In a way I live in your future. By virtue of receiving 150 startup pitches per week, I have a good sense of what founders are trying to build for the coming decade. At the same time, as a student of history, penetration and cost trends, I can make calculated guesses for when things go from being fringe to mainstream.

In today’s episode, I take a stab at which categories investors and entrepreneurs should focus on for the coming 5 years. This time horizon is relevant because for an idea to be investable by a VC today, it means the company needs to hit its stride in 3-5 years, which in turn implies the market must be ready for the idea.

From fringe to mainstream

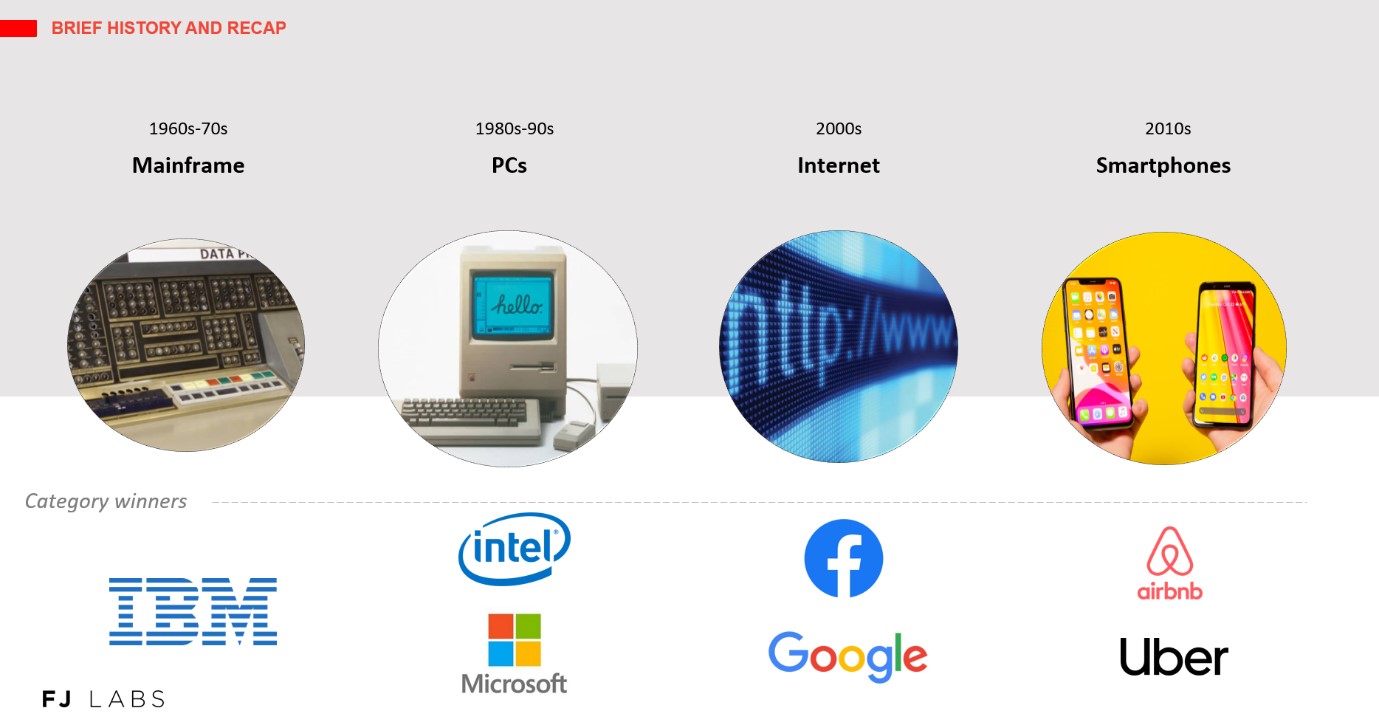

The ideas that create the most value are those that go from fringe to mainstream. Those ideas often look like toys in the early days of their evolution before becoming juggernauts. Think of PCs in the early 1980s which led to the success of Microsoft and Intel when Bill Gates’ vision of a PC in every home was realized. Likewise, video games started as a niche and are now a $160 billion a year market, larger than movies and music combined.

The Internet was first a niche for enthusiasts willing to dial-up with slow connections and horrible user interfaces, but spawned huge companies like Amazon, Google and Facebook. Likewise, smartphones in the 2010s helped Apple become a $2 trillion company and made possible apps like Uber and Instagram.

So what ideas are currently fringe but will be mainstream in the future?

