I have been putting a lot of thought into macro considerations of late. There are time periods when macro trumps micro. In those moments, all asset classes correlate to 1 on the way up in moments of exuberance. Due diligence goes out the window and markets do not differentiate amazing companies from clunkers. Likewise, all asset classes correlate to 1 on the way down in depressed times. The market throws out the baby with the bath water.

We have been living in such times for the last 18 months. In February 2021, I argued in Welcome to the Everything Bubble that negative real rates with aggressive expansionary fiscal policies were fueling a bubble across every asset class and that it was time to sell overvalued assets aggressively. In March of this year in The Great Unknown, I argued that people were significantly underestimating the risks to the global economy. Those risks have only increased since.

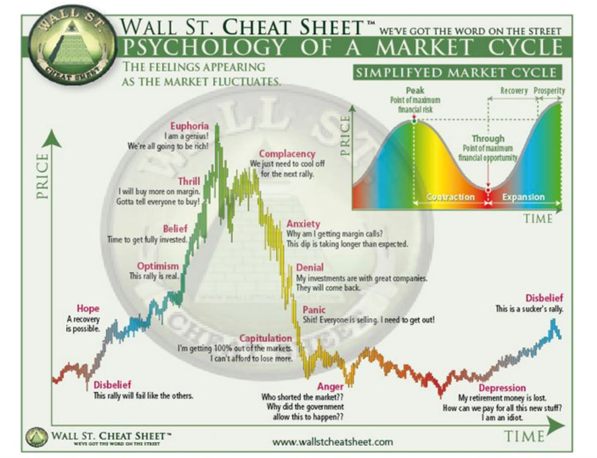

Being bearish about the global economy is consensus right now. As usual, I am contrarian, but in this case, my contrarian take is that the consensus is not bearish enough. Most people are underwriting some form of soft landing or mild recession in 2023. We are far from being in the valley of despair where all hope has been lost. Any news that is less bad than expected sees the market rip. This happened last week when the CPI print came in at 7.7% instead of 7.9%, or when people greeted the news of a potential slowdown in the rate of increase in rates with exuberance. Mind you, inflation remains stubbornly high, and rates are still going up even if the rate of increase might decline (e.g., the second derivative is negative, but the first derivative is still positive).

There are nine factors that are driving my bearishness.

1. Rates may go higher than people expect for longer than people expect

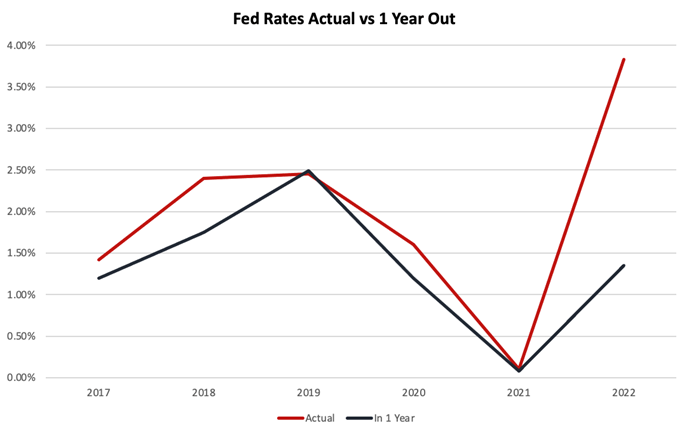

Until the September 20-21 FOMC meeting people were underwriting a US Fed Funds rate peaking at 3.5%. It’s currently 3.75% to 4% and expected to peak at 4.6% in 2023 before declining again.

Earlier this year I fretted that no one was considering the consequences of rates above 5% as they did not consider it within the realm of possibility. This is one area where the consensus has been repeatedly wrong over the last year.

With inflation remaining stubbornly high and showing signs of becoming structural as workers start requesting wage increases in line with expected higher inflation, rates may have to be significantly higher for longer than people expect. I would not be surprised if rates ultimately reached 5.5% or more and stayed high well into 2024 or longer.

