I had not done an Ask Me Anything session in over a year which led to many questions on a wide variety of topics: macro, marketplaces, AI, fundraising, wealth management, education, island shopping, India, how to lose your accent, adventure travel, climate tech, the state of VC, and much more.

Here are the key questions we covered:

- 00:01:17 How will all the geopolitical changes, tariffs, and Trump policies influence the world?

- 00:06:14 What are the key tips for finding and persuading investors?

- 00:08:44 What do you think is the future of fashion marketplaces? How has it been impacted by downfalls of marketplaces such as Farfetch? What is the role of AI in these?

- 00:13:19 What’s your view on the best investment opportunities currently? Is the stock market, given the current drop off, attractive or still overvalued? I read a while ago your non-traditional approach to wealth management. How would you allocate $10 million now?

- 00:19:21 We have around 15K revenues per month, are we okay to raise a pre-seed?

- 00:21:14 What kind of education, school, university degrees do you recommend for kids to best prepare for them for the jobs market in 10 years considering the impact of AI? What skills should they start developing?

- 00:26:46 What is the best cold inbound email you ever received?

- 00:29:39 If you’re finishing your studies today, what kind of job or company would you join to best train yourself to launch a tech startup later? Is a place like McKinsey or investment banking still relevant if the goal is to learn to work with intensity and structure?

- 00:32:40 As a recent French graduate with a background in BA in finance, which countries do you think offer the most learning opportunities today in terms of ease of doing business, networking, potential, etc.?

- 00:33:34 When will you launch the updated and new version of Fabrice AI? How can I build a network in the tech community in France?

- 00:38:30 Fabrice, any exciting travel coming up? What’s your favorite personal use of AI?

- 00:42:39 If an incumbent exists in my category, are there still opportunities to enter the market?

- 00:45:51 What made you decide for Turks & Caicos and not another island?

- 00:52:57 What is your favorite place in India?

- 00:55:48 How did you lose your French accent? What is your secret?

- 01:00:52 What is on your target list for climate related investment opportunities?

- 01:02:55 Did you do your long hike through Greenland that you wanted to do?

- 01:06:03 If you were building a tech company like Zingy today, would you still raise VC money or bootstrap it considering there are many examples of founders barely making any money in $500M exits?

- 01:08:39 What advice do you have for a home care marketplace founder who has found product market fit but ran out of money in 2023 but has “survived”?

- 01:10:55 What are the future big trends in AI and especially with consumer usage?

- 01:13:12 For personal or small retail, which AI tools do you believe are worth paying a subscription for today?

- 01:13:49 What do you seek in founders for pre-revenue Startups?

- 01:14:34 What is the biggest turn down for the VC while seeing the pitch deck? What is the biggest green flag as well? What is the red flag when cold connecting with VC people?

- 01:16:17 Can you address the opportunities for crossover funds?

- 01:18:43 Any view on Indian VC opportunities?

- 01:19:29 Should I hire a CTO or CFO?

- 01:20:23 What do you see as the future for companies like Alan (French Unicorn) nearly 10 years in €500 million raised, still unprofitable, operating on tight margins, valued at €4.5B?

- 01:21:15 From your perspective, what skill or type of service is the easiest to sell today is a freelance consultant?

- 01:22:20 How much will Bitcoin be worth in 2030?

- 01:26:35 What do you think of initiatives such as WorldCoin?

- 01:26:43 Loved the shoot-out story in the Dominican Republic. Do you have any other crazy adrenaline pumping stories from your adventures?

- 01:30:27 Do you prefer repeat founders or first-time founders?

- 01:32:22 Why is it so hard to raise capital for fashion marketplaces?

- 01:33:28 In your view, what is the most important trait or skill for a founder – being emotionally stable, able to handle the extreme stress, something else entirely?

- 01:36:11 Would you be open for a lunch in New York so I can bring all the questions I have for 45 minutes?

- 01:37:13 What makes niche marketplaces breakout and go big globally?

- 01:39:44 Is artificial intelligence dangerous for humanity? Will it increase unemployment? Should countries create rules to prevent that? Can we master something that might be beyond us?

- 01:46:46 What’s your take on vibe coding trend or real shift?

If you prefer, you can listen to the episode in the embedded podcast player.

In addition to the above YouTube video and embedded podcast player, you can also listen to the podcast on iTunes and Spotify.

Transcript

Hello everyone. I’m hoping you’re having a wonderful week. So, it’s been over a year since I did a ask Me Anything, and of course, a lot has changed in the world. There’s been so many developments in AI, so many developments in politics and geopolitics and the world at large. So, I figured it was time to basically take your questions, assess where we are, and yeah, see how things are going to go.

So, with that, any further ado, let’s get going. Welcome to episode 48. Ask me Anything.

So as usual feel free to put questions in the, in the, in the chat and I will answer them real time as they get posted. And just to get us started, I’ll, I’ll start with the pre asked questions. People send me by email post me sending a newsletter saying, Hey what are the topics that you want me to cover?

So I’ll start with, [00:01:17] I want to ask your opinion about how all the geopolitical changes tariffs, Trump policies will influence the world in trade and what opportunities this will create. It would be amazing if you feel like sharing this. So obviously there’s been a lot of changing, there’s been a lot of disruption with all the terror policy, et cetera.

I mean, here’s what’s interesting is when Trump got elected I guess a lot of people in tech community were maybe hopeful that, hey, the markets will reopening again, right? Like the problem intact in the last few years is outside of artificial intelligence, there’s been no real investment.

There’s been a very big compression, and there’s been no exits, no M&A, no IPOs. And the M&A was blocked mostly by like the antitrust regulation, so SCC, FTC, FCC, and, the IPO is just the IPO market and the IPO windows closed, so we were hoping it was going to start reopening and we in fact have several companies in our portfolio like Klarna, that have filed to go public in, in early 25.

But with all the tariff stuff like then the noise and the markets and the uncertainty and the fear of what might happen in the unknown the IPO windows closed. They delayed at least the IPO don’t know if they pulled it forever. And so things haven’t played out exactly as we were hopefully expecting. Now to answer the question that I was asked specifically is like, what do I think is going on?

I try to give in general the benefit of adapt to policymakers while decisions assume they’re not idiots. And so if I’m assuming they’re not idiots, why are they doing what they’re doing? And so I thought through long and hard, and here’s a rational potential explanation I came up with for why this may make sense.

So I think Trump sees himself as the peacemaker in chief. He wants to make peace in Ukraine. He wants to make peace in the Middle East. And I think the problem that he’s faced or he is facing is he’s like, look, no one has ever given Putin an exit strategy, right? Like if Putin any made any concessions, left Ukraine with nothing to show for it, perhaps his own safety might be at risk.

Can we create an environment where we give them an opportunity to make concessions, to get a piece? And so one way to think about it, I’m like, Hey, maybe we’re pretending to fight with our allies. We’re maybe we don’t tell them because if you tell them with all the slice, leak, et cetera, it comes out and we put tariffs on all our allied countries to create more of a common ground, to give them an opportunity to negotiate and make concessions that lead to last piece.

Now, I think it’s a bad strategy cause I don’t think you want to be negotiating with Putin who cannot be trusted. But if that was your intention, maybe you try it and if it doesn’t work, you know what? You’re goanna get token concessions from the EU, from Canada, Mexico, whatever.

And perhaps you roll everything back. So I’m hoping that these things are temporary now. The problem is temporary in the world of politics, maybe a year or two and not like three months. And in the meantime, to answer the specific question, like what are the opportunities being created? Well, clearly, you know, thinking through how you’re moving your supply chains, thinking through how you are dealing with your cost structure and, you know, are you onshoring things as we’re seeing some companies do, or are you moving the supply chains out of China?

