is to intellectually challenge the founders who pitch us. We challenge their assumptions, where they expect to be and why. We test how they react to this. If they crumble under the pressure of the questioning we have about their business, then obviously they are going to crumble against the much bigger pressures of the myriads of failures they will face as an entrepreneur. Ultimately, your response to our challenges also comes across in your storytelling and analytical skills.

In summary, we really want to back that rare breed of founders who are both visionary and fantastic at execution.

2. Do we like the business?

It is worth mentioning that for some VCs, having an amazing team is enough. Their reasoning is that extraordinary teams will figure the business out even if they are not in a compelling business to begin with or do not have a business model with attractive unit economics.

This is not true for FJ Labs. There are around new 5,000 startups every year in the US that raise $500k or more in funding. The 5-year survival rate of these startups is 7% on average and it is much lower for companies that start with no business model. By comparison, we have made money on 50% of our 150+ exits because of our discipline and liking the business plays a large role in that.

There are several criteria that make a business compelling. Is the total addressable market (TAM) large enough? If not, can you grow the market sufficiently to support a billion-dollar company in the industry? There are a lot of ancillary things that go along building an unbelievably valuable large business in a marketplace environment. Are you in a position to be the market leader? Is this scalable? Success also means you do not get disintermediated, which implies there is reasonable fragmentation on the supply and demand side. But to me, these factors all fall under the subset of: “is there an opportunity to build a billion-dollar company here?”