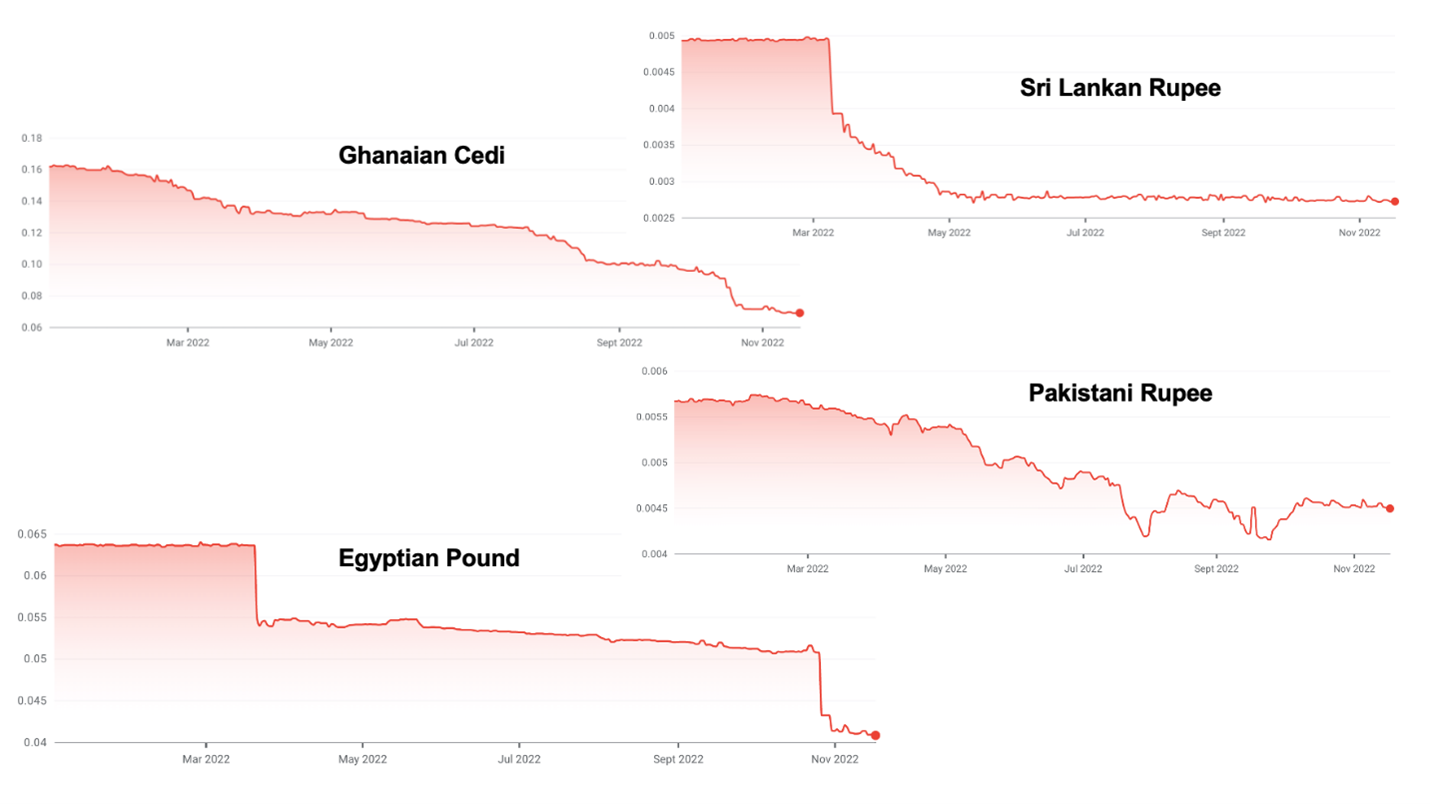

2. The strong dollar is creating a sovereign debt crisis in emerging markets

Most emerging markets have their debt priced in dollars but have their tax revenues in their local currency. Increased rates in the US, combined with very high inflation, and often self-inflicted economic mistakes is seeing the dollar strengthen dramatically.

This increase is putting many emerging markets in a precarious position. Sri Lanka has already defaulted. Ghana and Pakistan look to be next with many others under pressure.