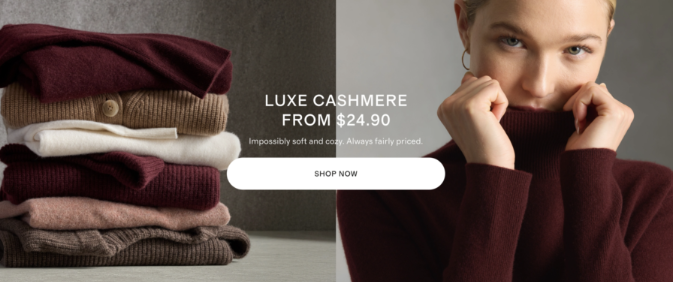

You know, we’re investors in Quince, which is an affordable luxury marketplace, and they’re crushing it zero to billion in like three years. They’re going to a multi-billion dollar run rate. Historically, they were sourcing everything from China. In a three month period they moved their entire supply chains out of China.

Now, they would benefit tremendously if de Minimis continues the de Minimis exemption for orders below $800. But even if it doesn’t because they’re the lowest cost provider, I suspect they, they will continue to do well. So I suspect the low cost nimble producers, so the startups of the world will continue to do well in that world.

Now that said, I. With global geopolitical macroeconomic uncertainty, it’s harder to raise venture funding. It’s harder for VCs to raise venture capital. And until there’s exits and IPOs, the flywheel is not really open. So it’s still going to remain complicated, but hoping that this plays out in the next few years in a not too disruptive way.

And it will create opportunities. But I suspect that disruptors, the startups are better positioned to take advantage of these opportunities than the Cummins because they move quickly, they have lower cost structures. Let’s see. One of the questions we got in, and then I’ll go into more email questions.

So Onur and I’m not going to mention your last name to avoid completely torturing on how I say it. [00:06:14] What are the key tips for finding and persuading investors? Because I have a start-up called Cusinea. It’s an AI powered online training platform for restaurant workers and a marketing social media platform for restaurants. We already have partnered six restaurants before the official launch. I’m currently seeking investment.

I would describe where you’re at kind of at the pre-seed stage and the pre-seed stage. You know, pre-launch or like proof of concept. This first half million, million dollars you need to raise honestly is still, is mostly, there’s not many funds that focus on that. The pre-seed.

There are a few, like Afore A-F-O-R-E is an example of that. There’s iSeed in India from, I mean there’s a few but very, very few. Amplify in LA most pre-seed honestly is fool’s friends and family. It’s like going to your wealthier friends who support you, back you and saying, Hey, I need 5-10K.

And the thing is, you know, 50 times 10K, 100 times 5K actually is enough money to pre-seed. Also you need to realize it’s cheaper than it’s ever been a build a startup. You know, when I was building my first startups, I needed an like Oracle database servers, Microsoft Web Servers.

I needed to build my own data center that was pre-open source, pre Rackspace data centers. And that’s even pre, obviously cloud and now AI. You can kind of build anything these days with 15K you can launch and then you can use whatever capital you raise a couple hundred K to prove product market fit.

But your objective is to get a seed level traction. So what I would try to get to is 20K a month in net revenues. But if you’re charging SaaS fees, you get 20K in MRR, not ARR. With that, you get to the point where you can go raise seed ramps and then you can go raise 2-3 million from VC’s proving product market fit.

Likewise if you’re in a marketplace, you know you want to get to 150K a month in GMV. If you have a 15% take rate and same thing, you have 20-30K in net revenues, you prove product market fit, then you go raise the two, 3 million people like us who are unlikely unless you’re a second time founder, you’ve proven it before to invest your seed round unless you’ve proven a modicum of product market fit by getting there with very little cap.

Second question from notionXarma on Twitch. [00:08:44] I wanted to ask your idea about what do you think future of fashion marketplace and fashion is and how it impacted downfalls of marketplaces such as Farfetch? Just to add, what is the role of AI marketplaces in these?

So it’s interesting because in the US especially, the fashion marketplaces, and maybe let me put a full screen, you see more of the questions here?

The AI marketplaces, sorry, not the ai, the fashion marketplaces have not done very well, right? Poshmark? The real, real, I don’t know where the market cap of the real, real is. It’s actually not very high because the cost structure is too high. And so from the outside it could look like the category of fashion marketplaces is not doing well.

But there is a counter example. There is one company that is completely crushing it in Europe that has redefined and reinvented the category. And I’m very proud and happy to say I’m an early investor in the company since at least the pivot. And that company’s called Vinted V-I-N-T-E-D, so Vinted, which is actually currently being run by my right hand man at OLX.

He was like the fixer. When something went wrong in like whatever, Kenya, he would go and fix it. The difference they have to the Lithuanian based startup, most of biggest markets for them were France and the UK. They’ve made multiple innovations. First innovation is instead of charging 10-15% commission on the seller, they’re completely free, completely free to sell, completely free to buy.

And they say, if you’re the buyer, if you want optional escrow and shipping and payment, we will do it for you and we’ll charge whatever, two euros or like $2 plus 5% and everyone’s doing it. And as a result, they have an effective take rate of 10%. And what’s interesting, and, and some of these numbers are public, so I’ll give the public numbers from the last round.

Last year they did 6 billion in GMV, they did 600 million in net revenues. I think they did 80 million or so in free cash flow. They have a 50% EBITDA margin in the UK, 45% EBITDA margin in France. And they’re growing like this. And now, they’re in Italy, Spain, and like they’re growing across Europe, they’re launching into luxury.

And because they have the lowest cost structure, because they have the lowest take grade, they’re doing extraordinarily well with this buyer paid model. And so fashion is working really well. Now AI is playing multiple roles here. First role AI is playing is Vinted is probably the first true 10 European company.

It used to be when you were launching in Europe, you were like a French company or a German company, or a UK company. And when you were launching, you were actually opening a new office and having a different site and, and you would not sell between the sites in place. So what they’ve done is they realized we can now ship cross border in Europe very cheaply.

And so what you, what they do is the listings in France are actually translated automatically by AI and listed in Spain and Italy. And when a buyer in Italy wants to talk to a seller in France, all the conversations are translated automatically. So you have automatic translations of the listings, automatic translations of the conversations, all done by AI.

The listing process is also massively improved and done by AI. So when you list right now, the AI will identify the category, the items suggest, the price, et cetera. So AI is being used to improve, like the background of the photos, to increase the sell-through rate, to, to automate the conversations between the users and to improve the sell through rate.

So massively disruptive and fashion is doing very well. And by the way, there are other innovations in the fashion marketplace space, not just in in buying and selling goods. We just invested in a company called Pickle. Pickle is a rental marketplace. So think it rents the runway but rental. And in New York, like all the Gen Z and millennial women have basically used it for dresses, et cetera.

It works extremely well. So I would say Vinted and Pickle, probably the two best examples of things that are happening in fashion. And these companies have way more growth to grow. I would not be surprised if Vinted is a 20-30 maybe even 50 plus billion dollar company in the next few years.

I’m very bullish on that investment. We’re going to continue investing, even though we now value a lot higher. And we’re all in on that company.

Mitch, on Twitch. [00:13:19] What’s your view on the best investment opportunities currently? Is the stock market, given the current drop off, attractive or still overvalued? It was a while ago on non-traditional approach to wealth management. How would you allocate the $10 million now?

The answer is, it depends on who you are and what your life needs are, and also where you are in your life cycle, right? Like if you’re 80 years old, investing in venture or you’re not going to make money for 10 years doesn’t make sense for me.

But on average, I stick to my knitting, like the reason I invest in venture of courses. I know what I’m doing. I’ve been returning 30% a year every year for the last 25 years. Nothing else I could invest in. And I think it’s pretty safe because a tech and software is eating the world and I know what I’m doing and I have a very, very diversified portfolio.

So I like investing in venture, investing in tech, but I would not invest in specific startup names, right? If you just started, you have 10 million in cash and you’re like, Hey, should I be an angel investor? I would say probably no, because you don’t have a deal flow, so you might not be seeing the best deals.

If anything, because you don’t have a deal flow, you’re probably seeing the worst deals. And venture follows something like called a power law, where the top deals account for all the returns. And so unless you’re investing in at least 50 deals, which guarantees you get some of the good deals, you’re very likely to lose money.