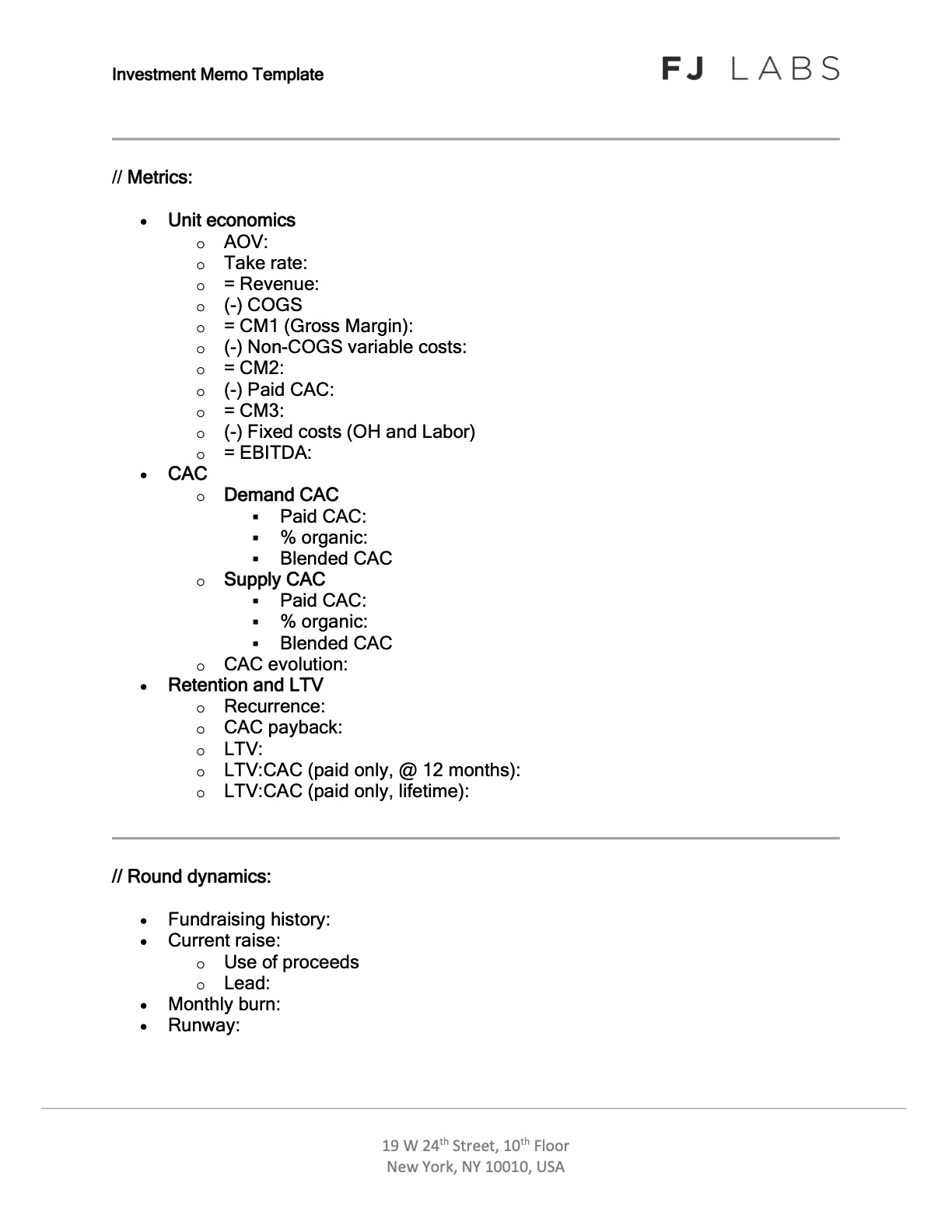

Beyond that, there is one thing above all else that we care about as we are evaluating the business: does it have attractive unit economics? If the startup is pre-launch, the question applies to your theoretical unit economics. If the startup is post-launch, I expect to discuss actual unit economics. Note that in the interest of conciseness and brevity, I assume readers of this article know what I mean by unit economics. I will create a separate post on how FJ Labs looks at unit economics soon.

Good unit economics from our perspective is one where the startup can recoup its customer acquisition cost (CAC) on a net contribution margin basis during the first 6 months of operations. We also look for the startup to 3x its CAC in 18 months. In the best businesses we talk to, they have no idea what the long term value (LTV) to CAC ratio is (LTV:CAC) because of negative churn. Even though they lose some customers, the remaining ones keep buying more and more and the LTV:CAC may be 10:1 or even 20:1.

Note that there are some exceptions to this rule. For a super sticky SaaS business with negative churn, and essentially an endless customer lifetime, it is ok if it takes 12-18 months to recoup its CAC.

For a pre-launch business, we expect the founders to have thought through what the unit economics should be. They should know the average order value in the industry and expect to be in line with it. They should also have a strong grasp of the underlying cost of goods sold (COGS), and hence should have a good sense of their margin per order. The average recurrence in the industry should also be known.

The unknown part is the customer acquisition cost. However, you can test for it. You can create beautiful landing pages describing the concept before you even build a functional site. You then spend some money on marketing and can make reasonable assumptions on cost per click, cost per signup and potential purchases from those sign ups. You can again use averages for the industry in terms of what % of visitors to a site in this category purchase something.

Note that I also expect you to assess the density of your customer acquisition channel. Could you spend 50K a month, 100K a month, 500K a month or more, and still have attractive unit economics? If not, you have an interesting small business on your hands, but not a scalable venture backable business.

If you are post-launch, we want you to walk us through your actual unit economics. They may not meet our expectations of 3:1 18-month net contribution margin to CAC ratio yet because your CAC is too high, or your contribution margin per order or recurrence are too low. However, we can overlook these if you can walk us through why your unit economics are going to get there with scale, without needing all the stars in the universe to align.

For instance, perhaps you are in the food delivery business. Right now, you are paying your food delivery drivers $15 an hour, and they are only doing one delivery per hour. And as a result, your economics are underwater. But if you tell me, “Look, right now I am at $100k a month in GMV, or gross merchandise sales. Once I am at $300k per month in the same geographies, which will conservatively happen in the next 12 months, the drivers will be doing three deliveries an hour. The cost per delivery will come down to $5, and at that scale, the unit economics work.” That is a believable and compelling story if you can convince me you have a reasonable plan for tripling in those geographies in the next 12 months.