3. High gas prices are going to cause a recession in Germany

Germany’s business model for the last few decades has been to build things with cheap Russian gas and to export them to China. This business model is coming under pressure on both sides. The shutting down of Nordstream by Russia may leave Germany without enough gas both to heat its population and fuel its gas dependent heavy industry. Rationing and increased prices will cause a recession in Germany in 2023 with estimates ranging from a 0.4% to 7.9% GDP contraction depending on the duration and severity of the winter.

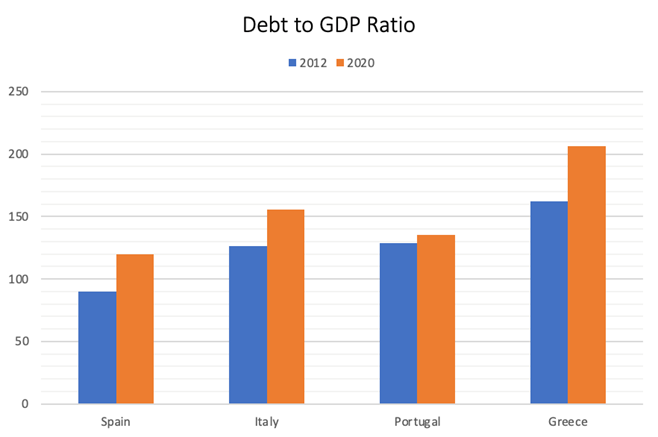

4. There is a new euro crisis looming

Greece almost took down the euro in the aftermath of the financial crisis of 2007-2008. The fiscal position of many European countries, especially in the PIGS (Portugal, Italy, Greece, Spain) is now significantly worse than it was back then.

The level of indebtment is such that it would not take a very large increase in their borrowing costs for these countries to become insolvent. The biggest risk probably comes from Italy whose debt to GDP ratio now exceeds 150% and whose economy is ten times larger than Greece’s. Worse the country elected a far-right nationalist government which may not find many friendly faces in Europe, especially as Germany is in the midst of an energy crisis.

I suspect that when the crisis happens Europe will do whatever it takes to preserve the euro, but that the process will be extremely painful.