So you should not do your own angel investing. Now, if you want to give a little bit money to your friends, sure, I would allocate probably. So if you have access to a venture fund like ours, which we’re not that hard to get into, I would allocate a fair amount in venture. But again, you need to think through venture funds, capital calls every three years.

There’s going to be another fund in three years, another fund, three years, so whatever allocation. My personal allocation, by the way, it would be 10% in treasuries, T-bills, you know, you’re still generating 4% of your completely safe, and that’s your cash management and you use that for capital calls, et cetera. 10% in real estate. And real estate for me is not an investment, it’s consumption. It’s where I live and I have three beautiful homes, and in my case, the rest I’m putting in venture now I’m putting it in my own fund because I know what I’m doing. If I would probably, for most people at 10 million, your real estate is going to be more than that because you, you’re, the value of the real estate you want to live in is going to be higher.

That said, you’re getting leverage on it. So, you know, maybe you can have a $4-5 million house, but you put equity and then you can invest the rest in T-bills, you know, 10-20%. And then the rest, I still prefer the venture strategy. If you have a long term horizon, you don’t need cash. But I would invest in a fund and diversified funds, like box group or us, whatever would probably better.

You don’t have access to that. Yeah. S&P 500, ETF. Invest it, call it a day. Never look at it again. Or you know, in fact, I don’t, look, I don’t follow the news. I wouldn’t look at the portfolio. This is something that’s meant to compound over many years. So if you owned an ETF and S&P 500, or if you own Bitcoin, and yeah, I would probably have 5-10% of crypto invest it. Never look at it. If you want to look at it, look at it January one of every year. Don’t look at the ups and downs unless you’re a trader and you should not be a trader. You shouldn’t be looking at it. So most people, I’d say, I don’t know, maybe you go 20. I, obviously, I’m way, I don’t feel tech or venture is risky.

So I, I’m like 80% venture, 10% real estate, 10% cash or T-bills. Maybe other people should be 30% S&P 500, ETF you know, 10% crypto. And might just even be just BTC to make it simple. In crypto, let’s say another 20 or 30, not 20 in venture, 20 in T-bills and 10 in real estate, maybe something like that.

I mean, and you go up and down that way. Now it depends on sort of cash needs, income, salary, et cetera, life cycle. But a good sense of how I would think about it. But I would not be actively trading, I would not be investing specifically in my own startups because you’re not going to have enough and you’re not going to have the deal flow.

Okay. Let’s see. The next question Sheelagh Brady. In your experience, how do you think a new platform entering the risk management and safety space can leverage the geopolitical environment to its advantage? In your view, should the influence be for companies be on demonstrating ROI, or are there other strategic angles you’d advise focusing on at this stage?

There are a lot of companies in risk management, so I would want to understand what your real core differentiation is. Or you lower costs and better because you are leveraging AI or you going after a very specific vertical. I don’t hire these types of companies. If risk management, et cetera, I think, you know, they’re like salt on type stuff.

It’s like a waste of money. So I’m probably the least good person to ask. I’m probably the least good person to ask like, what, what this is. But look, the same strategy would apply for me if you’re at the beginning of launching the process. How do I validate business ideas? I talk to potential clients.

I test whether or not they value the proposition. By the way, we talked to 50 of them, not five of them. I would say, okay, if I’m charging you this much, would you be willing to pay for it? I would like basically try to get these pilots going and I would not raise money until I have some modicum of product market fed.

if you even need money, right? It may need more of a cash flow. Lifestyle consultancy type business more than it is a scalable venture business. Sean on Twitter, thank you for doing this. Well, thank you. I’m I love doing this actually. It’s fun to like brainstorm, see what people, what is on people’s minds.

But I’m doing it once a year. Maybe I’ll do it every six months or so, on a go forward basis.

Yamini: [00:19:21] We have around 15K revenues per month, are we okay to raise a pre-seed? Oh, for sure. Pre-seed. You could be pre-launch Well, are you talking GMV the value of the merchandise sold or are you talking your take rate is if your take rate is 10% and you’re making 15K a month, that means you’re, you have 150K of sales per month.

That’s actually enough. Not just for pre-seed, but it’s actually enough for a seed round. Yes, for sure. You’re ready for a pre-seed. You may even be ready for seed depending on the business model and what you define as revenues, right? Because a marketplace that’s selling whatever, a hundred dollars a piece of clothing, their revenues not the a hundred dollars, their revenue is the percentage they take, which is like 10%, let’s say.

So it would be $10. But it depends. And okay. I’ve invited you on LinkedIn, happy to meet you one day in New York. Great. But while we wait for the next questions appear, I’ll go to the pre-sent questions by email. Sometimes when I do this, for some reason the view changes when I click out of the window, so I’ll fix it in a second.

Try to address it for the next stream.

Sorry about that. Misclick. We will have. This is annoying at 45% margin. Okay. So you mean you’re making like 7K a month? Yeah. You’re too early for seed, but you’re a pre-seed. But yeah, you should definitely raise right now. Okay. Let me go back to the questions.

Question from Rio. [00:21:14] What kind of education, school, university degrees do you recommend for tedious kids to best prepare for them for the jobs market in 10 years considering the impact of AI? What skills should they start developing?

You know, it’s actually really interesting because the schools, let’s say you’re in high school, I find that high schools are really doing a terrible job of thinking through preparing people for the future of the job market.

And frankly, for future life, right? Like when you graduate high school, let’s say you’re not going to college, you should know how to do your taxes. You should know how to have basic financial management skills where you’re doing your P&L and you know, okay, every month I’m earning this much, I’m spending this much, and my cash flow is positive or negative.

You should have like these very basic, how does a credit card work? You know, what if what happens if you don’t pay in time? How much interest you’re accruing? How do you save like basics, like how does a 401k work? How do you, all these basic life skills should definitely be taught in high school.

And many schools I think are also taking the wrong approach with ChatGPT clearly working with AI is going to be a key valuable skill set on a go forward basis. And so the idea that you’re making use of AI illegal in school for homework is idiotic. Now, no student in their own right should like just have a GPT write the essay.

That results are awful if you do that, by the way. But they should absolutely use it for research and should absolutely use it to improve the quality of their homework. And so schools are doing a very bad job. Now, let’s go to college for a second. Should you even go to college?

And I think here the answer is, it depends, right? Like if you are a self-motivated individual, you now have access to the very best education in the world, kind of for free, right? Like you can go to Coursera, you can go to YouTube. You can go to all the different products available online.

If you’re self-motivating, you can actually learn almost everything on your own. The problem of course, is you don’t have the pedigree, right? You don’t have the degree structure, which is a signaling device. What’s interesting is that signaling device is becoming less relevant on a go forward basis.

So when my companies hire programmers, we don’t actually even look at your resume. What school you went to, your grades. Literally it’s like programming tests, IQ tests or ability tests. Do you fit in? And often enough, the very best programmers are actually the ones who have been coding since they’re five and they’re in India or whatever, but like there, or Bangladesh, they didn’t go to Harvard or MIT, it doesn’t really matter anymore.

Yeah, it’s not true in other categories. And there were many other things you learn in school. From managing your own calendar to socializing, to building relevance skill sets, to having credibility that you develop. And it’s a signaling mechanism for jobs that are less quantitatively measured, like programming, right?

Like, so if you want to be in business involvement or sales, et cetera, way harder to evaluate how good you’re going to be absent, you know month of testing or like hiring you to see if it works. And so we use these recruiting, these schools as like signaling devices and the grades you have for how disciplined you are and how talented.

So it’s not going to go away anytime soon. So would I still probably go if you can, to like Sanford and MIT and Princeton, et cetera? Yes. Probably would not go. And what about I study there? It doesn’t matter all that much, honestly. I still am partial in my own life to things like math, and engineering and computer science, but economics I think explains the way the world works reasonably well.

And I do think even things like philosophy are useful. But is it necessary? Absolutely. No. First of all, the, you know, the field, whatever, fellowships, these kids are so bright and they’re so ahead of the time, they’re so high on IQ, honestly, they’re not going to benefit from going college. But that’s not true for most people.

