As some of you may know FJ Labs has a startup studio program where we help build companies. The model used to work as follows: we hired entrepreneurs in residence (EIRs), typically former P&L or product managers at large marketplaces (e.g., Uber, Instacart or Airbnb) who were ready to strike out on their own but wanted our support to come up with the idea, get off the ground, and with fundraising. The model was particularly appealing to first time founders. While we were co-founders, we invested $750k for 35% and gave most of the equity to the founding team. We did this model for several companies including Rebag and Mundi which have come into their own.

Over the years, we came to realize the model was not as scalable as our venture investing model as the studio companies required a significant amount of time from FJ partners and more capital for follow-ons than we had given our fund size. As a result, we paused the formal program and turned into an opportunistic model. We no longer review 250 candidates every year to get two EIRs. Instead, we either evaluate founders who come to us through word of mouth for the studio program, or we build the companies we want to build. This is where Midas comes into play.

Before I delve deeper into Midas, it’s worth mentioning that we are testing a lighter touch incubation model for repeat founders. We invest $250k for 10%. We still help with ideation and fundraising and are happy to provide our office space and resources, but without taking a board seat and being operationally involved – which repeat founders do not need anyway. It’s a good way to work closely with founders we love who value our marketplace expertise.

It’s also worth mentioning, that we have been in crypto since its inception. I was mining BTC on my GPUs in the early 2010s and FJ started investing in crypto in 2017. We were early investors in Figment and Animoca and now have around 100 crypto investments. In fact, as I explained in a post last summer, around 10% of FJ Labs is invested in a long only liquid crypto strategy which currently has around 30 positions. As you can expect our crypto strategy has been doing rather well given our contrarian approach to investing: selling in 2021 and investing in 2023.

As I was spending a lot of my time focusing on the FJ Labs crypto strategy, I started thinking through companies to build into the space. Over the years, I had 7 ideas, 3 of which I actually fully coded. However, given that “my friend” Gary Gensler would have disapproved of said ideas, and that we are ultimately a US based fund, I never launched any.

In February 2021, I wrote the blog post Welcome to the Everything Bubble! where I argued that because of overly loose fiscal and monetary policy all asset classes were overvalued and correlated to 1 on the way up. And by all asset classes, I really meant all asset classes: bonds, equities, NFTs, crypto writ large, SPACs, real estate, privates, etc. I suggested to people to sell everything that was not anchored to the ground. We listened to our own advice and did as many secondaries as we could in as many companies as possible. Given that we play in private markets, we only sold a fraction of what we would have liked to sell, but nonetheless did better than most.

As rates started to rise in November 2021, it became clear that crypto, which was the ultimate speculative asset, was going to enter a bear market. I started reflecting on what ideas would make sense in the crypto that would work in both a bear and bull market. Ultimately, one crypto application has demonstrable use cases: stablecoins. They are used as a medium of exchange, as a store of value, and as a trading asset. Even at the bottom of the bear market, there was over $130 billion in stablecoins mostly through Tether (USDT) and Circle (USDC). My good friend Mark Lurie, CEO of Shipyard Software, which we are investors in, explains it best in his recent Forbes article.

The idea that occurred to me was that in a non-zero rate environment stablecoins should be yield bearing. The reason that Tether and Circle are some of the most profitable companies in the world is that you give them dollars, they buy T-Bills which currently yields them 5.25% while you earn nothing on your USDC or USDT. I felt there should be a safe stablecoin fully backed by US T-Bills that gave the yield to its underlying owners. After all the distinction between a savings account and a checking account in the bank is merely a ledger entry such that the bank can increase its profits by giving you less yield on the money in your checking account. Such a distinction should not exist in the Web3 world. There is no reason you could not be settling directly in a yield bearing instrument.

Now we happen to be at a recent high point in interest rates, making this idea particularly valuable. I have no idea what the terminal Feds Funds rate is going to be. It may very well be lower at say 3%. All that I know is that the long-term rate is not 0% and that as such stablecoins should be yield bearing.

The question that remained was whether this could be done in a regulatory compliant way as we believe the future of CeFi and DeFi is regulated. Enter Dennis Dinkelmeyer. He had traditional banking experience at the likes of Goldman. We had worked together for a few years on a SPAC buying $200 million of treasuries in the process and going through SEC registration. We discussed working together in the summer of 2022 and I told him that if he found a legal way to bring this to light, we were a go. To his credit, after hundreds of hours talking to dozens of lawyers in more jurisdictions than I can count, he found a solution. Midas was born. Dennis became its CEO, and I joined him as Executive Chairman, the norm for FJ Labs studio companies.

Midas just launched mTBILL, an ERC-20 token tracking short, dated US T-Bills, passing through the yield to its holders. mTBILL is European MiCA, MiFID, and Prospectus Regulation Compliant and does not have the liquidity limitations of Reg-S competitors. You can redeem or transfer your mTBILL to non-US and non-sanctioned individuals without restrictions. The framework we have can also be used to tokenize other real world financial instruments, which we may very well do in the future.