5. There is a banking crisis on the horizon

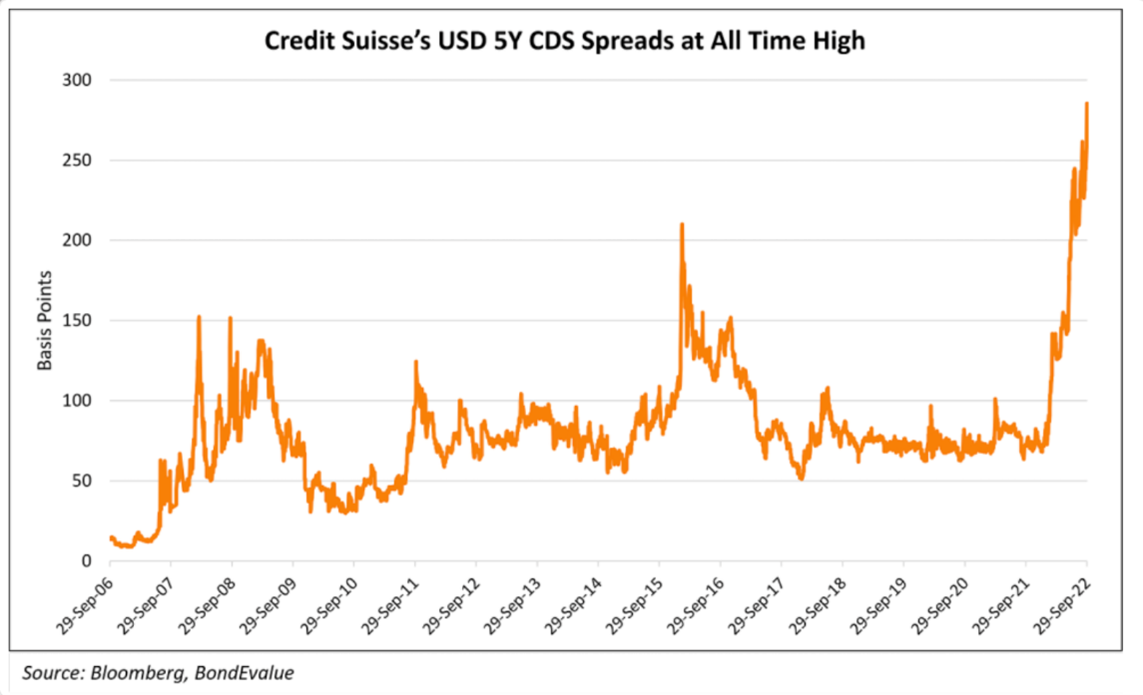

Earlier this year I predicted that Credit Suisse and possibly UBS could default bringing down Switzerland with it. These banks have found themselves at the epicenter of every recent international debacle involving bad lending, e.g., Archegos , Greensil , Luckin Coffee, etc. Foreign currency denominated loans by themselves amount to ~400% of Swiss GDP. Officially, Swiss banking system assets are ~ 4.7x GDP but this excludes off balance sheet assets. Including these suggests a ratio of ~9.5x 10x is more accurate.

Since then, the market has come to realize the weakness at Credit Suisse.

European banks are generally in a weak position. They own a lot of government debt, which would expose them to a possible debt restructuring in the PIGS. They have issued mortgages with little collateral at extremely low rates and will suffer from rate increases and real estate price declines.

Moreover, they have not built significant reserves as their US counterparts have. Should there be a full-blown crisis of confidence it’s not hard to imagine the entire banking system seizing up as banks try to avoid counterparty risk leading to a massive financial crisis.

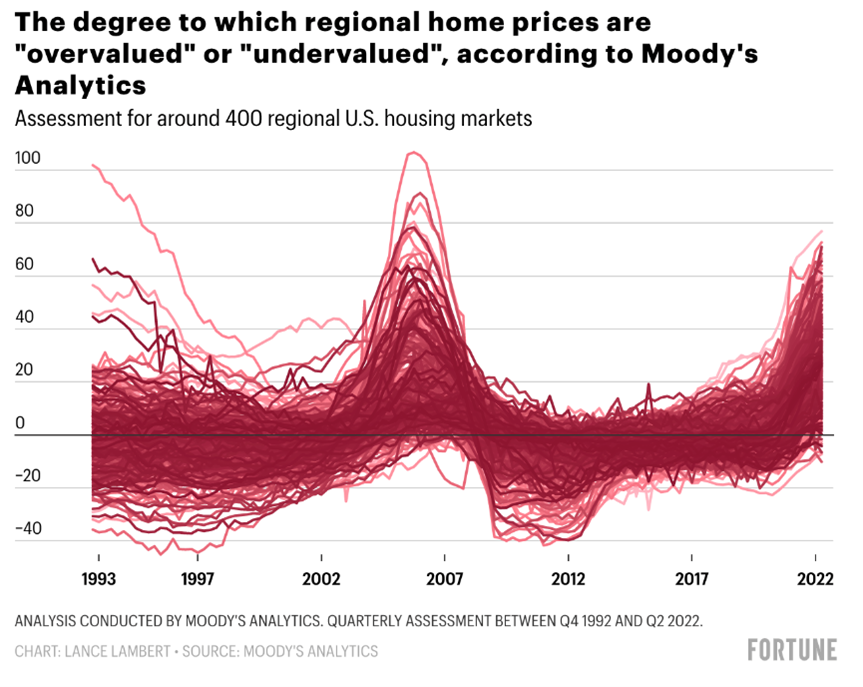

6. Real estate prices are about to fall

Like all other asset classes real estate saw a massive run up in prices in the past decade. Real estate is now overvalued in most places in the US and worldwide.