Most people do benefit from going college. And if you’re in specific categories, like as I programming or whatever, SEO, whatever you can, if you’ve been doing it for 15 years and you don’t value anything else, not necessarily necessary, so. More nuance than before. And going to second tier colleges probably becomes way less value because the branding is not there.

And what you’re learning is probably not, not better than if you go online, if you have the discipline and you go teach yourself and Coursera, YouTube, et cetera. I mean, it’s shocking. Like for fun, I do that myself. Like I’m tea, I’m learning things I didn’t know. Just because I think it’s interesting, like the same way I built my AI last year and I wasn’t even using, you know, the Cursives or Lovable.Dev et cetera, products of the world that exist now.

And there’s so much to learn that you can self-teach. That could be, that could be helpful. And that’s true of everything else I mentioned before. But having a structure that kind of forces you to do it, like going to college is reasonably helpful. So, you know, I guess the answer is often in, in life is, it depends.

It depends on your personal life circumstances, where you’re at, where you’re going. But yeah, lots of opportunities to learn and be amazing.

Ani Amar: [00:26:46] What is the best pulled email you ever received that led eventually led to an intro meeting? So we are one of the few VC firms that actually looks at cold.

Like I think if you send a deal to deals that Sequoia capital.com or whatever, I’m sure it goes the auto delete black hole, never, no human ever even looks at it. Some of our very best deals have been called inbound emails, where a founder sends me an InMail on LinkedIn. LinkedIn, unless you have in my email.

If you have my email, you can send it to me, but it’s either directly my email or by LinkedIn in mail. They said, look I’m not a traditional founder. I didn’t go to Stanford or MIT or whatever, but I’ve been working this for many years. We have this level of traction, by the way, like series B or C level of traction.

But because we’re in Belo Horizonte or because we’re in like a non-traditional geography in the us we’re in whatever, upstate New York, we haven’t been able to raise capital. We’re not that well connected, but I have real business, real union economics. Here’s my deck, you know, and we meet, and you’ve made it easy for me to say yes.

Yeah, you gave me all the information I needed. So I have the deck. I’ve been in economics, I have traction. I meaningful traction. And I understand your problem, which is you haven’t been able to raise because you’re not connected to that venture world. You didn’t go to Sanford. Your friends are not in VC, et cetera.

You’re maybe not even surrounded by wealthy, you know, bankers and consultants that can give you this 5-10K of pre-seed money we discussed earlier, right? Like. The reason if you went to one of these universities, it’s kind of easy to get the pre-seed money. It’s like all your friends are becoming doctors, lawyers, consultants.

They can all afford to give you 5-10k, and you have enough of them. You’re yourself. You’re in, you know, Belo Horizonte instead of Sao Pao Rio, maybe not so much. You’re in whatever, Albany, New York, maybe not so much. And so we’ve had a few examples like that. There was a company called Milus in Brazil. The one we invested that amazing traction.

We helped them raise, they ultimately went public and we did it very well. TCG Players, this company from the electable Pokémon and Magic, the gathering marketplace based in Albany seeming completely non-traditional. The background of the foundry was a, a comic bookstore owner. Who just built his own software because it served his needs and then he, he brought it to all the other comic books or earners and created a massive marketplace but under the radar, not a category that was deemed sexy or big enough.

And yet ultimately we sold it eBay for like whatever, 300 million and did extra. So send me a LinkedIn InMail, make it easy for me, which means make sure that you include the deck, the traction, all the information I know to make the decision as to whether or not it’s worth a meeting or a conversation.

Green18: [00:29:39] If you’re finishing your studies today, what kind of job or company would you join to best train yourself to launch a fast growing tech startup later on? Is a place like McKinsey or investment banking still relevant if the goal is to learn to work with intensity and structure?

There are two path I would take. I suspect the best one is probably to join an early stage startup, like a series seed, A or B, not later than B startup, where you see what it’s like to be in an early stage startup and you learn the ropes. And the benefit of being a small company is you get to do a little bit of everything. You’re a jack of all trades, there’s fires to be brew burning everywhere.

You’re going to learn a lot. And a lot of that is directly relevant for your future job as founder, CEO. Now, I worried that when I was 21 in a graduate college that I wouldn’t be deemed seriously in a startup. And so I wouldn’t be McKinsey root. Which is also valuable. And I think McKinsey probably better than investment banking or consulting better than investment banking.

cause you’re also, you’re not just like a deck monkey and you’re actually using your brain. But I learned oral and written communication skills, public speaking skills, how to write a deck, and how to write a deck and how to present that deck is actually very key in the fundraising processes. A future founder.

So kind of also depends where your skills are. When I came out of college, I was Sheldon Cooper. I was shy, I was introverted, I was narcissistic and condescending, despite really lacking emotional intelligence, empathy, the ability to work with teams, et cetera. And so it played a very fundamental role.

Now, I think I probably would’ve learned the same skills if I joined a startup, and I probably even would’ve learned the same skills if I created a startup and fallen flat, flat on my face. I can even argue, just go ahead and create one today. You’re going to fail. But like the life lessons you’re going to learn and in that process are going to be great.

So I don’t think you can go wrong. I think all three are good. Meaning consulting about consulting or joining an early stage startup or creating your own. Now, I’m not sure I would join a late stage startup because I think then the job role is very defined. They’re also probably they’re willing to experience, but less likely to hire you.

And if they hire you, they’re going to give you like brunt jobs that you’re not going to learn that much at. So I think these would be the three probably would lean, if you’re entrepreneurial enough to go, just go do it. If, or, or the startup thing, but you know, can’t go wrong. And, and the benefit of the McKinsey type route is, let’s say you’d leave and then you fall flat on your face because you fail at your startup, you could always go back or maybe you can go to business school.

So it, it does if maybe it’s a little bit safer. And also if you need capital, like maybe you need the first 10-30 K of capital, then a job that actually pays something is better than a job that pays very little. So depends on life circumstances. All three are reasonably good. Okay.

TheJpstan on YouTube: [00:32:40] As a recent French graduate with a background in BA in finance, which countries do you think offer the most learning opportunities today in terms of ease of doing business, networking, potential, et cetera?

Honestly, the answer is easy. If you can be in the US, be in the US, you have a. Large population of wealthy individuals that are early adopters of tech. The market is bigger, valuations are higher, everything’s easier. So there is no doubt in my mind, I mean, if you were Chinese, maybe I would say go to China and if you’re in India, maybe go to India.

But if you’re French or whatever, anything other than Chinese and Indian, go to the us. It is the place to build startups. It’s still the hub of innovation. Everything’s easier, et cetera, except getting visas that can be painful. But there’s usually a path for making it work in some way, shape or form. So undoubtedly the US.

NotionXarma: [00:33:34] When will you launch the updated and new version of Fabrice AI? Second important question, as you are from France, what are the best places to do warm introductions and networking in the country not connected to the network?

First of all, Fabrice AI is constantly being updated. The. Every new piece of content that I upload on that is uploaded in my blog is added to the content repository of Fabrice AI. And whenever GPT, because I’m using OpenAI as my back office it has a new upgrade, I upgrade or the new back office. So Fabrice AI is constantly being updated. It’s not a static thing.

Now, the things that are being, that are being included, that are coming next I originally wanted a version. Well, next thing that’s coming probably is if you want, instead of having me send you texts, you can actually write the question or dictate the question, which you’ve already do today. Then you can have a Fabrice avatar speak the way I’m speaking to you right now, giving you the delivery coming in the next few months.

That works pretty well. The next thing I wanted to do, which is way harder, is have a live conversation with Fabrice AI that is interactive for either two things, just general questions, and I thought it would be by video, but I’ve been trying to code this for six months and the latency, and I tried multiple back off backhands, like I tried a Tavus, I’ve tried I’ve tried HeyGen, and you ask a question, I need to transcribe it in text, send it to Fabrice AI. Fabrice AI has to come up with the answer.

