我很幸運有一個了不起的家庭,它包括我擁有的家庭和我選擇的家庭(也可能是家人的了不起的朋友)。 我們是 Grindaverse,我很榮幸成為其成員之一。 我們花時間互相支援,共同創造充滿歡笑、歡樂和無條件的愛的美好回憶和體驗。

2022 年不斷強調這個家庭的重要性,不要將其視為理所當然。 三月到六月,我暫時擱置了我的生活,搬到了尼斯,説明我父親準備和處理他的癌症治療。 我很高興地報告,由於他的韌性、充滿愛心的家庭、守護天使和免疫療法的奇跡,他完全康復了。

大大小小的健康問題困擾著我的家人。 這是一個很好的提醒,要在場並與他們共度時光。 我也很高興地報告,他們都做得更好。 我確實利用了在尼斯家鄉的延長時間,這是我多年來第一次這樣做,與該地區的朋友和家人共度了有意義的時光。

在那裡,我和我的兄弟奧利維爾在索菲亞安蒂波利斯的 莫拉托格魯網球學院 進行了為期兩周的訓練,這很有趣,很有挑戰性,而且是一段很棒的兄弟情誼。 我們還參加了一些板式網球錦標賽,甚至贏得了一場。 我們還一起玩和完成了 《艾爾登法環 》。

我還有機會與凱文· 里安(Kevin Ryan )在普羅旺斯的家人建立聯繫。 這是我這一年的亮點之一,也是處理家人健康問題的一個非常需要的喘息時刻。 我非常感激他的家人如此歡迎我。