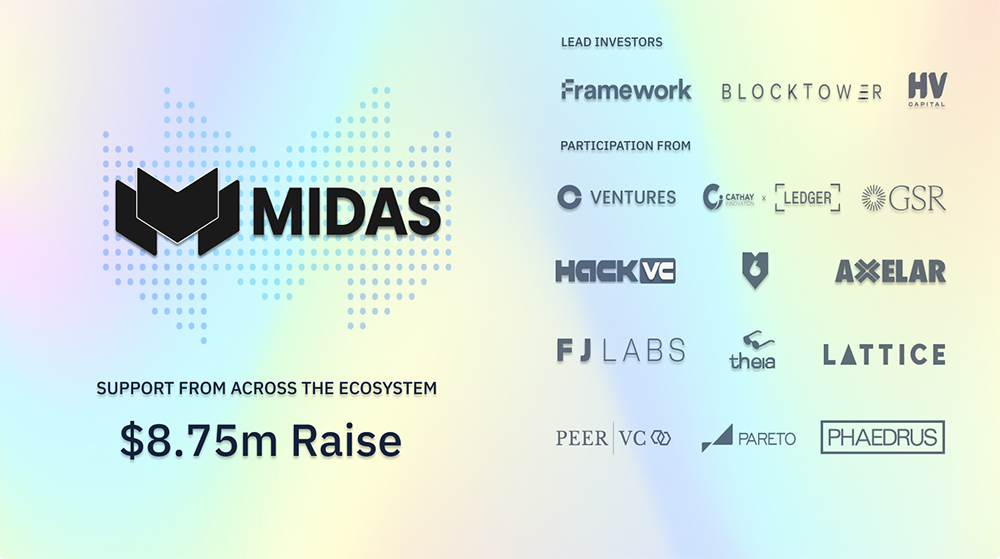

We have hired an amazing team and just raised a $8.75 million round from the whose who of crypto investors including BlockTower, Framework, 6th Man Ventures, FJ Labs, Axelar Foundation, Peer VC, HV Capital, Theia, Cathay Innovation x Ledger, Coinbase Ventures, and GSR. They bring the experience, connections, and credibility we need to accumulate TVL and integrate with all the relevant CeFi and DeFi protocols. I am including a copy of the fundraising announcement below.

Midas Raises $8.75 Million Funding Round Led by Framework Ventures, BlockTower and HV Capital

Today marks a new chapter in decentralised finance (DeFi) as Midas announces an $8.75 million funding round, led by visionary firms Framework Ventures, BlockTower and HV Capital. We’re also honored by the commitments from Cathay Ledger, 6th Man Ventures, Hack VC, GSR, Lattice Capital, Phaedrus, Theia Blockchain, Pareto, Axelar Foundation, Peer VC, FJ Labs, and Coinbase Ventures, whose commitments reinforce our mission to bridge the realms of traditional and decentralised finance.

After more than two years of intensive research, we’re thrilled to unveil mTBILL. This ERC-20 token, tracking short-dated U.S. Treasury Bills via an ultra-liquid BlackRock Treasury fund, offers an innovative way for stablecoin investors to earn yield on-chain, seamlessly melding the worlds of traditional finance and decentralized finance.

Stablecoins represent more than just an anchor in the volatile seas of cryptocurrency; they’re a lifeline for efficient, cross-border transactions. As traditional financial systems grapple with layers of intermediaries and protracted processing times, stablecoins emerged as the swift, cost-effective alternative for global transfers.

However, the last few years have seen a dramatic shift in their supply, coinciding with rising interest rates. The pivot of capital to traditional securities underscores the need for a DeFi solution that can offer competitive returns. mTBILL is engineered precisely to meet this challenge, distributing yield on-chain while enabling free participation in the DeFi ecosystem.

In the rapidly evolving world of finance, Midas stands at the forefront of innovation. With the introduction of mTBILL, we’re not just participating in the market; we’re aiming to redefine it. Our token represents a bold step forward, merging the reliability of traditional financial instruments with the efficiency and accessibility of DeFi.

mTBILL offers a sustainable, equitable, and fully compliant method for investors to tap into the yield potential of U.S. Treasury Bills, leveraging the best of both worlds to secure a future where financial empowerment is accessible to all.

Hear from Those Who Believe in Our Vision

As we chart this ambitious course, the support and insight of our investors reinforce the potential of Midas to make a lasting impact. From leading venture capitalists to seasoned finance professionals, the consensus is clear: Midas’s approach to bridging the gap between traditional finance and DeFi through mTBILL is not only innovative but necessary for the next stage of financial evolution.

Who can invest?

mTBILL is meticulously designed for a global audience, adhering to German regulatory standards to ensure wide accessibility while prioritizing security and compliance. This approach opens opportunities for investors outside the U.S. to engage with a stable, yield-generating digital asset, underpinned by one of the most secure financial instruments available.

Interested in Investing or Learning More?

We invite you to explore the potential of mTBILL and discover how Midas is paving the way for a new era of financial innovation. Whether you’re an investor seeking enhanced yield or a blockchain enthusiast interested in the future of DeFi, Midas offers a gateway to the next frontier in stable capital.

For more information on Midas and the mTBILL token, navigate to https://midas.app/, or contact us via [email protected]. For a technical deep dive, visit our documentation at https://midas-docs.gitbook.io/midas-docs.

Socials:

- Midas’ Twitter: https://twitter.com/MidasRWA

- Midas’ LinkedIn: https://www.linkedin.com/company/midasrwa/

- Dennis Dinkelmeyer’s LinkedIn: https://www.linkedin.com/in/dennisdinkelmeyer/