It has to be sent by API back to whomever’s creating the video and then displayed, and the latency is too high. Like, it feels asynchronous. It doesn’t feel like you’re having a real live conversation. And as a high IQ, fast speaking person, as you can figure it out from here, that latency kills me.

And, I’m not happy with the results. So I think the next version is going to be a voice only version, where you’re going to have my voice and you’re going to be able to chat by voice. And I think I can get the latency low enough that this can work. And again, next few months, the harder version. The third version that I’m working on right now is pitch Fabrice AI.

I’m going to ask you for your deck, for your story, for your background, and I’m going to give you feedback on your deck and see if I like it or not. And, and I’m going to write a debrief, which, and maybe it’ll lead to deals that FJ Labs like looks at. It’s really more of a public service humanity.

It’s more, right now we get 300 deals in ban. Every week we take 50 calls, and maybe I’ll take, and we take 5-7 second calls, and I’ll take a few of these. So five calls per week. So A. there’s 250 people that don’t even get a call. There’s 295 they don’t talk to. This would be an opportunity for everyone else to get feedback.

The thing is, I need to upload all of our existing transcriptions of calls, summaries, calls, decks to see if Fabrice AI can get smart enough to actually give actual advice for. So the advice is not valuable and, and not kind or whatever. It doesn’t make sense to do it. So it’s on the to-do list. This is slow.

I think we only, I only have like a hundred because we never did transcripts calls before, et cetera. So we only have a hundred right now uploaded so far. I think we need a couple hundred, maybe a thousand to get to a point where I’m going to be comfortable making it public. This one may be a year away, may I hope earlier, and I will only release it if I think it’s helpful.

It’ll be in the tab of Fabrice AI, it’ll be Pitch Fabrice AI or Pitch Fabrice or Pitch Me whatever. Working on it. This one is slow going. So no promises that it’ll even be released. But in the to-do list now. How would I network in France? Not very connected to France, even though I am French.

But first of all, I’d be in Paris, you know, the tech community of in, in France is in Paris. I would do the same way, like if I showed up in New York and I wanted to go start networking, I would go to like all the different tech events that are happening on a regular basis. You know, there’s like the Primary Conference, there’s the Collective Conference, there’s the whatever.

And the same thing exists in Paris, I’m sure. I’m sure that Station F is doing a lot of these and I’m sure that a lot of VCs have these meetups and gatherings. So I would like find the gatherings, find people connected there, and like little by little entwined myself into the community and like be the VCs, be the founders, et cetera.

Sure. You know, someone knows someone and can like start doing these intros. So, but yeah. Good luck in doing that.

[00:38:30] Fabrice, any exciting travel coming up? What’s your favorite personal use of AI? Hi, Lacey on YouTube. So, my exciting travel or written plan this year was to go in March in theory to go train in Finse, Norway, which is a glacier in order to learn how to I guess ski kite surf.

So I can drag a hundred pound sled because I wanted to train to cross Greenland in 2026 by Snow Kite. I was going to snow kite across Greenland for like hundreds of miles or maybe a thousand miles or whatever, a thousand kilometers. But for that, you need to learn how to snow kite. You need to, you know with, with a hundred pound s flood, you need to figure out how to deal with polar bears.

I like get ready with how to learn how to use these shotguns, et cetera. Not that we’re hunting the polar bears just as defense in case they want to eat us. And polar bears contrarily to the Coca-Cola ads, or not friendly. They really want you eat your face. The problem is I ended up having terrible tennis elbow.

I guess the downside of playing paddle and tennis like 20 hours a week in the last like 45 years and lifting, and, you know, to remain fit is I tore 80% of my right tendon. So I haven’t been able to play tennis. I’ve been able to play paddle. So what I, so I had to cancel the trip. I had to cancel the trip because I couldn’t go and shovel snow.

Like the way these tents work is they have to be facing the wind and because you’re eating rehydrated food and you’re drinking water, you need to dig a trench, have snow to melt the snow in your pots to cook your food and have water. And I can’t, my elbow hurt too much. I can’t even open a bottle of water so I could not dig a trench.

And if I fell on the elbow snow kiting or ruining a ski, it could be catastrophic. So. I put a hiatus on the fun travel, decided, okay, priority number zero, fix my elbow. So I think PRP with like exomes or growth factors, I’m doing like peptides. I’m doing BPC 157, and TB 500. I’m doing isometric exercises and I’m hoping that it’s going to get fixed.

And once it’s fixed that I can restart life, then I will go back again. I will go back again in, into the crazy adventure travel mode. And question two, what’s your favorite personal use of AI lately? GPT? The deep research is mind bogglingly good. I asked to make like a, a financial analysis and the valuation analysis of two different hotels because I was thinking of buying one of them for completely unrelated reasons.

And it was like McKinsey level consultant analysis on like using different valuation models, figuring out who owned the history, how much it could be worth on a, on a per key basis of financial model based on where it was, et cetera. But like, I got in, in a 30 a mind boggling, extremely thoughtful and detailed analysis that would’ve taken like consultants weeks and, and not have mentioned tens of thousands or hundreds of thousands of dollars of research.

So doing profound, thoughtful, deep research analysis. it’s mind boggling, and I’ve used it for many, many, many things. And I continue to use that. Like I, I’d stopped using any other tool. GPT and I were having ongoing conversations, and in fact, it leads to a lot of ideas and iteration, et cetera.

And now it’s like having my own McKinsey console in my, in my back pocket. And that’s my main use, frankly, for everything. So I guess it’s a boring answer cause I’m not using any other tools now.

If you want to build a little acute website Yeah. Use Lovable.Dev if you don’t know how to code, but you want to be, build something for fun. Yeah, use Cursor, right? Like, so there are these two I would probably add to the list, but yeah this is it.

Alex in LinkedIn: [00:42:39] How do you know a successful startup in US that has developed an instant booking solution for corporate meetings and events? So do you think there’s still room for competitors?

Yeah, there’s a lot of those that have existed in the past. I’ve looked at a few of these. Now is there room I would look at like density, like what types of rooms are they booking? What, where does this apply? Is it like specific offices? Is it in other people’s places in a marketplace? They have their own inventory. Is it concentrating in certain cities or there other verticals you could go after?

Like are they going after small startups that are renting small rooms or are they going after massive conference rooms or whatever where they need 400 people. Usually I would expect that there might, there would be cities or geographies where they’re not, there would be verticals of categories of potential clients that they’re not going after.

Now whether these are big enough and the fact they already have traction, is that a problem relative to, because obviously if like their client is whatever, McKinsey or Google they’re going to want to be global, et cetera, so they can bring them at different geographies over time.

So you have to think through what vertical niche you’re going after. But do I think there’s usually room? Yeah, absolutely. You can find a niche that no one else is going after and do it better than anyone else. Now, is it a big enough category to make it interesting for you? Yeah, who knows? And by the way, one thing to think about, people overestimate the risk of competition when they build a startup.

I don’t worry all that much about competition. You do your own thing, you do it well, you’re going to do well. The main reason startups fail is not competition. This is like number eight on the list is competition. The main reason startups fail is, number one, they don’t find product market fit.

You know, you don’t have a product that people are willing to pay or you can’t acquire pe customers that are willing to pay for it at a good enough price that you can make the unit economic number one, by far, you cannot find unit product market. Number two reason startups fail is the founders fight.

The co-founders disagree on the strategy. They have a fundamental disagreement of where they’re go, things are going, they break up, et cetera. It destroys companies. Now, two founders on average better than one, two founders fighting. It destroys the company. So higher success rate higher, higher probability of success if you have two founders.

But if they don’t, if they fight higher probability of like zero number three. Raising too much money at too high a price. Now this one is paradoxical, but if you raise too much money at too high a price and don’t grow into your valuation, it will kill the company. And so you need to be careful because Dan rounds often don’t happen because it triggers tide dilution and so the companies just die.

So these are the three main reasons companies die. Competition is low on the reasons why companies die. Now, obviously, marketplaces, competition matters more because it’s winner. It takes most where it takes all. But you, I still think, Alex, you can find a vertical that works.

