While AI investing continues to reach new highs, we have been contrarian. Given how non-consensus we are, I wanted to share our thoughts and perspective.

In this episode, I cover:

- The general state of venture.

- The explosion in AI investing.

- The varying fortunes of AI startups.

- FJ Labs’ perspective on AI.

- FJ Labs’ AI investments.

The episode was highly interactive with dozens of audience questions. Here are some of the questions that I answered:

- How is AI impacting sports, especially tennis from an entertainment and industry standpoint?

- How are you utilizing AI in your personal life to improve your processes? Which tools?

- What is your recommendation towards founders or technology enthusiasts about AI that want to explore technological solutions using AI or find funding?

- How will AI help secondhand fashion marketplaces?

- How will labor marketplaces be impacted by AI?

- How will AI impact the media industry?

- What is my perspective on how AI and AR will be combined to create better experiences?

- What are examples of picks and shovels companies we are investing in to benefit from the AI boom?

- How to address sellers’ fears that AI will make it harder for them to compete effectively with other sellers in the marketplace?

- Which roles will be most impacted by AI? Will it cause mass unemployment?

- Will AI amplify the best or worst traits of humanity?

- How will AI impact healthcare and education?

- What should startups focus on in terms of implementing AI: customer service, product search or other?

For your reference I am including the slides I used during the episode.

If you prefer, you can listen to the episode in the embedded podcast player.

In addition to the above YouTube video and embedded podcast player, you can also listen to the podcast on iTunes and Spotify.

If you prefer to read the content, here is a transcript of the episode.

Hello, everyone. I hope you’re having a wonderful week. So it’s been a while since we’ve done one of these. And over the past year, frankly, everything has been about AI, AI, AI all the time. And many people ask me, what’s my perspective on what’s going on in the AI world? And How is FJLabs addressing it? Are we all in like everyone else?

And if not, what are we doing that’s different? And so I figured I’d take the time to share what we’ve learned and our reflections on the topic. So without any further ado, let’s get going. Welcome to episode 46, FJLabs AI thesis.

So when it comes to AI, you know, what’s interesting is it’s really a tale of two cities when it comes to the world of venture capital. So venture capital has been really in a recession and it doesn’t appear in the public markets because in the public markets there’s the magnificent seven that have actually been benefiting from the AI bull run and are doing extraordinarily well.

But venture investing and much smaller tech companies on average have not been well. I mean, peak to trough, right? We went to over 60 billion a quarter investment. Now we’re down to 20 billion. So it’s divided by three. In terms of the amount of invested in venture capital on a quarterly basis. Now, obviously, it was inflated back then.

So I’m not saying that these should be the run rate, um, levels, but clearly venture has been doing rather badly. And there’s also been very few exits. The fundamental difference, though, is everyone has been going in an AI. And I think it’s kind of possibly a case of FOMO. It’s like, oh, they missed out on, Open AI early and clearly there’s something real going on and it’s magical and beautiful and they want to be part of it.

And you, we have like big in answer. And so that’s where we’re saying a third of the latest funds going to be in, in AI. We just looked at the most recent YC batch, 77 percent of the companies that were presented there, and we’re talking hundreds of companies were tagged as AI companies. So clearly, AI is buzzing right now and, you know, people, people really have a tendency to be kind of lemmings, right?

Like the same way in 2021, everyone’s like, we need to invest in everything and anything right now, everyone’s like, we need to be an AI no matter what. And a while back I thought, Oh, maybe we’ve over already gone over the hump, meaning we’re past the peak of the hype cycle in AI, but when it comes to actual dollars invested, clearly were not past the peak of, the AI bubble, given that the amount invested in AI continues to grow. And of course, with the massive rounds expected for open AI, this is likely to continue to happen, in the foreseeable future. And so while venture as a whole is divided by three, AI investing has exploded and it’s continuing to explode.

And, a few companies are attracting the bulk of the investors, right? Like the opening eyes of the world or Anthropic or Mistral in France and many others. But that said, the one thing that worries me is I’m seeing a lot of people being in the category because they want to be in the category and it doesn’t feel like many of these are completely differentiated, have access to proprietary data, have a valid business model.

And when you enter at very high valuations, in a category that’s moving so quickly, I think there’s going to be a lot of pain to come. Now, it’s not to say that everything’s going badly. Some companies are doing well, right? I think, OpenAI may be on a 5 billion revenue run rate right now. I think they are expected or projected to grow to 10-15 billion in revenues next year.

Most of that revenue is coming from subscriptions, so it’s actually reasonably high margin. Obviously, the API calls are lower margin because their compute costs are high. And they’re still burning a lot of money because they’re investing in capacity. But OpenAI specifically is doing very well, and there are a number of other companies that are doing well.