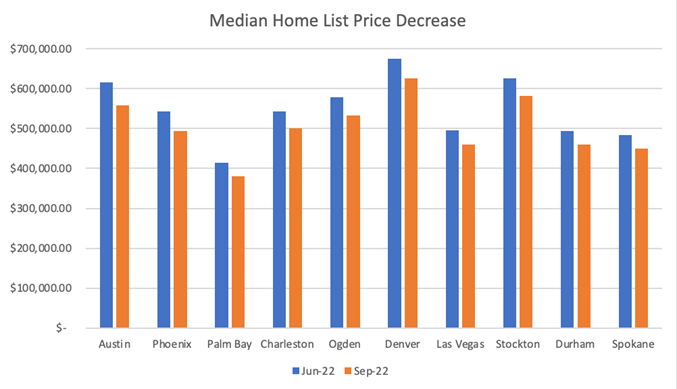

Contrarily to other asset classes, real estate prices have not yet adjusted despite mortgage rates increasing from 2.5% to 7% in the last 18 months. It takes a while for sellers to adjust their price expectations, so liquidity first dries up, then prices fall.

Prices have already fallen upwards of 7% in the last 3 months in cities like Austin, Texas. I would not be surprised if we saw national declines of upwards of 15% in the next 24 months.

This is happening globally. New Zealand house prices are down 10.9% in the last 11 months. Sweden is expected to see home prices drop 20% from their peak. Canada and the UK seem particularly vulnerable as most consumers have variable rate mortgages are exposed to the significant increase in rates.

7. Continued conflict in Ukraine and Russia will keep grain, gas, and oil prices high

There is no end in sight for the conflict. While it continues grain, gas, and oil prices will remain high given, keeping inflation high irrespective of interest rate levels given that the price is driven by supply constraints rather than high demand.

This does not even take into consideration what would happen should a tactical nuke be used during the conflict, the consequences of which would be unimaginable.

8. China is no longer a force for economic growth and disinflation

For decades, China was one of the driving forces of global economic growth and disinflation. The world greatly benefited from China’s ability to manufacture at low cost and at scale helping keep inflation in check.

This is no longer true. Xi Jinping’s incompetent management of the Chinese economy with its zero-covid policy, anti-tech regulation, and generally anti-capitalistic policies have crushed economic growth in the country.

Moreover, his jingoistic policies are leading to a decoupling of China and the West and a de-integration of supply chains. The process of moving these supply chains to India, Indonesia, Mexico, or back onshore, is inflationary as the world loses out from the specialization and the economies of scale it had benefited from during the past 30 years.

On the bright side, most military experts suggest that China will not have the amphibious capacity to invade Taiwan for the next five years. While this geopolitical Damocles sword still hangs over the global economy, it feels like the day of reckoning is not yet at hand.

9. Structurally higher geopolitical risk

The post Cold War entente is breaking down. We are entering a new Cold War in which the West is arrayed against China, Russia, Iran, and North Korea. The Ukraine conflict is making this dynamic crystal clear. Russia is fighting with Iranian made drones, North Korean made artillery, and with China’s Xi having Putin’s back at the UN as well as on the world stage.

This new Cold War could result in awful outcomes in any number of ways:

- Nuclear conflict or a dirty bomb or an accident at the nuclear power station in Ukraine.

- War in Taiwan.

- Escalating cyber attacks on infrastructure in the West.

- The use of technology to destabilize Western democracies, e.g., Russian and Chinese election trolling here in the US.

All of this makes the world a less stable place, erodes the rule of law, and increases the risk of catastrophic left tail outcomes.

Conclusion

Any one of these nine factors would be enough to create a global recession. What worries me is that they are all happening and playing out simultaneously suggesting that a replay of the Great Recession of 2007-2008 may be in store.

I am generally the most optimistic person in the room, and I have not been this bearish since 2006. I still think in probabilistic terms, but now I think the probability of a severe recession trumps the probability of a mild recession, which in turn trumps any optimistic outcome.

For the sake of completion, it’s worth mentioning the things that would make me re-assess my probability weighing towards more optimistic outcomes. If the Ukraine / Russia conflict came to a definite end, with inflation tamed, I would become way more sanguine. Likewise, China has the potential to spring a pleasant surprise in 2023 by tweaking its covid rules and addressing its housing crash.

What to do about it

Despite the high inflation, I would sell assets that are still reasonably priced or when bear market rallies occur to build up US dollar cash reserves to invest at deflated prices in the coming crisis. Should I be wrong in my read, I suspect that asset prices will not have recovered, and you can always re-enter at prices similar to those when you exited. The moment I would re-enter the market, especially with risk assets, is when rates started declining again.