TheJpstan on YouTube: [00:45:51] What made you decide for Turks & Caicos and not another island? I started in the Dominican Republic because I liked the raw authenticity of the place. So I was first in Cabarete because I like hiding in the North coast in a reasonably poor neighborhood. And I found this most beautiful piece of land ever. It was La Boca. There was a river going into the ocean. I had a mile of beachfront, 200 acres. I’m like, okay, this is so pretty. And there are a lot of other benefits. Like three hour flight from New York, an hour and a half from Miami, or an hour from Miami. Beautiful friendly people. Low cost of everything.

No murder rates reasonably low. Okay, this is, this makes sense. So I went to Dominican Republic. That was in 2013. It turns out that the Dominican Republic was more of a banana republic than I expected to be. Everyone there wanted bribes, the mayor of the city, the minister environment, the minister of tourism, the vice president, and also the mob wanted like protection money.

At first, I didn’t even know I existed. Like I, I did lead, especially at that time, had no kids, nothing. A very low key life. I was like, shorts, t-shirt, hanging around. You know, I had a broken down, hundred thousand mile like Ford Explorer, whatever. Very little by little people realized that I had wanted to invest tens of millions of dollars that was becoming relevant in the community.

I was paying for the education 10,000 kids, K through 12. I was building this like tech center to help people have access to internet. When there were problems or floods, I was donating food and like mosquito net, etc. And, as my profile increased unwittingly, it problems started, started happening.

Like we, we had attempted rapes of some of my female guests. We had burglaries. They poisoned one of my dogs. We got a full blown attack of people with shotguns. There was a shootout in my garden between the attackers of my guards and, and you know, I didn’t like the idea. I needed guards to begin with. But fortunately they attacked, they attacked the shift change.

So be two X number of guards. Plus it’s a place that a tropical diseases, you know, dengue, Zika, chikungunya, everyone that came to visit got a tropical disease at some point or other. And the more time went on, the more it was like giving me signals, okay, this is not the right place. And of course, my family didn’t like it.

They felt the waves were too big, the place was too poor, you know? And I lived in a very low key place. I like cockroaches, rats, et cetera. But it didn’t bother me. Like I liked, like roots grand level living. And so it was time to leave. And when it was time to leave, it was late 2018. And I considered where else I should go.

I should go. You know, Tulum is beautiful, but it’s not viable for me. And it’s too violent, too far from the airport of Cancun. So Mexico was not viable. Bahamas I didn’t like because it’s too far north.

And so Nassau is too developed. It’s actually too cold. In the winter, November, December, January, February, the water’s cold. The air was cold. Like it didn’t feel like a proper Caribbean destination, so it didn’t make sense. Bonaire, Aruba fell too far, I wanted direct flights. So like, things like St. Bart’s where you had to fly through St. Martin didn’t make sense. And Anguilla beautiful, but like didn’t sense. And so I chose Turks & Caicos and I’ve been here now for six years and it has been amazing, right? It’s like easily safe, the most beautiful water in the world. I build my little compound direct flights.

Everyone loves it. Now, I actually am considering leaving Turks & Caicos but not because anything’s funnily wrong in Turks & Caicos. Turks & Caicos has as many things right. But there are a few things that I’ve learned over the last six years that I would do differently. So right now, I’ll give you a few examples.

First of all, despite how beautiful and wonderful Turks & Caicos is. They are very anti-immigration and it’s a country that depends and lives off of tourism and you don’t feel welcome. You know, every time you go in through immigration, they’re like, and, and also you can be a one hour flight from Miami and a two hour immigration queue makes no sense.

They’re like, why are you here? Why? I mean, they treat you really badly. And if you’re a young, let’s say professional tennis player in your twenties or thirties coming here for a month between the offseason or paddle player, they’re like, you must be looking for a job. And they only give them a five day or seven day visit permit not 30 days.

If you want to hire anyone that’s not available on island, it’s impossible to get a work permit. They’re so anti-immigration and if you know, my neighbors here don’t particularly love me because they don’t like all, I mean, 85% of the neighbors love me because I brought like development.

I’ve increased I spend a lot of money renting their houses. Every year when I bring the FJ conference, when I bring my friends, you know, I bring a hundred people, I rent 30 houses. But a small subset of the community doesn’t like the development. They don’t like the changes, they don’t like the lights from the tennis and paddle court.

I also built my compound here on the east coast, which is where the wind is. And it’s great for me cause I love kiting, but a lot of my friends who don’t kite, they find it too windy. It’s also windy for tennis and paddle. So if I had to do it again, I’d probably pick an island where on average, they’re way friendlier to immigration.

They’re friendlier to a tourist. They want you there. And learning what I’ve learned, I’d probably be on the west coast with no wind protected. I could just take a little boat to go kiting, et cetera. So I’m actually toying the idea of moving. And I’ve either moved to Nevis in the St. Kitts and Nevis islands or Antigua and Barbuda, probably in Antigua.

My current two choices, if I were to move, would be Antigua or Nevis. Both are amazing, well connected, safe, wonderful, very welcoming. And I learn, you know, I built, I’d buy a lot more land. I build my tennis center in a way that the lights don’t bother anyone. Like a lot of the lessons I learned from here, but TBD it’s on the to-do list.

You know, this, this year I’m thinking of making a lot of changes, right? As you may have seen in my blog, I’ve listed my apartment for sale. It’s too small to accommodate with my kids. The kids want to be near green spaces and parks, so I want to put them in Tribeca. And I’m currently Lower East side, so I’m selling my apartment.

I’m moving my apartment to Tribeca. I’m probably going to like, at some point sell this place in Turks, move to Antigua or Nevis. So a lot of changes in 25. I also thinking of like getting another kid. So I’m currently looking for a surrogate and yeah, so all this process ongoing.

So I think that title of 2025, which I will post of course in January 26th when I write my year interview will be New Beginnings. Now, of course, these are ideas. BD, what comes through, I, I put these ideas in the universe and like kind of go with the flow and see how it happens.

NotionXarma: Continuing the travel question. [00:52:57] What is your favorite place in India? So I understand OLX has a huge footprint there. You in the coming years, VC funding will love towards South Asia as it was a case for China.

Well what is my favorite place in India? It depends on if I’m going there as tourists for fun or if I’m going there for work, right? Like, so OLX is huge and they we’re part of Fabric Society.

You know, we were on tv during cricket. We have tens of millions of users every month. Literally, if you want to buy, sell anything it is the place to be. The company is in, is in Delhi, in the tech center. And I would go there probably a month, month and a half every year in Delhi to go meet the team, et cetera.

I’d go two, three weeks every quarter, basically. But Delhi is very polluted. It’s not the most scenic city. I wouldn’t be going there other than, other than for that reason. Mumbai for that is much better from a city perspective, but actually, you know, I think the entire country’s beautiful. I like going to ran them border, which is where you go, like glamping to look at the for the tiger.

I liked in the southern part of the country going to Madras and, and seeing the history both religious and, and the geology and the northern part of the country not far from Madras. I love Ranthambore. Obviously I went to the Taj Mahal as everyone does. So frankly love the country grid large, and it’s worth spending time to get to know and travel, et cetera.

Depends what you’re looking for. OLX happens to be in Delhi because my country manager, who’s the number two at eBay India, became obviously my CEO of OLX India. Was based in Delhi and we built the entire team there. But Delhi would probably not be on my list of places to go and visit for fun.

Now, Indian venture capital has been exploding. It’s completely on tear. India is growing. A lot of people are moving their supply chains out of China into India, and we’re investors in SMB enabled we’re investors with a company called Zyod which is helping apparel manufacturers like sell to Europe by doing the prototyping and, and helping them deal with customs and payment and finding clients, et cetera.

So that is a mega trend. Venture capital in India is exploding. Now the question of course is Southeast Asia. Yeah. To a less extent, right? Like yeah, Vietnam, Indonesia, Malaysia, Philippines, we’re investors in a friendly fund called FEBE, which is doing really well there. But I don’t expect a huge explosion in venture capital in Southeast Asia.