And of course, companies are raising a lot of cap money at very high valuations. Some are not doing so well. Some are fads, right? I don’t know if you remember, but a few years ago, everyone for like a month got the Lenza profile pic done for themselves. And so the revenues of the company literally went from like a couple hundred K to 30 million, back down a couple hundred K a month later, like everyone churned.

And we’re seeing companies that rise and fall rather quickly, right? All of AI, I think, raised or valued at 4 billion in healthcare automation and then shut down. And so these things are more fleeting than they may otherwise appear. And OpenAI itself is kind of causing a mass extinction event, right?

Every one, every time there’s a new release of OpenAI, it actually takes over. It does things like vertical. Businesses were vertical websites were doing and I lived through this story with Fabrice AI. So as some of you know, I built Fabrice AI, which is a digital representation of my thoughts by digitizing or taking all of my digital content.

So my podcast, my speeches. My blog posts, my interviews, all the things I’ve published, the PowerPoints that I put on, on my blog, transcribing all of it, uploading it, such that you can go and ask Fabrice AI, what is the FJ Labs current thesis? What is the median evaluation at seed or series A of the traction people were expecting?

Or frankly, even more personal questions. And I started with OpenAI, wasn’t working really well. I then used, Langchain and Pinecone. Worked a bit better, but still not great. And finally When OpenAI released 4.0, with the Assistant API, everything works so well, I basically switched over completely to OpenAI.

So it replaced all the startups I was using. The last piece that I haven’t replaced yet is, currently, the voice to text interface. But I’m going to replace it with Whisper because Whisper, which is again, the OpenAI API is multilingual versus the open source version I’m using is not multilingual.

Now I’m working with HeyGen to do a digital visual representation of myself. So you’re going to be able to have a conversation with a Fabrice like avatar that looks and sounds like me. You’re gonna be able to zoom in and hopefully in the long run even pitch in ideas. That’s probably in the next year.

It’s gonna take me a while to code that. But, right now I’m using HeyGen. I can expect that at some point, maybe with GPT5 or GPT6 this will be integrated and, and it’ll be replaced. So, you know, I look at it as well in my, in my, the way I use, AI on a daily basis. I was using Midjourney for images, but because I have a ChatGPT subscription.

Now, frankly, I just used Dall-E, which is integrated in ChatGPT, and I no longer pay for Midjourney. And this is kind of true of all the other products. And so all the verticals, some will succeed and we’ll be okay. You know, maybe runway, if you’re a movie studio makes more sense than whatever OpenAI is developing, but many may be replaced.

Now, again, Our entire thesis at FJ Labs has been that verticals have a tendency to win in certain categories, but you need to be thoughtful about the vertical. It needs to have something that’s very unique about it in terms of the data or the data access that you have, and the way you presented the user interface such that the horizontal doesn’t do it.

And many of the companies that have been launched, especially things like simple Copilots, I don’t think are particularly interesting. They have no barrier to entry, and I think they will be replaced. The other thing to think about. And by the way, I’m not bearish AI. I’m very bullish AI. I’m bearish investing in AI, which is a very important distinction and nuance.

Typically, what happens in tech is there’s an innovation. People notice something great and amazing happening, and then everyone’s so excited. It’s going to change the world is going to lead to an extraordinary productivity revolution and things are gonna be better, etcetera. And then eventually, delusion sets in.

It’s like it didn’t happen as quickly as people expected. And people kind of forget about it. It like goes in the background. But fundamentally, ultimately, you wait long enough. It actually changes society way more than we can expect. And this has happened many times before. And I expect it will happen here as well.

And I’ll talk about timing in a minute. So if you go back to the late 1990s, during the web revolution, everyone was like, Oh my God, these companies are going to take over the world. They’re going to make things cheaper, better, faster. And people thought of Webvan for grocery delivery.

Pets.com when it came to food delivery, eToys, et cetera. And here’s the funny thing. All these companies went under, but the actually, the ideas were pretty good. Webvan, you know, it’s kind of Instacart. Pets.com is Chewy. eToys, I guess you could buy it on Amazon. Cosmo is Postmates.

The ideas were good. It’s just the structure for it to happen, what was needed to happen, frankly, was the instruction of the smartphone, was not really there. You needed GPS and payments and adoption, etc. And, same thing has happened, by the way, for self driving. Right. I don’t know if you guys recall, but like the first few self driving cars, like Waymo, it was like a decade ago.

And people were all excited. We’re going to have millions of self driving cars on the road within a few years. I think in 2018, Elon Musk said, Oh, we’re going to have a million robo taxis next year on the road in 2019. We’re in 2024. Where is all the self driving? Where are all the self driving cars? And so people have like kind of forgotten about it.