There are countless examples of margin improvement through scale as you get leverage over your suppliers and get better at marketing and at customer engagement. Ultimately you just need a compelling story of how you will get there with scale even if your unit economics are not there yet.

To conclude this section, while there are many things we look at when evaluating the attractiveness of a business, they all boil down to: can we build a billion-dollar business with attractive unit economics?

3. Are the deal terms fair?

In a funding round there are many terms:

- At what valuation are we able to invest in?

- How much is the company raising?

- Is it preferred?

- Is it a convertible note versus an actual equity round?

- Do we have drag along, tag along, pro-rata and preemptive rights?

All investments we do have at least a 1x liquidation preference because we do not want to be in a position where the founders make money when the investors lose money. In other words, we would never invest in common shares. Beyond that, the term I am going to focus on is valuation. We care about valuation. This is not to say we invest at low valuations. I do not think there is such a thing as a low valuation in Internet startup investing. However, we want to invest at a fair valuation considering the traction, opportunity, and the team.

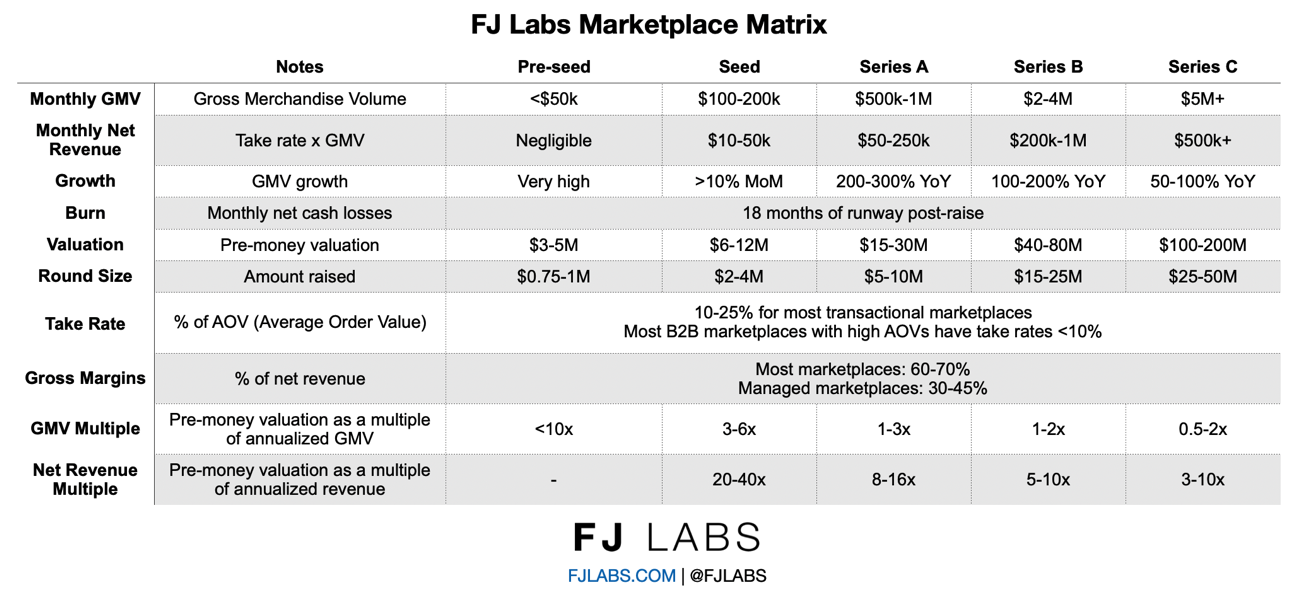

In our area of focus, marketplaces, there is a reasonable set of expectation for valuation and traction at various stages. I am going to give a few examples but note that the ranges cover the median. There are many exceptions, especially on the higher end. In other words, the standard deviation is rather high. A second time successful founder can raise at a much higher valuation. A company growing much quicker than the average can often “skip a stage” and have its Series A look like a Series B or its Series B look like a Series C. However, these are general guidelines that should be helpful for most entrepreneurs.

