In 2019 I moved to Turks & Caicos and decided to sell my apartment in New York. I love my hybrid life where I split my time between New York and the Caribbean. It allows me to spend a month in New York where I am intellectually, socially, professionally and artistically stimulated beyond my wildest dreams. I meet countless extraordinary people, host intellectual dialoging salons and enjoy all of New York’s entertainment options. But after a month, I admit I am exhausted, and the constant doing takes time away from thinking. That’s why I then love spending a month in the Caribbean where I can work during the day, kite, and play tennis and really take the time to read, be reflective and recharge my batteries.

I decided to leave the Dominican Republic in 2018, and had to ponder where I should go. My real estate travails from 2012 to 2018 meant that for 7 years I did not have a real home or the playground with all the activities I adore. It’s not as though those are life essentials and I was deprived. Quite the contrary, I had amazing life experiences in asset light living (see The Very Big Downgrade & Update on the Very Big Downgrade). I traveled extensively and went on many adventures, but I must admit I do miss the convenience of being able to play tennis and padel every day or just to have my friends come over for a LAN party.

In hindsight, I should have just bought an already built house that I could just move in, in a stable country where I could buy inexpensive nearby land to build my playground and call it a day. It would not fulfill my grandiose vision of building a “Necker Island 2.0” to invite a community of entrepreneurs, artists, spiritual leaders and intellectuals to hang out, nor would it have my specific aesthetic preferences, but it would have the convenience of being immediately useful and to play the role of gathering point for friends, family and colleagues.

This led me to buy Triton in Turks & Caicos. Turks is very built out and does not have the raw authenticity of Cabarete. There are fewer days of wind for kiting, and it’s insanely expensive. However, it has the most beautiful water in the world. The weather is fantastic all year long. The flights are only three hours from New York. It’s English speaking and uses the dollar as its currency. The safety, flat water and gorgeous beaches, not to mention the absence of Zika, Chikungunya and dengue make it appealing for all my friends and their families, and not just my adventurous friends who liked the rougher conditions of my Cabarete dwelling with its massive spiders, rats and cockroaches.

Having gleaned some lessons from my prior experiences, I decided to buy a house on Providenciales on Long Bay Beach where I can kite directly from the house and play tennis at the house. I opted not to buy on the other islands despite significantly lower prices and the availability of more land, because the lack of infrastructure makes things way more complicated and expensive. It’s also inconvenient to go for a few days if upon landing you need to be driven to a boat to get to your destination. I will now buy a little bit of inexpensive non-beachfront property to build the missing elements of my playground starting with the all-important padel court.

At the same time the never-ending travails with my New York apartment made me decide that the time had come to move on. In 5 years, I have not been able to enjoy the apartment properly and the water damage has been such that I have been living in hotels and Airbnbs for the last 18 months. As the building is badly built, the management intractable and the building broke, I suspect that even if I ended up rebuilding it as my dream apartment, problems would keep popping up. In hindsight, I undervalued the benefit of being in a well-managed building with the financial means to address issues, nor did I realize the downside of having by far the best apartment in an otherwise relatively small and poor building. Having moved dozens of times in the last 18 months, I intend to rent an apartment March 2020 onwards.

These travails have also cured me of home ownership. I would much rather rent and have the owner deal with whatever issues arise rather than having to deal with them myself. It means I won’t have the apartment of my dreams, but as life keeps highlighting: the best is the enemy of the good. I look forward to having a place in New York I can call home for the next few years bringing a modicum of stability to my life.

I keep being surprised by the amount of work and costs involved with real estate ownership and how illiquid an asset class it really is. The maintenance required highlights that it is a depreciating asset that requires constant work. When you take into consideration property taxes, insurance, maintenance and the constant renovations, the net yield is negligible. Despite historically low interest rates it makes much more sense to rent. This is especially true in New York right now as the glut of high-end apartments makes it a renter’s market. I can’t wait to be rid of all the real estate I own, though the pace of divestiture has been glacial.

In an ideal world I would not have bought the house in Turks, but it was unfortunately not available for long term rental. The limited housing stock on the island, almost none of which is available for long term renting, forced my hand. I do not consider it to be an investment. It’s consumption, pure and simple: a place to call home.