But actually, the funny thing is, it’s about to happen. The tech is getting there, and it will actually completely transform society. It’s just that people thought it would happen within a few years, and it’s going to take 10, 15, 20 years, well, more than 10 years, and, but it will absolutely undoubtedly happen.

The kind of same thing happened with smartphones. I mean, now we take them for granted, but when the iPhone was introduced, it was exciting, but, like, they sold 20 million in the first year. People didn’t feel necessarily there was that much has changed. It’s also a tiny screen, it wasn’t 3G. It was extraordinarily expensive.

And yet today, if you’re a poor farmer in Africa, in your pocket with your smartphone, you have access to the sum totality of humanity’s knowledge. You have this super smart, intelligent advisor. And,, you know, in ChatGPT, and you have like free global video communications. You have access to more information.

More communications is probably just as good advice as the President of the United States had 25 years ago, and we take it for granted. So, you know, as I said, it happened in the internet. I think it’ll happen here as well. So here’s how I think about the timing on AI, by the way. So when I think of AI, so GPT is amazing, about 100 million people or maybe 300 million people are using it.

And it will improve productivity. We’ll make things and we’re seeing it in our startups. All of our startups are using it too. improve customer care to improve programmer productivity. But if you take a step back, most of GDP in the economy is governments, and it’s like 30 to 60 percent of GDP depending on the country and large enterprise.

And those are the laggards, the late adopters, right? When do I think that we’re going to have the U. S. government use, you know, AI in order to improve productivity. I mean, it’s gonna be a while. Same thing with large enterprise, right? Is Mercer, like, healthcare is 20 percent of GDP. Do I think a United Healthcare is going to do medical cleaning processing through AI anytime soon?

Probably not, because they don’t want to be sued and there’s hallucination problems, etc. So AI will change the world. It will change it in a more profound, dramatic way than we can imagine. But it’s also going to take longer than people expect and many of the investments that are like based on hope We’re probably not going to pan out especially given the valuations.

So what is FJ Labs specifically been doing when it comes to AI? So we’re not an AI fund. We’re a network effects and marketplace fund. We like investing in marketplaces because their winner takes most, they’re acid light, capital efficient, trend. And they are deflationary. They bring liquidity and transparency to opaque markets.

What we’ve been focusing on the last few years, because the consumer world is kind of, it’s not completely done, but it’s been pretty largely done, right? Like your life as a consumer is amazing. I can order food on DoorDash and I get it in like 15, 20 minutes. I can order anything on Amazon and get it between like an hour and two days.

I can, you know, book an Airbnb or get a hotel on booking.com or get an Uber in a few minutes. I mean, our life is always extraordinary, but when it comes to B2B, the world is like in the dark ages. Most things are still done by like WhatsApp and email and Excel and relationships and Rolodex, and it hasn’t been digitized.

Now, a lot of reasons for it. Some people want the opacity, but there is an extraordinary opportunity to digitize B2B supply chains. And so when we think of like what we, we want to do is actually invest in these things that are gonna make the world cheaper, better, faster, solve the problems of the 21st century.

To us, AI is a tool. Like, I think you could use the word AI almost interchangeably with the word technology. Technology is making the world better, cheaper, faster, more productive. And it takes a while to be adopted, especially by late, late adopters, be they older generation or government or, or, or a large enterprise.

So for FJ Labs, that, you know, 9 percent of our investments so far have been in AI this year. So what we’ve been focusing on, given that we don’t want to be investing in just pure LLM type models, we’re late in the game, right? If we’d invested early in OpenAI, it would be different. Maybe we’d probably keep going.

And do I think OpenAI is going to win? Will it probably be a trillion dollar company? Absolutely. But we’re seed and a investors. I want to get 100x, 1000x. So investing at 150 billion in open AI. Yeah, probably will be a 1. 5 trillion company. That’s a 10 X. It’s good, but that’s not what I’m looking for.

So I missed the early stages. Frankly, didn’t like the corporate governance structure. You know, I don’t know if you guys recall, but it was a non for profit and and some often did not control the board. It didn’t feel like an investable company felt like a research lab. It turns out it turned itself into a company, but that wasn’t obvious to make.

And the other companies like Mistral, you know, I don’t know. It feels, I have no information on Mistral, so I don’t know well or badly they’re doing. What worries me about companies like that is the communications they’re doing is about how good their AI is. It’s never about how many users they have, what retention looks like, how much revenues they have.

That gives me pause. It makes me think that perhaps even though the tech is great, they’re not actually doing all that well. Don’t know, but wouldn’t be surprised if one day it dies. So investing, I can’t remember the seed round, it was like hundreds of millions. The next round, the A round, it was billions.