The list below covers several of the ideas I think will make it. Just as importantly, it covers ideas whose time has not yet come even though they became hot and entered the technology zeitgeist.

Virtual reality – Not Yet.

The technology has improved tremendously over the years, but the adoption of virtual reality has been much slower than expected. Graphic quality is too low relative to a PS5 or Xbox X, latency is too high leading to motion sickness, prices are too high, and there are no killer apps. I would not build apps in the category until there are 100 million users on 1 platform, which I don’t expect to see for years to come.

Augmented reality – Not Yet.

Interacting with technology through a tiny screen hunched on our phones is slow and unnatural. With mind reading and either lasers in glasses writing on our retinas or intelligent contact lenses, you can recapture your entire field of vision and work much more seamlessly with the real world. When this technology comes of age the smartphone industry will disappear. I have seen prototypes of these technologies in the lab. However, their accuracy and pricing are akin to that of voice recognition in the 90s and we are at least 10-15 years away from mass market adoption. That said, it’s a platform switch I am very much looking forward to.

Self-driving vehicles – Not Yet.

There are many startups innovating in this space. The main hurdle seems to be that humans have a much lower threshold for machine error than for human error. Self-driving is coming and will become the norm, greatly reducing the cost per mile unleashing a wave of creativity and productivity. However, given the current costs, required behaviour change, and seeming regulatory requirement of 99.99999% accuracy I see it becoming more relevant for 2026-2030 than 2021-2025.

Personalized medicine – Not Yet.

It cost $3 billion and took 13 years to sequence the first human genome in 2003. Incredibly you can now order DNA test kits for under $200. Personalized medicine will transform the healthcare system by providing treatments that account for every individual’s specific need using their DNA, blood, and bio-tracking data. However, my interactions with researchers in the space suggest that practical applications are 5-10 years way.

Healthy lifestyle – Maybe.

In many circles, and especially among the elite, I have seen an explosion of interest in healthy living. Most people I know are doing some combination of intermittent fasting, eating healthy organic food (usually gluten and dairy free), with a commitment to sleep, yoga, meditation and exercise to achieve general well-being. Historically, the habits of the elites eventually become adopted by the masses as their cost decreases. I fully expect technology to allow for healthy inexpensive food options to become the norm. The reason this trend is a maybe is that it requires willpower which humans have historically not been very good with. If diet and exercise were easy 73.6% of Americans over the age of 20 would not be overweight.

No code – Yes!

The open-source and cloud computing movements have already made software cheaper and lowered the cost of entry. When I built my first company, we had to assemble our own servers, run our own data centre, and write all the code ourselves. Now you can create an ecommerce store on Shopify with little coding experience at little cost. We are still in the early phases of the no-code revolution. Eventually anyone from anywhere will be able to build apps, using software like Bubble, unleashing an extraordinary wave of creativity.

Psychedelics – Yes!

We live in a world where addictive and destructive drugs like alcohol, tobacco, sugar, and caffeine are legal. However, psychedelics, which have shown themselves to be useful in treating PTSD, addiction, and depression, not to mention provide extraordinary spiritual experiences, are for the most part still illegal. As more research about their benefits continues to emerge, I expect psychedelics to become mainstream in the coming decade.

Blockchain and Crypto – Yes!

The current speculative bubble in crypto will burst but will have laid the foundations for a new era of decentralized computing. Defi is attempting to address the horrible user experience, high fees, slow settlement times (of wires or stock/FX/commodity/derivative trades), and the interchange payment tax of traditional finance. Likewise, a new Web 3.0 is emerging putting users at the centre of the experience. NFTs are already shaping the art world and set to impact gaming and the creator economy in large ways. I will cover this trend in more detail in Episode 28.

Climate change (thanks Ricou44) – Yes!

For years, VCs were hesitant to invest in climate change companies because the ideas were too capital intensive. In recent years, the continued rapid decrease of solar and battery costs (divided by 10 in the last decade) and the increasing role of software in the industry has led to an explosion of startups in the space. This is set to continue. It is both one of the greatest upcoming challenges of the 21st century and one of its greatest opportunities.

I hope this list inspires you to build the future you want to live in!

If you prefer, you can listen to the episode in the embedded podcast player:

In addition to the above Youtube video and embedded podcast player, you can also listen to the podcast on:

- iTunes: https://podcasts.apple.com/us/podcast/the-tech-of-tomorrow/

- Spotify: https://open.spotify.com/episode/2zoEwwamsDUn2nSH8gzeox

Thanks to IJ Makan for helping write the episode summary.