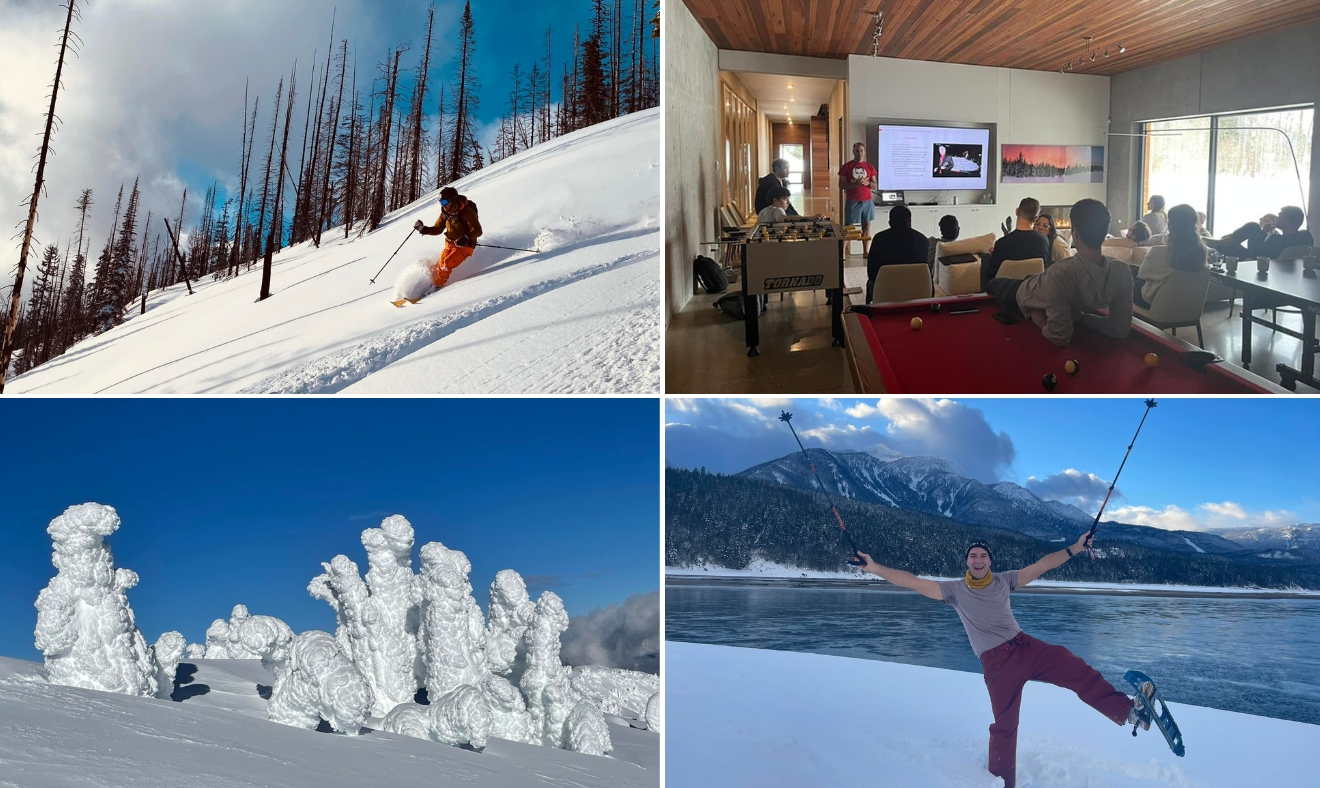

在我去法國之前,這一年的開局非常好。 正如我在《 2021:有史以來最好的一年》中解釋的那樣,我剛剛通過FaceTime在雷夫爾斯托克購買了一棟小木屋,我在那裡度過了今年的前兩個月。 我接待了無數的滑雪夥伴,瘋狂地進行直升機滑雪,甚至在那裡主持了FJ Labs一年兩次的頭腦風暴。

之後,我前往挪威為即將到來的 2023 年 1 月在南極洲的極地探險進行訓練。 凱文·里安(Kevin Ryan)邀請我和他一起贊助 INSPIRE 22,這是一項研究探險,從海岸到極點,在冰上度過了50 +天,從赫拉克勒斯灣到南極徒步1,100公里。 他們正在研究極端條件下性別和飲食的影響。 作為贊助商,我們可以在旅行的最後 10 天加入。

我前往挪威的芬斯(Finse)進行訓練。 我必須承認,這與我以前做過的任何事情都不一樣。 雖然我在熱帶氣候中做了很多生存訓練,但應對寒冷帶來了全新的組成部分。 我不得不購買大量不敬虔的專用裝備。 然後我必須學會使用它:

- 用我的帳篷、睡袋、食物、丙烷罐來融化積雪以獲得水,以及我所有的裝備。

- 拉說 130 磅重的 pulk 帶有帶有半皮的特殊滑雪板。

- 在 -30 的條件下組裝一個迎風的帳篷,戴上手套。

- 融化的雪用於飲用水和烹飪補水飯菜。

- 一般在非常陌生的環境中應對寒冷和雪地。

在該地區期間,我決定跳到瑞典,在Niekhu進行直升機滑雪。 在去那裡的路上,我在基律納的冰酒店過夜。 弗朗索瓦(François)喜歡這兩種經歷,並且非常偏愛直升機滑雪,咕咕叫和唱歌,我走得越快。 他只在我放慢速度或停下來時表示不高興。

夏天,我從來沒有在山上呆過太多時間。 鑒於我已經在法國,我決定去看看聖莫里茨美麗的山脈,並在維登峽谷漂流。 在那之後,我前往雷夫爾斯托克,看看我在夏天對它的看法。 我喜歡它,打算每年八月回去。 這是一場為期一個月的多運動冒險,在華麗的環境中進行激烈的山地自行車、徒步旅行、站立式槳板衝浪和全地形車。 這感覺就像一個訓練營,但我絕對玩得很開心。

我很高興火人節在中斷兩年後於 2022 年回歸。 今年對我來說很特別,因為我和我的兄弟奧利維爾一起去,對他來說這是第一次。 我喜歡向他展示繩索,蜿蜒穿過藝術,並通常與他進一步建立聯繫。

我終於在9月份搬回了我在紐約的公寓,經過多年的裝修,由於水災。 我很高興把這一切拋在腦後,終於回家了。 這套公寓真的感覺像家一樣,在我的工作/生活平衡中發揮著有意義的作用,使我能夠平衡紐約緊張的智力、社交、專業和藝術生活,以及特克斯和凱科斯群島和雷夫爾斯托克的運動和精神生活。 能夠再次舉辦知識份子沙龍,並有幸接待 丹尼爾·卡尼曼、 喬·斯蒂格利茨和 尼古拉斯·湯普森等了不起的人,我感到非常高興。 令我非常高興的是,帕德爾終於到達了紐約。 我在 Padel Haus 度過了無數個小時,距離我的地方有12分鐘的路程。

我在 11 月和 12 月回到了土耳其,加入了一個超級有趣的輪換角色陣容,放風箏、玩板拍、網球,總的來說很快樂。 Grindaverse 於 12 月 10 日開始與我的父母、叔叔、中弟 Chris 和堂兄弟一起抵達,然後在 12 月 16 日之後與其他有孩子的家庭成員一起加入。 儘管這是我們第三年這樣做,但今年感覺很特別。 30個人沒有戲劇,只有感恩和愛,這是非常罕見的。 看到每個人都健康快樂,並希望明年有更多的 Grindaverse 成員能夠成功,這讓我度過了這一年!