Just didn’t make sense to me. And so didn’t invest. Obviously, so far I’ve been proven wrong, but I don’t care if I’d like the, the markups on the way up. I care about like the ultimate valuation at exit and whether the company is successful in doing something meaningful and valuable for society. So. We shall see on, on how the war with these LLMs plays out, but I suspect it’s winner takes most, right?

It’s super capital intensive. You need to build these data centers. The more access you have to data, the more you train them, the more people, users you have, the better you become. I suspect that, you know, OpenAI plus, one or two more are going to control the category. And by the way, I also suspect the prices of compute and the price of AI will probably trend towards zero at the same time.

So it’ll be reasonably monopolistic. And yet the revenue per API call is going to be near zero. Now, even though we haven’t invested in AI companies, it’s not what I mean is AI companies building AI, like LLM models. A hundred percent of the companies we invest in use AI, have AI built into it. So just to be clear, every startup we invest in today, we’re the early adopters, right?

So we are, we’re the ones replacing customer service agents and salespeople with AI. Well actually no, replacing customer service with AI, yes, and then complementing salespeople with AI, using AI to make programmers more productive and even changing the flows of the way buying and selling works in marketplaces to make them more efficient.

That’s it. But that’s using AI as part of the pipeline of your company. It’s not like an AI company that’s selling AI tools to other people. So the type of companies we’ve been focusing on the AI side have been follow a few categories. So as I said, we’re mostly marketplace investors. So companies that improve marketplace listings or sell through.

So I’ll give you a few examples afterward. So. Right now, right, if you wanted to sell on eBay, you need to take your phone, you take 20 pictures, you have to pick a title, select a category, write a description, select a price, describe the condition. You don’t actually even have all the information to do this very well.

So companies that basically, if you can just take a photo and boom, you’re done. And there’s some ways to do that that are intelligent that I’ll present, you know, we’ve invested in. Then their specific applications of AI were okay. We don’t want to be ated by open AI in the future. So you large enterprise want an AI tool, but you, you want to have, you want to be building in a, you know, propriety data with a vertical application.

So companies that are using, that are using these proprietary data sets at preferably in categories where there’s willingness at play. Then we’ve been investing in like some of the pick and troubles of the category. And and then we’ve been thinking about like what happens in services and then one big crazy bet, which are our foundational bet in robotics and and I’ll talk about it.

And that’s Figure. So some of the companies we’ve invested in. So Hero now again, I don’t know if they’re going to work and succeed because they need to create liquidity and that’s really hard marketplaces. But they are going after creating a wonderful user experience on the seller side. And so the way they do it is, you take a photo and then you create a video and in the video, you describe the item and because of course, if I take a video of it or a photo of a computer, it doesn’t say how much storage it has and how much memory and even the model, or frankly, a phone, you can’t really recognize it based on a picture, but I can actually describe it.

Oh, it’s a 2022 LG gram 17 inch. That’s like a two terabyte SSD and six gigs of RAM, 16 gigs of RAM. And it’s this condition, and then it opens, it uploads the content of Whisper, tags all of it, and creates a beautiful listing, and then also, then creates a, a 15 second video that you can share on Twitch, or not Twitch, on TikTok, and Instagram, and YouTube,, etc.

And, it’s really cool, and it’s really innovative as a means of, of like, optimizing selling flows. And that’s a new startup now. You can, you can imagine some incumbents are going to use things like that. And the idea here is it makes it so easy to list that people that are not listening will have, will start listening and we’re going to have unique, beautiful inventory that will itself start attracting buyers.

Whether it works or not is unclear, but it makes a lot of sense in terms of the direction of where marketplaces are going. Now, existing companies are often in a good position to do this. So we’re investors in a handbag marketplace called Rebag. Rebag. They’re nearing like 200 million revenues. They’re profitable.

It’s a great place to buy used handbags for cheaper than if you were buying for new. And they’re guaranteed authenticity. So they have all the data. They know whether the handbags are real or not. They know the condition. They know what price it sells. And they actually know, yeah, pretty much the model, the year, etc.

And so, with their AI You take a few photos of your bag, it’ll immediately tell you, okay, this is the bag, this is the model, this is the condition, this is how much it sells for, boom, done. And literally, you get the money like , in a day after you sell the bag. And so it’s sold instantaneously, which is a pretty profound user experience improvement over on eBay.

Now, of course, eBay is moving in the direction of this, but it’s way easier for Claire to do and Rebag to do because it’s only handbags and they have all the database. So. And trying to create a multi-category item that works in every category. Number three is a French company we invested in called Photoroom.