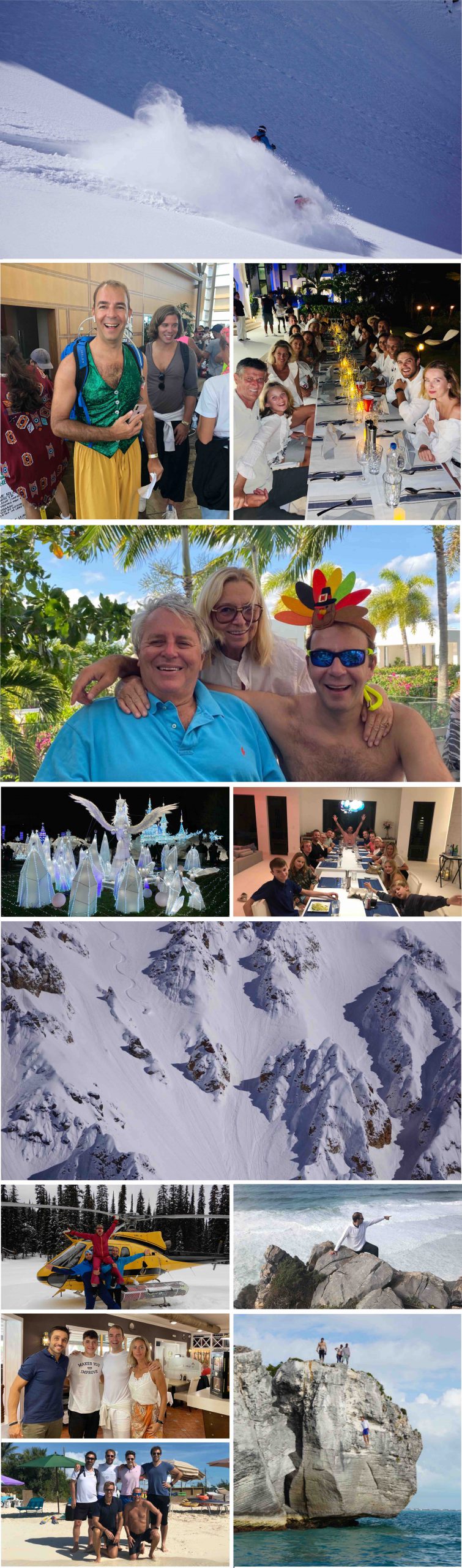

Having found my new home in Turks, allowed me to have an amazing year on both the personal and professional fronts. I brought my friends and family to visit countless times. I started learning to kite foil and had countless adventures.

Highlights were:

- Heliskiing with Kingfisher in Kelowna both to start and finish the year

- Skiing with lots of my friends and family in Niseko (Japan)

- My sister in law Cristina’s graduation from Fuqa (Duke)

- My nephew Edouard’s christening

- Dog sitting seeing eye dog puppies in New York

- Hosting countless intellectual salons in New York

- My 45th birthday in Turks surrounded by friends and family

- Spending the night on Paul’s art car at Burning Man

- Going to the semifinals of the US Open

- Heliskiing in Chile

- Doing my first Ayahuasca ceremony

- Training at a padel academy in Barcelona

- Attending Greenmantle in Bordeaux

- Visiting Lisbon for the first time

- Spending Thanksgiving with friends and family in Turks

- The Luminocity Festival in New York

- Spending Christmas with my family in Miami

I also spent time visiting my family in Nice. It felt amazing to be back in my hometown enjoying the amazing food, playing tons of padel and spending time with my nephew.

FJ Labs continued to rock. In 2019, the team grew to 26 people. We deployed $51M. We made 124 investments, 83 first time investments and 41 follow-on investments. We had 22 exits, of which 11 were successful including the acquisition of Reverb by Etsy and the acquisition of Fynd by Reliance Industries.

Since our inception, we invested in 558 unique companies, had 191 exits (including partial exits where we more than recouped our cost basis), and currently have 484 active investments. We’ve had realized returns of 62% IRR and a 4.4x average multiple.

I spent some time thinking about the latest trends in marketplaces.