Beyond raising the right amount at the right stage, VCs often specialize by stage. You need to be speaking to the right VC for the right stage. There is also a built-in growth expectation that you need to go from stage to stage in around 18 months.

For the examples below, I am going to speak of marketplaces with a 10 to 20% take rate. For a pre-seed round, you are basically at launch, you have no sales or negligible sales. Most pre-seed startups these days are raising $750k-$1M at a $3-5M pre-money valuation.

At seed, you are doing $100 to $200K in GMV a month, taking 15%, that gives you 30K net revenues. You are typically in the $10 to $50k per month in net revenue range. You typically raise $2-4M at $6-12M pre. Now from your seed round, you are at 150K a month in GMV, to your A, we expect you to go from 150 to about 650K a month with an 18-month lag. In other words, the expected level of growth at that stage is 300% a year, or 15% month to month levels of growth.

And your series A, once you reach $500k-$1M per month in GMV, you can raise $5-10 million at a $15-30 million pre money valuation. The average is around $7M at $18M pre, $25M post. And with that, we expect you to get to $2-4M per month in GMV 18 months later. You can then raise your Series B of $15-25M at $40- 80M pre. I am including our internal marketplace matrix as reference.

This has been our default internal framework for years but is limited to marketplaces with a 10-20% take rate, which used to be our bread and butter. However, now we mostly invest in B2B marketplaces, which often have 1-5% take rates. The framework is also not applicable for SaaS businesses and e-commerce businesses.

In addition, it was not clear enough whom you should raise from and what the expectation was for the proceeds of the raise. Investors and VCs typically specialize by stage and you need to be speaking to the right VC for the right stage. As result, I redid the matrix to be clearer and cover most cases.

To address expected traction at each stage, I switched from using Gross Merchandise Volume (GMV), as the metric of reference, to net revenues. This allows us to make traction comparable across different business models, even though some differences persist as most SAAS businesses have 90%+ margins, while most marketplaces have 60-70% margins and ecommerce margins vary.

While there are well defined industry averages, some VCs are not valuation sensitive because in their mind the only thing that matters is getting on the best deals that generate all the returns. Venture follows a power law as opposed to a normal Gaussian distribution. Each decade there are 2 super unicorns – startups worth more than $100B created in the US ecosystem. They account for 40% of all venture returns. Beyond that, there are 20 decacorns (companies worth more than $10B) created every decade which account for another 40% of all venture returns. The 100 or so unicorns created every decade account for the bulk of the remaining returns.

Most VCs are playing “Powerball”. They want to be in the super unicorn lottery winners and will pay anything to get in them. They are ok losing money on most investments. FJ Labs does not operate this way. We want all the startups that we invest in to be viable which is why we care about their unit economics and the investment valuation.

It is the reason we make money on over 50% of the startups we invest in. We often invest at a $5M money pre-money valuation and exit at a $30M valuation because the company did ok but did not scale as originally expected. Had we been only unicorn hunting and been willing to overpay those startups we would lose money on investments like those.

Note that we push for “fair valuations” not just out of self-interest. We really think founders do themselves a disservice when they raise too much money at too high a price. They are then priced for perfection and if things do not go according to plan and they do not grow into their valuation, it might kill the company as few people want to go through down rounds. They are both psychologically scarring and negatively impact the cap table given the anti-dilution provisions in most rounds. Also, people who raise too much capital tend to spend it and not be as capital efficient as they can be.

Of course, there are counter examples with companies continuously raising ahead of traction successfully and making it such as Uber, but there are many more corpses along the way including our very own Beepi.