I think India for sure. India is the next wave to go. It’s already happening, but not, not so much more not the rest of that East Asia just yet.

Lewis: Off topic. [00:55:48] I want to know how you lost your French accent? What is your secret? So language, people don’t realize all languages, by the way, follow a mathematical formula called ZIPF law.

ZIPF for the most common word in the English language is the, T-H-E. It’s 4% of the words in used. Second most common word in the English language is half as often used. The 100th most common word is 100th as often used. The 20th thousand most common word is one 20th thousand as often used. So, you know, sum of n equals one infinity to the, so it’s one to the divided by key to the power n, right?

Like, so the top 15 a hundred words of the language, about 15% of the language, the top 300 words of the language are 95% of the language top 1500 or 99%. So if you learn, frankly, even 500 words, you’re good. Most erudite intellectuals, you know, if you think of like Neil Ferguson, whatever, will only use 300 unique words per day.

If you learn 300 words, frankly, you’re good. So what I did when I came to Princeton, I was 17, I did a very strong French accent, and people were making fun of the way I spoke. I decided I was studying mathematics and economics. And I was not being taken very seriously. And because I started like this people thought I was less smarter than I actually really was.

And I’m like, oh, if the US is the future of my economic destiny, I need to learn English perfectly. So what I did is I took the top 1500 words in decreasing order of frequency in English language. And at that time it was not online. Now you can do it with Google, you know, or GPT. At that time I had to go and like find resources at the Firestone Library in Princeton.

And then I’m like, okay, for each of these I’m going to break it down with the underlying syllables and, and replicate the sound and understand exactly how you move your mouth in order to replicate the sound. You make the word. So would sort of like ego dobies, it’s at noob next, right? For mathematics.

So the way, for instance, in, in English, you do the T-H sound is you put your tongue between your teeth and we don’t have that sound in French. So it was “the”, “thus”, “therefore”, “that”, and then eventually with repetition practice it became the, thus, therefore that or “Hs”, we don’t have that. So, “ah, he add the out in the amptons” becomes Harriet has house in the Hamptons.

So what I did was one hour a day, two words a day, recording myself, looking mechanically at work, playing it back until I could replicate the sim very scientific, mathematical way of learning the language. I also learned one way of expressing future, past and present. And then one way to ask questions.

So simple grammar. You know, like in in French for instance, you have all these tenses, et cetera. You actually don’t need all of them. You need one way of expressing the past point of asking question. And by combining that with being an obviously in the US and getting feedback and taking an English for non-eighties figures literature class where every week I read a book of like three, 400 pages and wrote a 15, 20 page essay.

Within two years I learned English perfectly. So by 19 I was good. And I’ve kept working on it. When I add new words, because I read a lot. There are many words I didn’t know how to pronounce. And so I keep adding them to the vocabulary. And by the way, this is something I’ve used for other languages.

I speak Spanish fluently as well. And I speak Mandarin reasonably well. And I spoke it fluently when I learned it. I haven’t practiced it in a long time, but I’m still reasonable at Mandarin. And so this approach works in every language. But you know, it’s not the most fun and you need a lot of you need a lot of dedication, right?

People often say, oh, I can’t do that. I can’t learn language, I can’t learn to dance, I can’t paint. That’s not true. You can do anything. You have chosen not to allocate the time to become good at this because it doesn’t capture your interest. You’re too busy or whatever. But whatever it is you want to do, you can accomplish.

You just need to put your mind to it and decide that this is where you want to be focusing on. cause most people don’t want to allocate the time. So most people have come to the us. You know, if you’re a guy maybe having the cute French accent ” who’s the woman?”” why would I lose the accent the women are throwing themselves at me?”

But that, that wasn’t what I was optimizing. I was optimizing for how can I be the most compelling pitch person when I go and sell my startup and raise money, sell the vision and the employees, the founders, the investors, the process, et cetera.

And so that’s why I wanted to learn English with a perfect accent, even though possibly to my comparative disadvantage when I was going to go dating and wooing the women. But it’s a question of like the effort people were willing to make. If you’re willing to do it, you can do it.

Liz: [01:00:52] What is on your target list for climate related investment opportunities? So, there is a, the good news, first of all, I’m profoundly optimistic about climate. The decrease in the cost of batteries, the decrease in the cost of solar panels, the decrease in most of the technologies that are leading an explosion in greenification of our systems, like heat pumps, et cetera. Now, what I like is finally, software is coming to this category.

It used to be you needed like billions of dollars or hundreds of millions of dollars to open a plant. But now you can create marketplaces. So the types of things we’re investing in were a company like Tetra. Tetra is a Boston-based marketplace to help people replace their heat pumps, to improve their energy efficiency. So it’s a marketplace, it’s an acid like model, and it is aligned with the climate change movement. So back in the day, if you wanted to hire a contractor to change your heat pump, you would go to Angie’s List or Thumbtack. You would take photos, you’d get like, say what you want and people would come in at your place and give you a quote.

You don’t even know how to pick one very well. You pick one and then typically they overcharge. You take longer than you think. You’re disappointed and it’s painful. It’s very painful. It’s painful for you, but it’s also painful for the 10 people who keep showed up and only one of them got the job.

Tetra, what they do is like, you take a few photos, they’ve automated the process, they are the experts. They pick the very best contractor. They say, this is the work, this is the amount, and you’re done. They will, you will pay that price if nothing else. And then they are going to go and send the person. It gets done, it gets paid all good.

And so these types of things we’re investors in solar installation marketplaces or investors in grid management. Marketplace is like leap that is connecting like the batteries of your Tesla car into the grid as surge as like surplus for the grid. I mean lots of these types of software type companies. So lots of opportunities.

Oh, I got two questions. Let me first ask. [01:02:55] Did you do your long hike through Greenland that you wanted to do? I’m in a small marketplace in Holland last time gave tips on onboarding less sellers and ensuring all sellers have decent revenue on our platform.

Okay. So what did I do? Well, I didn’t do the Greenland trip, so I wanted to do the Greenland trip. I didn’t do the training because of my tennis elbow. I wasn’t able to go and train in Finse for the trip. So the trip is supposed to be in 20, in 2026, probably delayed to 27 or 28. I was also thinking of maybe moving into, and so Greenland for a variety of reasons but TBD, but why do I do these trips?

I like being disconnected from the world, right? We live in a hyperconnected world where all day long we have WhatsApp, iMessage, telegram, signal, emails. It’s all busy all the time. And when you go to a place completely off grid where. 10 days a week, two weeks, you have no meetings, you have no WhatsApp, you have no connectivity to the world.

It’s a real privilege. You’re like, resets your mind. You think through your, and you realize in these moments like how grateful you are. You have the life you have because you come back in these places where you’re completely disconnected from anything, you know, if you want to poop, you have a shovel to make big a hole and you come back and there’s like electricity and hot water and toilets and like amazing food.

So it’s exercising gratitude. It’s like mindfulness. It’s like, to me it’s like an active, the Vipassana retreat where I’m often alone with my thoughts in these moments where you’re very active for like many hours a day. And I love it. I think more people should find ways to be disconnected for longer.

It would be great for their mental health and for also understanding where they’re at, reconnecting and, and it’s a sort of amazing ideas. So I do it both in the cold and in the hot. I need to fix my elbow, and then we’ll see when and where it goes.

[01:04:59] Do I have tips or opinions on short-term revenue versus long-term brand trust?

I think I probably missed a question. I’ll go back there. When you’re starting a marketplace, you want to highly curate your sellers. The biggest mistake you can make is have too many sellers because you don’t have enough demand for them.

So many of them are not going to be engaged. They’re going to churn, and many of them are going to be low quality. So what you want to do is you want to curate the best sellers possible. And then bring them demand. And once that has worked, then you could get a few more sellers. But I, I absolutely curate my seller quality.

Otherwise you end up with a very bad you know, experience. And if you have a bad experience, you know, you don’t have the magic of the marketplace. People are going to churn and not, and leave and not continue to use you.