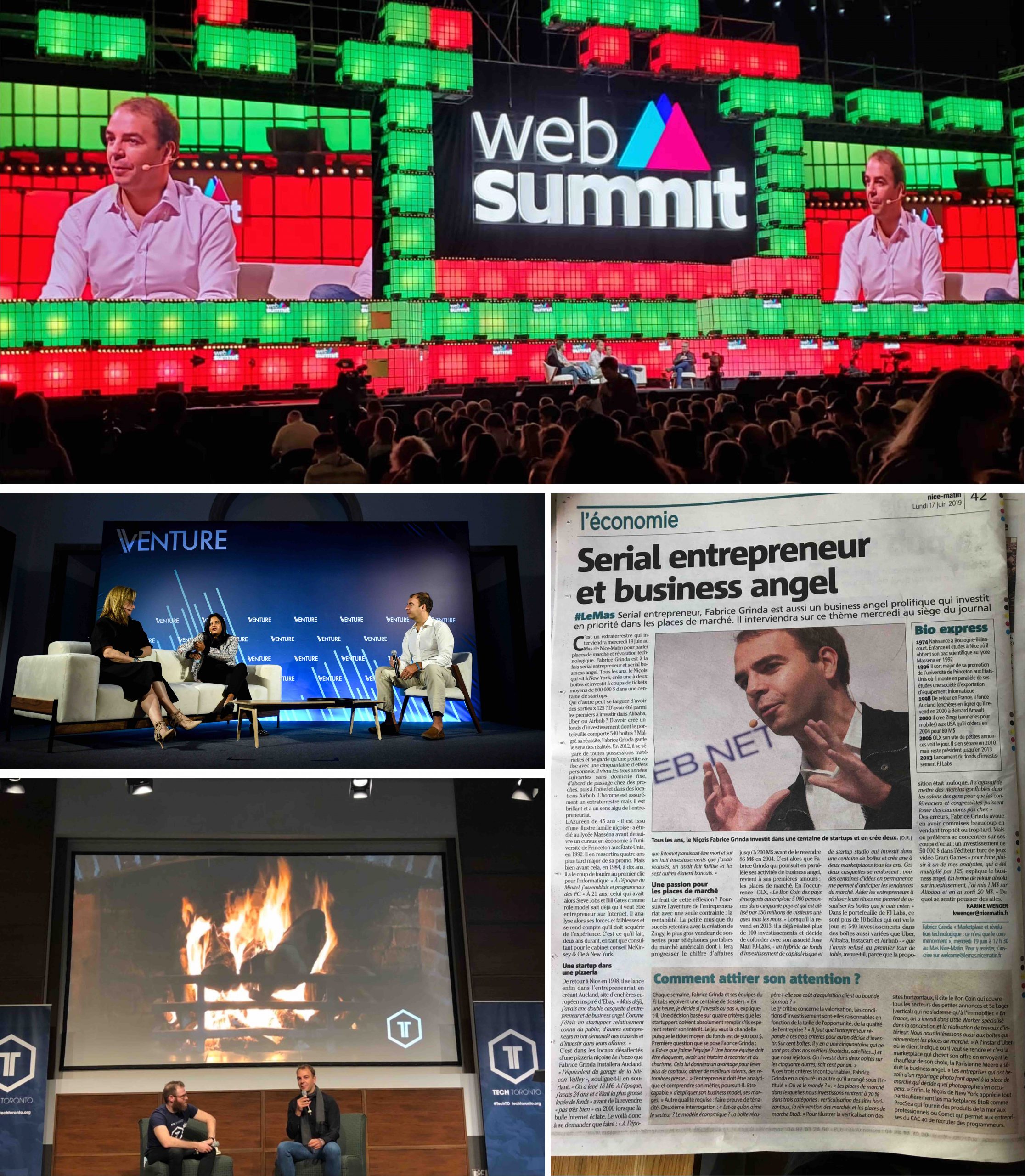

I also shared a lot of my entrepreneurial lessons learned in a series of keynotes, fireside chats, podcasts and video interviews:

- I gave a keynote at Noah in Berlin: Marketplaces: The Party is not Over!

- I had a fireside chat about building marketplaces with Jason Goldlist at TechToronto

- I had a fireside chat with Liz Myers organized by the Princeton Entrepreneurship Council

- I gave a keynote on how tech will make the world a better place for La French Tech

- I moderated a panel at Web Summit and spoke on 5 panels including:

- I covered my origin story on the Origins podcast

- I discussed the ups and downs of entrepreneurship on the Creator Lab podcast

It was fun to get a full page in the local newspaper just as I came to visit my family in Nice and to be covered in Les Echos around the French Tech conference.

In terms of writing, I finished my framework for making important decisions in life:

- A framework for making important decisions: Step 3 of 4

- A framework for making important decisions: Step 4 of 4

I also reviewed Why We Sleep given that I made significant life changes post reading the book and wrote a packing list for Burning Man to help virgins and grizzled veterans alike.