我不能在寫一篇關於家庭重要性的博客文章時不提到弗朗索瓦出現在我的生活中並看著他長大是多麼令人驚奇。 我以為我不會享受他生命的頭兩年,因為他不會很互動。 事實並非如此。 我喜歡它的每一分鐘:看到他學會爬行,邁出第一步,開始瘋狂地跑來跑去,以令人難以置信的速度學習新單詞和概念,所有這一切。 他也非常善於溝通和表達,很容易理解他想要什麼。 我可以花幾個小時和他在一起,只是在我們之間滾動汽車或看他打球。 我想這也有助於我似乎中了嬰兒彩票。 他非常和藹可親,從不哭泣,整夜睡覺,而且似乎總是很開心。

在專業方面,2022年繼續格外繁忙。 我們正確地稱 2021 年泡沫正在膨脹,並在那一年的大部分時間里尋求退出機會。 2022年,當其他人都在裁員時,我們決定逆勢而為,積極投資。

總體而言,FJ Labs繼續搖擺不定。 2022 年是我們有史以來最多產的一年。 該團隊發展到32人,增加了投資者關係主管和投資組合主管等關鍵職位。 我們部署了1億美元。 我們進行了 308 項投資,182 項首次投資和 126 項後續投資。 我們有 33 次退出,其中 16 次成功,包括 Animoca 和 Clearco 的二級出售,以及 eBay 收購 TCGPlayer 、Despegar 收購 Viajanet 和 Victoria’s Secret 收購 AdoreMe 。 AdoreMe 對我們來說是一個特別的公司,因為它是我們正式孵化的第一家公司,也是我們 EIR(駐地企業家)計劃的起源。

自從Jose和我24年前開始天使投資以來,我們投資了989家獨特的公司,有266家退出(包括部分退出),目前有749家活躍的獨特公司投資。 我們實現了 39% 的內部收益率和 4.0 倍的平均倍數。 我們總共部署了53000萬美元,其中17300萬美元由Jose和我提供。

2022年,我經常受到寫作的啟發。 當我們進入一個宏觀壓倒微觀的時期時,我重新關注了宏觀經濟問題。 我還寫了為什麼我做了很多事情。 我最好的文章是:

我在《與獨角獸一起玩》中不那麼多產,因為我在法國照顧父親時沒有流媒體設備。 然而,我喜歡深入研究 印度金融科技生態系統。 我還與我的朋友 奧斯卡·哈特曼(Oskar Hartmann)進行了一次有趣的對話。

像往常一樣,我是一個非常多產的讀者。 我最喜歡的書是:

我今年的罪惡感是科幻肥皂劇系列 《後院星際飛船》。

我對 2022 年的預測是命中註定的。我正確地預測了後期科技股的估值將得到修正,藝術 NFT 的泡沫將破裂。 我認為加密貨幣將受到美國宏觀經濟環境和內生衝擊的影響,但擔心的是 Tether 而不是 Terra 和 FTX。

我還對烏克蘭發生戰爭的可能性打了折扣。 我寫道,「中國在台灣問題上發生事故或俄羅斯在烏克蘭問題上發生事故,雖然可能性很低,但仍有可能發生」。,但我認為這不會發生。

2021 年底,我想知道共識看跌這一事實是否意味著事實上我們無法在保持低失業率的同時控制通脹。 然而,我在這一年中做了一個艱難的轉向,並得出結論,共識還不夠看跌。 正如我在 《冬天來了》中強調的那樣,現在有九個因素在推動我的看跌情緒:

- 利率可能比人們預期的要高,持續時間可能比人們預期的要長。

- 強勢美元正在新興市場造成主權債務危機。

- 天然氣價格高企將導致德國經濟衰退。

- 一場新的歐元危機迫在眉睫。

- 一場銀行業危機即將到來。

- 房地產價格即將下跌。

- 烏克蘭和俄羅斯的持續衝突將使糧食、天然氣和石油價格居高不下。

- 中國不再是經濟增長和通貨緊縮的力量。

- 結構性地緣政治風險較高

這九個因素中的任何一個都足以造成全球經濟衰退。 令我擔心的是,它們都在同時發生和上演,這表明2007-2008年大蕭條的重演可能即將到來。

我通常是房間里最樂觀的人,自2006年以來,我從未如此悲觀。 我仍然從概率的角度思考,但現在我認為嚴重衰退的可能性勝過溫和衰退的可能性,而溫和衰退又勝過任何樂觀的結果。