4. Is the business in line with our thesis of where the world is going?

We focus on marketplaces and have specific theses on the future of marketplaces. Right now, we are specifically focusing on:

- Verticalizing horizontal (multi-category) platforms

- Marketplace pick marketplaces

- B2B marketplaces

By virtue of seeing so many deals in so many industries, combined with being students of history and trends, we have very well-defined perspectives on the future of these industries. We have specific theses on the future of food, the future of work, finance, lending, real estate, and cars amongst many others.

Most of the businesses we invest in touch upon many of these themes simultaneously. I will write a detailed blog post covering our current investment thesis soon.

Conclusion:

When we evaluate startups over the course of our two 1-hour calls, we evaluate them along the four dimensions we covered: the team, the business, the deal terms, and alignment with our thesis. We want all four criteria to be conjointly met: amazing founders, with great businesses, raising at fair terms, in line with our thesis. If you are an amazing founder, but feel the valuation is too high or the business not compelling, we will not invest. Likewise, if it is a great idea, great terms, and full-on thesis, but we feel the team is mediocre, we do not invest.

Of these four variables, we are a bit flexible on the thesis. While we are mostly marketplace investors, we also invest in startups that support marketplaces but may not be marketplaces themselves. Very exceptionally we invest in ideas that are out of scope, but we find incredibly compelling. We also back founders that have been successful for us in the past, even if their new startup is not a marketplace. This is how we ended up investing in Archer, an electric VTOL aircraft startup. We backed Brett Adcock and Adam Goldstein in their labor marketplace startup Vettery which was sold to Adecco. We were excited to back them in their new startup despite our lack of domain expertise in electric self-flying aircrafts.

Requiring that our four investment criteria be collectively met is vastly different from the way many Silicon Valley VCs decide to invest. They back great teams at any price regardless of current unit economics and expect them to figure it out. However, if you analyze the distribution of venture returns, our approach seems justified. 65% of investment rounds fail to return 1x capital and only 4% return greater than 10x capital. We currently have a 61% realized IRR on our 218 exits (including all the failures) and have made money on over half our exited investments.

Note that part of the reason we chose this approach is that in the past most unicorns and decacorns came out of Silicon Valley. I chose to live in New York for personal reasons: I love the intellectual, artistic, and social scene here. It is also much easier to travel to Nice, where my family lives, from New York than San Francisco, and the time difference with Europe is a lot more manageable. In other words, I chose New York knowing it would make me significantly less financially successful than if I lived in Silicon Valley because I expected not to see and be able to invest in the very best companies. I was comfortable with that choice because I optimize my life for happiness and fulfilment and not financial returns.

With the advent of open source, AWS and the low-code / no-code revolution, we are seeing a democratization in startup creation. Companies are being created and scaling in more geographies than ever before. We are seeing super unicorns like Shopify emerge outside of Silicon Valley (in Toronto in this case). COVID is only accelerating this trend as more companies than ever are being built in a distributed fashion.

As a result, I even expect our comparative disadvantage to disappear over time and we will be able to invest in more unicorns from an early stage, especially as our ever-improving brand in marketplaces is allowing us to invest even in the best Silicon Valley deals. To date we already invested in 25 companies that became unicorns and in another 25 companies that were already unicorns but increased their valuation by over $1 billion since we invested. Despite these improving circumstances, we will remain disciplined and continue to apply our four selection criteria.

There you have it: how we evaluate startups in on hour! Now that you understand how we decide whether to invest or not in your startup, you should improve your pitch accordingly.

Good luck!

Fabrice, this is concise and complete. I love it and it really shows the transparency of FJ Labs’ process. Thanks.

Amazing

Great content . very useful!

Amazing content as always. Any big difference when it comes to stage of the round and Monthly Net Revenue for e-commerce/D2C brands?

Amazing! Merci Fabrice!

Best step by step guidance to compelling investment I’ve seen recently. Helped me A LOT. Thanks!

Hi Fabrice. I would like to write you a short description of our business, but not publicly.can you send me email address that only you will read. Thanks.

Send me a LinkedIn inmail with enough information for the team to evaluate the opportunity including the deck and traction.