My economic predictions for 2019 were correct: the US economy did well. We are now in the longest expansion on record, and tech remained the sector to be in. While we are late in the economic cycle, the US may very well continue to do well until the end of 2020. We are at full employment and presidential election years typically have loose fiscal and monetary policies.

The main recession risk seems geopolitical given the current slew of world “leaders.” I suspect that the largest risk to the world economy is a budget crisis in Italy. It would put the Euro project at risk and lead to a massive flight to safety, creating the next global recession.

The current political climate keeps reinforcing my decision to avoid following and reading news be it in newspapers, online or on TV. It’s sensationalist negative entertainment that misses the real technology-led improvements that happen slowly, but inexorably transform our lives for the better.

Despite the implosion of WeWork and the travails at Softbank, I remain very bullish on early stage venture capital. We are still at the very beginning of the technology revolution. Only 15% of commerce is online. Online penetration remains negligible in the sectors that account for most of GDP: education, health care, and public services. The way we build homes is still artisanal. Synthetic biology is in its infancy. The emerging trend of no-code, which allows non-programmers to build complex fully functional websites, is unleashing a massive wave of innovation. It democratizes startup creation and innovation allowing people from all walks of life and every educational background to partake in the Internet revolution.

We are meeting more extraordinary entrepreneurs than ever before. There are still billions of capital on the sidelines in later stage funds like Sequoia and Insight that need to be put to work in the next few years. I suspect that even if some of these funds disappoint, most will still be able to raise their next fund. The current low rate environment, with no end in sight, will continue to lead to yield chasing. All that to say Seed and Series A funded startups will have access to plenty of capital. The technology sector remains the engine of productivity and economic growth and will continue to do well in 2020.

Happy new year!

Hi Fabrice: I enjoyed the read, thanks; how visionary moving from NY to T&C before CV19. I’ll be visiting Turks on July 30 for ten days. Cheers, SL

Well said Fabrice ! Such a long time since I spend my weekend with all of you on East End and then East 57 th

Love you all greatly

Btw, have you seen that Why We Sleep has been substantively debunked? https://guzey.com/books/why-we-sleep/

Hope all is well etc etc

Merci pour le post et les quelques éléments de contexte.

Thank you for sharing – great post. Great adventures, love to see you spending time skiing and surfing my favourite sports! We should arrange a blog sc2 for fun one-day :P.

Fabrice,

The home in Turks looks spectacular. Congratulations.

Questions — do you worry about the impact of climate change (more frequent and instense hurricanes, rising sea levels) on Turks?

Great read, very inspiring! Thank you for sharing.

Great choice, Turks are beautiful. Try Cape Town next time, been here 3 months, stunning. Best wishes for an amazing 2020!

Fun read!

Thanks! Great read. As usual, it puts inspirational wind in our sails. Keep on keeping on Fabrice! Wishing you the best.

Love the update and it looks like you picked a solid spot 🙂

Great to read that you continue playing a lot of tennis haha, have a great 2020 Fabrice!

Always love reading your posts Fabrice! Interesting thoughts on reading the depressing and negative news outlets. Sad to hear you weren’t able to get the Cabarette playground to work out… would have been amazing. Congratulations on the terrific fund returns.

Fabrice, your “failures” inspire me as much as your successes. Even though a percentage of your goals don’t succeed, you always seem to give them a good go. You have an idea and you follow through.

This is not normal human behavior! lol. Most mortals set conscious goals, then, more often than not fail to follow through with enough energy to even have a shot.

I’ve been working on a framework, currently 10 conditions that need to be true in order for us (me) to follow through on our goals.

In theory, if we know what prevents action, we can compensate and improve our odds.

As a super high achiever, I’d love to know where my list rings true (or where it doesn’t) from your personal experience.

(Overview is less than 1 page, 2 min read) If you’re interested, just let me know where to send it. paul @ paulmontreal .com or DM me on twitter @thepaulmontreal

Great reflection and thank you for sharing, Happy New Years !

great and inspiring post! thanks for sharing and wish you and FJ an awesome 2020 and decade ahead!

Fabrice, I appreciate how you share your life as well as your passion for your work.

I hope we have an opportunity to work together this year!

Thanks for sharing, Fabrice, congrats to your great achievements and happy new year!

Great post Fabrice! I’m happy to be the first to comment Wish you another fabulous year ahead!

I could not agree more. It is refreshing to have an optimistic view in these days. Thank you Fabrice for sharing and happy new year! CL