So Photoroom is a tool to help increase sell-through rate in marketplaces. And so what they do, they’re doing tens of millions of revenues and doing really, really well, is you take a photo of the item you sell and they will change the background to increase the sell through rate based on the type of item it is.

And on the marketplace you’re selling it on. And so, of course, there’s some items you just want a white background. Some items may be in nature or on a table. And the objective is making sure that you sell your items at the highest price possible, at the highest speed possible. Again, a company that does extraordinarily well, it makes sense.

And are there basic image removal tools that are available? Absolutely. We’ll OpenAI. Can OpenAI do it if you ask it? Yes. But it’s very different than like knowing exactly. the correct background maximize the sell through rate on a marketplace. And that’s why in categories like this, I think verticals actually do make sense.

We invested in a company called CollX. And by the way, all the companies I mentioned are portfolio companies. It’s a type of things we invest in, you know, so we have not been investing in like Mistral, for instance, or like, and we were late at the party to OpenAI, even though I think OpenAI will remain to be a good investment at the 150 billion level.

So what would be what they do is they’re using AI and computer vision to unlock collectibles. So they, they, they can, they can find, you know, if you have a lot of comics or a lot of like collectible trading cards, usually a few are extremely valuable and most are not. And so here you can like super fast figure out which of the ones you have, Or valuable or not and many of our companies are doing that that are in the collectible space or doing things like that.

Now collectibles or trading cards are one of the easiest categories to do this. So we were investors in TCGplayer and they have a product like this. We’re investors in Hip eCommerce in the comic category and they have a product like this. but again, makes a lot of sense in the categories where there are a lot of items that are low value and a few that are high value and you want to identify as quickly as possible the high value items.

Another really cool one we invested in is Numerai. So Numerai is kind of like a. Acid light hedge funds where people can upload their quant models, the models fight each other and and then and then they create an investment model. And so it’s kind of like a virtual hedge funds where the community, it’s like an open source hedge fund is uploading models and the most successful models get invested in.

And then they payback part of the profits to to the people that made the models, and it’s working really, really well. Again, very unique, innovative way of using AI that a horizontal like opening. I would not do. And then our transformational that is Figure.AI. So Figure.AI is a humanoid robotics company and the reason it makes sense, by the way, like everyone’s like, wait a minute, why would I build humanoid robots when I can build specialized robots?

And the logic is, we’ve invested trillions and trillions of dollars in infrastructure for humans. And it’s way more expensive to rebuild all that infrastructure with dedicated robots and just create a humanoid robot. Now, of course, specialized robots, don’t get me wrong, are going to have their time and place and make a lot of sense in many cases.

But actually having a uninoid robot that you can both have in the home to help you with like chores and have in, in factories replacing like machinists, which is what the figure two robot is doing at the BMW plant, makes a lot of sense. And so Figure is created by Brett Adcock. It was, he was one of the founders.

We backed before. He built a labor marketplace called Vettery. Grew to whatever, I think 100 million in bookings. We sold it at Deco for about 100 million. We were very successful. We loved them. And then he came to us. He’s like, Oh, I want to build a flying electric taxi company, an eVTOL company called Archer.

We backed him, did very well. And now he wants to do this. And I think this is a ginormous category. Now, yes, it’s a robotics problem, but there’s a big AI component and, and there, the way, the way this is a three prong problem. There is a interact with the world, probably. You need to know where the world, what these items are, how they work, etc.

And for that, they’ve partnered with OpenAI. So they were like, you know, OpenAI is going to win the LLM game. For these interactions with the world, we could probably recreate it using OpenSource, but why do it? OpenAI is an amazing partner. We have them recognize objects, etc. For the then, And then we need a robot that walks, that, that interacts with the world and has extraordinary manual dexterity.

It’s super impressive in terms of what they can do and how gentle and delicate they can be. But then there’s this middle layer of AI where you need to take this understanding the world and actually translate them to the way the world, the robot interacts with the world. And you can only do that if you have robots, and if you’re building robots, and you have these robots doing these actions.

And so that’s the magic proprietary AI that Figure’s building. That is sort of enough Figure. I think it’s going to be has the potential at least to be and the better we’re making it is one of those disruptive companies where there’s a market for hundreds of millions of these robots. It’s going to take a while.

They need to get cheaper. They get manufactured at scale. They need to work better in a with human in a human environment. They need to be more multifaceted right now. They’re being manufactured They’re being trained to do one thing very well, right? Like so for BMW, it’s like literally taking apart, turning around, walking, putting it on the on the supply chain and doing that a thousand times over in order that it doesn’t screw up.

And because the robots work 20 hours a day, the there are 2.3 times cheaper than like the machinists that they replace on average. So it makes a lot of sense and there will be a lot more of these applications and the idea is that this can scale. So. transformational, more risky, because of course Tesla is going after this.