為了完成,值得一提的是,這些事情會讓我重新評估我的概率,權衡更樂觀的結果。 如果烏克蘭/俄羅斯衝突得到明確結束,通貨膨脹得到控制,我會變得更加樂觀。

短期內我也非常看跌加密貨幣。 雖然 2022 年是可怕的一年,但幾把達摩克利斯之劍仍然懸在加密貨幣上:

- Genesis 的潛在破產及其對 DCG 和 GBTC 的影響。

- 幣安在監管或經濟上的可行性。

- 對 Tether 的持續擔憂。

我們仍然非常看好區塊鏈技術的潛力,但正在等待上述一些問題的澄清,以及宏觀問題在更積極地進入市場之前得到解決。 我們在 2021 年 11 月至 2022 年 1 月期間正確地退出了大部分頭寸,現在我們的加密貨幣策略擁有 96% 的現金。 我懷疑,一旦我的一些擔憂成為現實,利率開始下降,以及我們接近2024年年中的下一次BTC減半,我們將重新進入。

儘管我總體上看跌宏觀,但我非常看好早期創業公司。 估值是合理的。 創始人專注於他們的單位經濟效益。 他們正在限制現金消耗,至少在兩年內不必進入市場。 初創公司面臨著更低的客戶獲取成本和更少的競爭。 雖然退出時間將推遲,退出倍數將低於過去幾年,但這應該通過較低的入場價格以及獲勝者將贏得整個類別的事實來彌補。

對於這些初創公司來說,重要的宏觀是6-8年後他們尋求退出的宏觀環境,而不是當前的環境。 就目前而言,重要的是他們籌集到足夠的現金並增長到足以進行下一次籌款。

當其他人都在裁員時,逆向投資是值得的。 過去十年中最好的創業投資是在2008年至2011年之間進行的(Uber,Airbnb,Whatsapp,Instagram),我懷疑2020年代最有趣的投資將在2022年至2024年之間進行。

此外,我們仍處於技術革命的起步階段。 我很高興我們能夠將技術的通貨緊縮力量帶入迄今為止未受技術革命影響的類別:B2B、教育、醫療保健和公共服務,同時繼續使可再生能源更便宜、更可行,以應對氣候危機。

我非常感謝我度過的這一年。 我非常高興我的每個家庭成員都健康了,我仍然能夠進行驚人的冒險,做有意義的工作,並能夠將 Grindaverse 聚集在一起過節。

我對 2023 年感到興奮。 新的一年應該以一個爆炸開始,因為我將踏上前往南極的跋涉,這將涉及與整個世界完全脫節兩周,這是我一生中從未做過的事情。 我希望這將是身體上的挑戰,精神上的覺醒,既是與我的想法獨處的美好時光,也是與隊友的聯繫體驗。 除此之外,我打算帶我母親去火人節,我相信她會喜歡的。 我只需要建造一輛合適的藝術車來帶她四處走動。 我也期待與法蘭索瓦一起進行進一步的瘋狂冒險。 我目前正在想辦法在我風箏衝浪時把他綁在我的背上,我相信這會嚇壞他的祖母。 除此之外,我還計劃學習翼翼。 我也希望 Grindaverse 至少能增加一名新成員,因為我希望在 2023 年春天最終歡迎白人德國牧羊犬 Angel 加入這個家庭。

這一年應該以另一次家庭聚會結束。 這一次,我的土耳其人任期不會被極地冒險縮短。 我將 Triton 保留到 1 月,這應該可以讓更多有孩子的家庭成員從歐洲旅行。 我期待著用一部關於家族歷史的電影來招待他們。 奧利維爾和我委託拍攝了這部電影,作為送給家人的禮物。 這部電影將以我們著名的祖先為特色,此外也是一封寫給我們父母、兄弟克裡斯托弗和整個家庭的情書。 它慶祝他們的貢獻,也是我們表達對他們在幫助我們成為我們成為的人方面所發揮的作用的感激之情的方式。

這是夢幻般的 2023 年。 新年快樂!