By Guimar Vaca Sittic

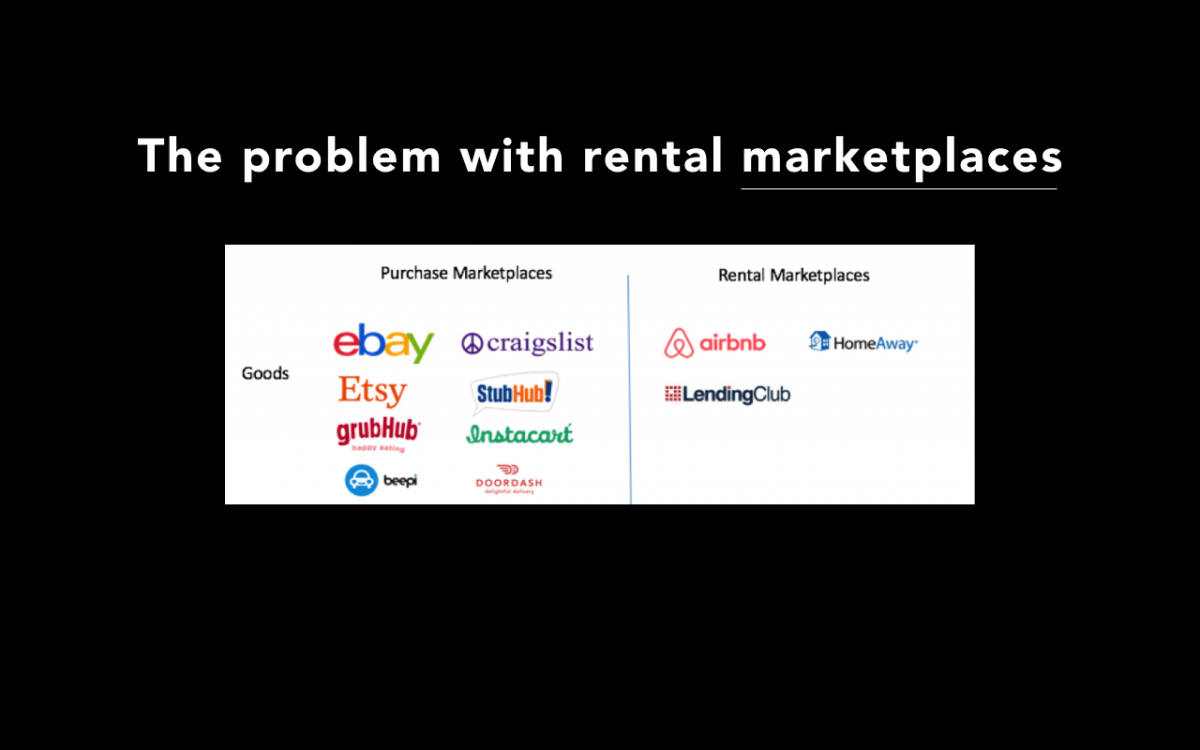

Most of the successful peer-to-peer marketplaces are purchase-oriented. The graph below categorizes some of the most successful peer-to-peer marketplaces and divides them by transaction type: rental versus purchase.

There are two fundamental problems with rental marketplaces:

- The average order value for most of them is too low

- Frequency from demand-side renters is too low

Incentivizing supply in any marketplace is really important to get liquidity. In most of the examples in the purchase category, the supplier of the products or services can make a living out of his or her activities in the marketplace.

Consequently, suppliers care about the existence of the marketplace and become dependent on it. The only companies where people are not making a living on them are Beepi or Opendoor, but in those cases, sellers are selling goods that represent a high percentage of their net worth: cars and houses.

The ratio between supply and demand for rental marketplaces is typically one-to-many. The owner of a house can rent it to multiple consumers. The relationship between demand and supply is also not monogamous. Renting is cheaper than buying, and consumers have the ability to use a good even if their own frequency of usage is very low.

However, the very fact that renting is cheaper than buying generates a problem for supply-side renters. There are very few categories where the average order value for renting something is high enough to warrant renting it out.

Airbnb and HomeAway work because people actually make a living using them. Renting your home for $100 per night is more than the annual income of a lot of people. If you rented it every night, it would put you in the top 0.75 percent of income earners worldwide. When suppliers can make a living using your platform, it makes a huge difference in their engagement, and increases fill rates.

Suppliers in a rental marketplace typically do double the work as suppliers in purchase-based models. Suppliers in rental marketplaces need to coordinate delivery and logistics both ways, which typically leads to more friction. The combination of more work and low average order values are not great incentives for suppliers.

Rental marketplaces are typically demand-pick, which means they have a big variance in fill rates (the number of requests from users that are actually fulfilled by the marketplace). People on Airbnb who do the best take great pictures, write nice descriptions, put the right price, keep their calendars up to date and respond quickly. All of these things are so important that there are even services like Pillow that help people do this. It’s already common for people to spend a lot more time creating their online profile on Airbnb. Airbnb renters know that even though demand is very strong, there will always be unmet capacity. The occupancy rate in the hotel industry is typically 65-70 percent of rooms every day. Assuming Airbnb has a similar utilization rate, suppliers know they need to “fight” against other renters and appear in the top results to be able to rent out their place.

People who really care reply within a few minutes and try to be nice to potential guests. This behavior increases the fill rate of a marketplace and, thus, the liquidity. On other rental marketplaces, where there are lower average order values, suppliers are less engaged and the outcomes are worse overall.

Going horizontal is also not a great choice for rental marketplace with low average order values. We’ve seen many try to do that before, like Zilok. They always struggle to build liquidity. Horizontal rental marketplaces have too many specific SKUs, and it is also very unlikely to make the supply work so much to upload all their available inventory before providing value first. The sooner any marketplace proves to their suppliers that they can make a living out of it, the sooner it will hit an inflection point.

The second big problem rental-based marketplaces have is low-frequency of usage from demand-side renters. Somebody renting a DSLR camera for a wedding doesn’t shoot a wedding every month. This doesn’t affect the supply-side renters, because the relationship between supply and demand is one-to-many.

Such behavior, however, creates a big problem for the marketplace itself. If the marketplace has low average order values, it will only net small dollar amounts for each demand-side renter.

A growth strategy in such cases is not sustainable because the marketplace needs to acquire new demand-side renters via paid channels, and the economics may prove challenging if there is no recurrence on the demand side.

Rental marketplaces are probably best suited for goods for which the suppliers don’t care at all and for which there’s little to no friction. A good example is a new startup called Yeloha where people rent their roofs for solar panel installation. Such an approach makes sense, because the cost for the supplier is zero, and it doesn’t need interactions with the renter. Another example is Breather where people rent a room for a few hours. Breather is a verticalized model that tries to avoid any human interactions. If you rent have a place and want to rent it via Breather, you never need to interact with customers. They install a smart lock so the experience is as smooth as possible. In this case, again, suppliers can make a living out of renting their place.

To be successful, rental marketplaces need to allow suppliers to make a living out of them, but also make sure that the incentives for suppliers are the right ones on a per-transaction basis. Going after categories with higher order values and higher frequency is optimal, but there are very few categories that fill those requirements.