I’m sure a lot of Chinese companies are going to go after this. Perhaps the Boston Dynamics of the world that have been more research labs are going to try to turn commercial skeptical, they’ll succeed. But yeah, so that’s really what we’ve been doing and thinking. And that’s why when I consider like what are pure AI investments, it’s really sub 10 percent of the funds.

Let me go through. So I’ll pause here. Let’s see. Okay, so LinkedIn user, yes, I will put the slides on my blog and the video of this will be, will be posted as well. Let me see questions that have been submitted ahead of time that I can address, while we do this. So, and feel free to ask questions in the meantime or comments or whatever.

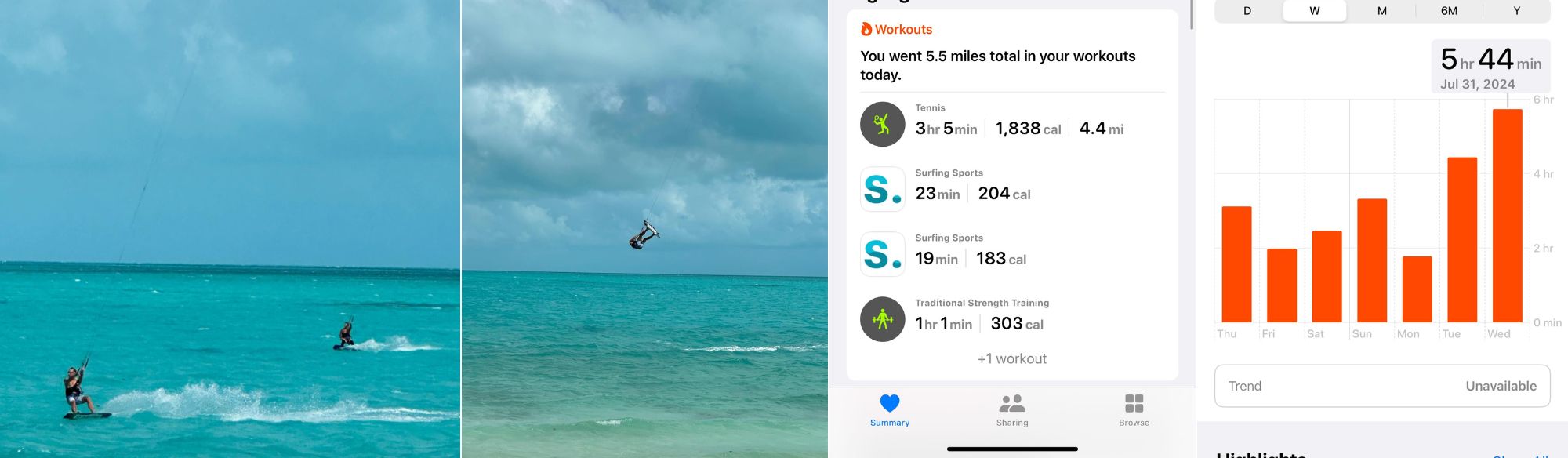

Jimmy Egas, how do you see AI affecting sports, particularly tennis, from an entertainment standpoint and from an industry standpoint? Are you utilizing AI in your personal life to improve your processes? Which tools? Okay, so, in terms of sports, the, or tennis specifically, I can imagine it happening in a few ways.

So, one is There should be at some point a, a tool that’s built where I can put my phone in the back of the court and I film myself playing and the AI will analyze my strokes, will analyze the way I play and will become my personal coach basically. And the issue with coaching in the tennis world is that it’s expensive, right?

If you’re, if you’re outside of the top hundred players. You make maybe 100K a year if you’re in like 100 or 200 or whatever, but your coach is 100K a year, plus flying, plus hotels, plus you name it. And so it’s really, really inaffordable. It’s only if you make it. So it’s the financial investments parents have to put in to turn their kids into successful players is really hard.

So I can imagine that you’re going to have your digital coach through AI where you put in the back. At the same time, in a way, AI is already playing a role. The judging system for the lines, I am sure is, is AI driven. The, they’ve replaced pretty much all the grand slams now it’s fully automated.

When you’re hearing the line calls,, like out or whatever. It’s actually recorded voice and they have multiple recorded voices, to make it sound like different people. There are actually no more line judges on the courts. It’s all Hawkeye, and I’m sure they’re using it on. Let’s see. I’ll ask Diego.

Then I’ll go back to the question from in terms of the tools that I use. So, Diego, great info. How do you think AI is going to help the secondhand fashion marketplace industry? It’s going to make listing items so simple that the volume of item increases. And so what Vinted has done to classify is in terms of making the process simpler and increase liquidity is getting, is going to happen again.