However, if I am right, most asset classes will become very interesting with distressed assets becoming particularly compelling. This will be the first bona fide distress cycle since 2008-2009. I expect there will be plenty of opportunities in distressed bonds, real estate and even crypto.

The exception to this rule is if you have a 30-year fixed mortgage at very low rates on your real estate. In this case, you are better off keeping your real estate even if prices decline 15-20%, because at the current 7% mortgage rates, your ability to buy real estate will have been impaired by up to 50% depending on how low the rates you were paying were. Moreover, inflation is currently above the rates you are paying, decreasing your debt load in real terms.

I would also decrease your annual expenditures to build up a cash reserves in case the recession leads you to lose your job. Repay all variable high interest loans, such as credit card debt, but keep low interest debt.

History trumps macro

In the meantime, the only place to invest right now is in early-stage private tech startups. Early-stage valuations are reasonable. Founders are focusing on their unit economics. They are limiting cash burn to not have to go to market for at least two years. Startups face lower customer acquisition costs and much less competition. While exits will be delayed and exit multiples lower than in the past few years, this should be compensated by lower entry prices and the fact that winners will win their entire category.

The macro that matters for these startups is the one 6-8 years from now when they are seeking exits, rather than the current environment. For now all that matters is that they raise enough cash and grow enough to get their next fundraise so avoid capital intensive industries for now.

The best startup investments of the last decade were made between 2008 and 2011 (Uber, Airbnb, Whatsapp, Instagram), and I suspect that the most interesting investments of the 2020s will be made between 2022 and 2024.

In the long run, history trumps macro. I remain extremely optimistic about the future of the world and the economy. Since 1950, the 11 recessions have lasted between two and 18 months, with an average duration of 10 months. We will come out of this. Moreover, if you take a step back, the last 200 years have been a history of technological progress and innovation that have led to improvements in the human condition despite numerous wars and recessions.

Because of technology the average household in the West has a quality of life unimaginable to the kings of yesteryear. Because of economies of scale, network effects, positive feedback loops in knowledge and manufacturing (also referred to as learning curves), and entrepreneurs’ desire to address the largest possible market and impact the world as massively as possible, new technologies rapidly democratize.

This has led to a massive increase in equality of outcomes. 100 years ago, only the rich went on vacation, had a means of transportation, indoor plumbing, or electricity. Today in the West almost everyone has electricity, a car, a computer, and a smartphone. Almost everyone goes on vacation and can afford to fly. We take for granted that we can travel to the other side of the world in hours and that we have access to the sum total of humanity’s knowledge in our pockets in addition to having free global video communications. A poor famer in India with a smartphone has more access to information and communications than the president of the United States had a mere 30 years ago. These are remarkable feats.

Despite all this progress, we are still at the very beginning of the technology revolution. The largest sectors of the economy have not been digitized yet: public services, health care, or education. Most supply chains remain offline. Their digitalization will make them more efficient and be deflationary, which in turn will be inclusionary.

At FJ Labs, we are meeting so many extraordinary founders tackling the problems of the 21st century, climate change, inequality of opportunity, and the physical and mental well-being crisis, that we are optimistic that humanity will rise to the challenges of our time.

Having read the macro tea leaves correctly and sold as much of our late-stage and crypto positions as we could in 2021, we find ourselves in a cash rich position with only 25% of our fund deployed. As contrarians, we are now investing extremely aggressively in asset light businesses and are extremely privileged to be in position to help build a better world of tomorrow, a world of equality of opportunity and of plenty that is socially conscious and environmentally sustainable.

The next few years are going to be tough, but now is the best time to build, and we will come out of this stronger and better than ever.

Love the read Fabrice Grinda! Do you see any particular industries that will do well in the foreseaable future? Green tech or semi conductor industry for example?

Thank you for your musings Fabrice, always a pleasure to read and listen to you on your podcasts.

Sobering but once again terrific sweeping overview. Let’s all batten down the hatches and keep building. Onwards and upwards!