Green’s 18: [01:06:03] If you’re building a tech company like Zingy today, would you still raise VC early or bootstrapping, knowing cases like BeReal were the founder really benefited from $500M exit?

Well, the answer of course is that it depends, right? Zingy did not raise VC money. It was 2001. I wanted to raise VC money, but like the tech industry had imploded. Every VC I called and I’m like, “Hey, I’m building this BDC telecom company” in a market where every BDC company, like ETOs, web Van, I all got under.

And all the telcos like MCI welcome, got under. I don’t think I finished the sentence that hung so. Through necessity, I ended up building a company from whatever, zero, I mean, missed payroll 27 times, lived in New York, and like $2 a day for a year, 18 months, slept on the couch at the office. It was really hard and disastrous.

I would’ve liked raise money, I couldn’t. But ultimately I was able to, I own most of the company at the end. The issue is, yeah, don’t raise too much capital. If you can try to be capital efficient, you can have multi-billion dollar exits and make very little money because you’ve raised too much money, looted yourself too much along the way and didn’t grow into the valuations you expected.

I mentioned earlier one of the biggest mistakes founders make is they raise too much money at too high a price. When you do that, you increase the price at which you need to exit dramatically ,and that’s risky because maybe not all the stars align. And so you can get a $500 million exit and make very little money.

So your first time founder, a VC says, yeah, I’ll invest 50 million or whatever, a hundred million at 300 pre and someone else is like, I’ll invest 20 million at 80 pre, or whatever. You’re like, oh, of course I should take the a hundred. But not really, because if you don’t actually need the capital in the prior case, if you don’t get him four or $500 million in minimum, you’re not going to, you’re, you might be screwed.

So raise the right amount of money at the right price, otherwise you actually might decrease your under or your, your fundamental outcome. Now, some companies you can bootstrap, some companies you can’t bootstrap, right? Like if you need capital for customer acquisition or servers or whatever, well then you need the capital.

But I would try to be capital efficient. So I would try to have a pre-seed of less than a million, a seed of 2- 4 million an A of like 7-10 million or 7-12, a B of 15 to 25, and then you can be profitable. I would try to avoid businesses where you need tens or hundreds of millions of dollars to get a profitability because then you might be in that situation.

Nicole: [01:08:39] What advise you for home care marketplace founder who has found product market fit, ran outta mining 23, revived 23 GMV 2x 2022 and we cut burn, founder funded. Product market fit because for customer grew yeah, I mean, you’re going to need to be able to convince people that, well, maybe it’s just a reset, right?

Like you re raise as though you were a seed company and you may have to do a reset of your calves, et cetera, et cetera to get it going again. Because you haven’t grown probably because you focus profitability, it doesn’t feel like a venture backable company. It doesn’t feel like a venture company versus being maybe a lifestyle business.

So either you find a way to like. Show that if you had capital, you can grow by growing by like six months, for six months or something like that, at like 200% year on year or something. Or you do whatever it takes to reset and you know, you’re re-raising a seed round, even though wipes out the prior holders, you can prove it coming.

I mean, you clean up your cap table such that you can get going again. We’ve done that a few times. We were in a car marketplace called Clutch in Canada, at 700 million valuation. It hit a wall. The investors didn’t want to do the next round.

We completely recapped it at 5 pre. We wiped out all the prior investors. The people put their money in. So we reinvested like 15 to five pre. We looted the founders, so maybe 30 posts effective where the founders having 30% and we restarted the company and now it’s doing extremely well.

So there are ways to do it. Given that you have 40% of growth this quarter over the prior quarter, and again, I don’t know if scale right? Like I don’t know what GMV we’re talking about. We’re talking, you know, a million GMV a month, it’s different. We’re talking 150 K and it’s different we’re talking 15 K, right? So based on that, I think the answer might vary a little bit, but I would, if you think this requires capital, I would do whatever it takes to get the company funded and there’s usually a price at which case you can get the company funded.

[01:10:55] What are the future big trends in AI and especially with consumer usage?

While everyone’s seeing AI take over the world in every category. And one thing where people were underestimating and I think is going to be huge is humanoid robotics. And there are a lot of companies right now like Figure AI starting to play a role in industry like figure as robots in the BMW factory like in the chain. And they have like contracts for like replacing human workers in like warehouses. That’s about picking and packing warehouses to bring the packages to the whatever UPS drivers or delivery drivers, FedEx or whomever. And these things are way closer than people think. And so when do I think it gets into the consumer home?

I think that versions coming in 2, 3, 4 years will be for wealthy individuals. So the Justin’s future, but in 5, 6, 7 years, do I think these things will be cheap enough and more, many, many more people will have them and within a decade they’ll become placed. Absolutely!

So I’d say that humanoid robots probably the category that people are underestimating is coming in the more recent future that people expect.

Being founder funded is a great idea, by the way. I mean, you can be a completely bootstrap company and you own most of the equity and you don’t always need capital venture capital. I mean, those are the questions someone asked me earlier is like, should you be raising, should you bootstrap or raise venture capital?

The way I think is if I’m raising capital, I’m taking dilution. Let’s say I’m raising and I’m taking 25% dilution, am I going to create more value with this 25% dilution than 25%? Right? And so if you’re going to quadruple the value of the company and you took 25% of dilution completely worth doing, if it’s close, definitely don’t do it.

So that’s the way I kind of think about it. Yeah. Clutch is amazing. They’re Carvana of Canada. They’re, they’ve, they’re crushing it.

[01:13:12] For personal or small retail, which AI tools do you believe are actually worth paying a subscription for today? Depends on your needs. For sure I use I use GPT for everything and I pay for it.

But I even stopped using Midjourney because I just used Dall-E to create my images. If you want to build a website or probably pay for Lovable, you want to code basic things I pay for Cursor. That’s kind of it. Frankly, GPT is enough, right? That’s what I use for a hundred percent of everything, and it works really well.

[01:13:49] What do you seek in founders for pre-revenue Startups? I don’t usually fund founders with pre-revenue startups. I want a modicum of product market fit. So I expect you to like figure it. I’ve spent some amount of money together, like 15, 20, 30 K in net revenues to show that you have union economics that work, and then now you need capital to scale.

The only case where I would do it is if you’re a second time successful founder. And I like what you’re doing or if your background is so extraordinary that it’s worth taking a founder bet. But other than that, I probably wouldn’t do a pre pre-revenue start-up. But yes, if you were like the first guy who built Open AI and you’re building something related to that, yes, I’m probably going to be willing invest pre revenue.

NotionXarma: [01:14:34] What is the biggest turn down for the VC while seeing the pitch deck? What is the biggest green flag as well? What is the red flag when cold connecting with VC people? How to approach that?

The red flag in cold connecting VC people, and I get a lot of these messages. Hey, I have a great idea. Can I send you a deck?

Hey, I have an amazing idea. Could I get feedback on it? Not even replying. You are making it hard for me. I need to say yes, I’m interested. Send me a deck. You need to send me a message that says, this is who I am. This like one line, my background, what I’m building, the traction I have, and here’s the deck.

And if you can do that, you will get a, a proper reply. If it’s more like, Hey, can I send you a deck? No, not even gonna bother reply. Like, you made it hard for me. I don’t have time. I’m getting literally 300 of these messages a day. Now within the deck itself and I have a playing the unicorns episode on what the Perfect deck looks like.

Yeah. Have, like what is the idea, what is the background of the team? What is the product? You’re, what is the solution you’re bringing to the market? What is the attraction you have? What’s the business model that you’re going to use, and what is the use of capital? Right? Like, pretty simple. You have like 10 deck, 10 pages, maybe 15 to show why this is an attractive idea.

No big red flags. Again, in general, I prefer things that are post-launch, post revenue, post product market fit, not small. Obviously I’m doing a seed investor. But not just an idea .

I think we’ve caught up here. So let me go back to the earlier, the messages submitted by email. Note that for some reason the thing is going to jump.