So I suspect the supply is going to increase. We’re going to have more items and more prices that are going to be amazing that would be available. And I suspect that the discovery will also improve. We’re going to, we’re going to show you the items that you’re interested in. And you’re gonna be able to buy them, so it will improve overall liquidity.

The entire volume, like GMV, will grow. The matching between the supply and the demand side will improve, and it’ll be great. Steven, this is great. How do you feel about talent marketplaces saying they’re using AI in their matching algorithm? So many say they’re using AI, but diving deeper is just a few filtering options.

So I would like them to use AI intelligently, And you’re right. Right now, many people that are using AI or say they’re using AI, it’s not really, I mean, and by the way, what is the definition of AI, right? Like, is it a large language model? Is it a deep learning model? I mean, there are different models that people are using.

And often the things that people are describing as AI are actually more simple as you’re describing. Doesn’t bother me that they’re exaggerating their claims. Every, every founder like sells the future they want to get there. But I suspect, do I think there’s a moment where AI will play a fundamental role?

Yes. Because here’s how, here’s how staffing marketplaces work. Like imagine you’re on Thumbtack or actually imagine you’re on Upwork. I’m on Upwork. I want to hire whatever, a developer, a graphic designer, etc. Right now, the way it works is I go and I create my job description. Dozens or hundreds of people apply, and I then need to go and interview them, and then I pick one.

There are ways to do it better,, but it’s not great. In theory, if you have the right AI, they should know who the perfect match is for you in light of your specs and your requirements, the type of person you are, etc. And they know the category better than you, right? Like if you’re a, if you’re a talent marketplace for hiring SEO talent, you know everything about SEO talent versus me, the employer, I’m only hiring one SEO person ever, right?

So I don’t really know the best practices. So the marketplace should say, this is the person for you. This is the person you should hire and you should be done it’s starting to happen in some verticals. It’s far from, from being universal, but it’s starting to happen, right? We’re investors in a HVAC installation marketplace.

And. You don’t pick the HVAC installer. The Marketplace picks it for you. The same way Uber. Uber has pretty smart AI. When I say I want to go from point A to point B, they pick the driver for me. I don’t pick my driver. And that’s the way Marketplaces, labor Marketplaces of the future will be built, and it’ll be using AI.

Diego Castro. Overall, what’s my view of the second hand fashion space? So, In the U. S. No one has cracked the not done very well. You know, posh and it’s also very fragmented. You have posh mark. You have the real real for the four to five items you have, and it’s all over the place. It’s a hard place of Craigslist, and none of these have great user experiences.

There is a unicorn company, and I mean that in the best possible term. Like it’s a one of one magical, extraordinary company. It’s revolutionized the space. It’s It’s going to be a 50 billion plus dollar company is going to, and it’s the most beautiful, extraordinary fashion company in the, in the world.

It’s called Vinted. Vinted was run by my former right hand man at OLX. His name was Thomas. He was also working with me at, at FJ Labs. We helped built a mobile classified company in Spain called Wallapop. In the U. S. we ended up merging and the, the U. S. operations had let go. And, and so he went in to Vinted, turned it around.

And the way it works is it went completely free. So it’s free to, it’s free to buy, et cetera. But, and, and it monetizes the, the person getting value. So if you’re a buyer, If you want to pay for shipping, and if you want to pay for escrow, you pay five percent plus the shipping fee. And if you’re a seller, if you want to head home and pick it up, you pay.

But you don’t take commission anymore. And that’s unlocked extraordinary liquidity. Plus, they have amazing user experiences, and they have an amazing shipping system platform and payments platform. And the company has grown. They’re now at six billion in GMV. I think they’re at like six hundred million in net revenues.

Like, eighty million free cash flow. crushing and growing like this. They’re expanding right now in luxury. In one year, they’re two thirds of the size of Vestiaire, which is a big competitor of the category. I think they’re going to win luxury. They’re going to expand to other categories. They are going to be at least 15, I think a 50 billion dollar company.

They’re one of one. If you’re interested in fashion, marketplaces, Vinted is the one to look at. They are the winner. They’re going to keep winning. Ivan, what are your thoughts on apps that facilitate connections between people? Do you think the market is already saturated or there’s still room for innovation and growth?

Not sure if you mean things like dating or you mean things like LinkedIn. Probably, look, are there new vertical niches that can be invented in general? The answer is yes, right? Like, so the, if you think of LinkedIn. LinkedIn, the, the whatever, oil services workers are not on LinkedIn, they’re on a RigUp.

And so are there verticals where, where you can create connections, business connections with people that are, happen not to be in LinkedIn, like blue collar workers? Absolutely. And in dating, people have been going more and more niche and new sites keep emerging. Now, by the way, I don’t love dating sites as a business because, , you’re, if you do your job well.

You’re going to lose your customer if you match them to someone they love. And so, on average, customers are part of dating sites for six months. So that’s not ideal. , but that said, do I think there are ways to improve connections and also make it more automated? Like, oh, I, the AI, know everything about you and I know everything about the other person.

Therefore, this is really the person you should meet. And have way less work. Absolutely. And that’s true in dating. That’s true in business. That’s true in hiring, etc.

Shagun Holder. We are building a marketplace that elevates the workplace experience, both in the office and beyond, using AI and AR to improve discovery, onboarding, storytelling, and overall experience of tech journey. Mimicking Airbnb. Okay. Is there a question? What is your opinion of AI and AR to create better experiences?

So AR will be in the future, a profound platform shift. The fact that we’re spending all our time in these devices, we’re like hunched over like the typing is limited in this tiny screen with typing and limited speed makes absolutely no sense. That said, something like the Apple Vision Pro is not the answer.

It’s too heavy. It’s too expensive. It’s too cumbersome. The, I imagine the AR, the AR revolution. Now, of course, you can have AR on your phone, but the real AR revolution will happen once You can have like intelligent contact lenses and or glasses that have lasers and lasers right in your retina. So you have your full over field of vision.

And, ideally, instead of using your voice, you probably use your thought, because it’s kind of weird to talk out loud in the middle of a room, etc. So I think thought control. We’re pretty far from it, though, on both those points. So, like, intelligent contact lenses are pretty far right now. We’re, like, able to tell if you have glaucoma, but that’s basically it.

Glasses, of course, with screens exist and they’re okay ish, but then they’re still controlled by voice. So I think the revolution is coming. I, I’ve, look, we’ve looked at brain computer interface companies and not just Neuralink, but Paradromics, many others, I’ve seen the first instant of a thought to text.

conversion that is essentially 100 percent accurate at like 100 words per minute. Now, of course it requires brain surgery, so we’re not at a point where it’s just putting electrodes in your head. It’ll happen. That’ll take a long time. I think 15, 20 years, maybe 10 years on the early end. VR, you know, for instance, it’s been early for a long time.

It’s been too many platforms. Not enough great use cases. I’m hoping VR, by the way, I mean, not your business. I understand yours is AI plus AR, which I think makes sense. And in a phone probably makes the most sense right now. You have AR, you look at the world and you can get some stuff, but feels reasonably niche, at this point.

VR may be on the cusp of becoming more mainstream because of the Quest 3S, which is 299, so it’s at the right price point. It’s good enough. And, especially for tweens, as you start having things like,, Gorilla Tag, and like,, Squidoo, which is like these Roblox type games, that are inherently social, it probably I think there’s they’re there.

It’s finally getting there. But AR feels early. Especially, like, the AR glasses today are still clunky, not great, etc. That said, better experiences in general are better. Obafemi Ayahi, sorry for butchering your name. Curious your thoughts on AI, the intersection of media, and how you think it will evolve from an IP standpoint where dollars flow.

There are a few companies that have been created to try to intermediate, Oh, we have interesting content, you want to run your LLMs on it, and you can do that thing. News Corp famously signed a 50 million deal with OpenAI to provide their data, in order to be traded. I think this is okay. It’s not a huge business.

Media The problem with media and information, you know, is it tends to It’s not that wants to be free from an information perspective, but it’s not extraordinarily valuable. So I don’t particularly care. I don’t invest in media companies for that reason. The, you know, the ones that are actually creating content, it’s not a business that is amazing to me.

It’s expensive. It’s head driven. And that’s true, whether you’re in the Netflix types of the world, or if you’re in the newspaper type of the world, so I don’t spend a lot of time thinking about it. I suspect there’ll be, A marketplace where the content provider is and the people that want to access the data.

But I don’t think it’ll be a big business. I, I think it’ll be small dollars. sings, thank you for doing this. What are your examples of the picks and shovels you’re investing in? The catch on the AI boom, which you referenced in your slide. So a an example is, a company called HeyGen. They’re, they’re trying to re prevent hallucination.

And, and so obviously many, many. current data set. Many AI models right now just make shit up. And obviously it doesn’t matter if you’re, you know, I’m trying to code something and I’m asking for help in the coding. But if you’re like mission critical environment, you can’t have like things be made up. And so companies that are helping provide,, yeah.

Solve hallucinations would be an example. Or in And the crypto space were investors in a company called Render. Render is a distributed GPU. So all the gamers in the world have these powerful GPUs, which they use while they’re gaming. But even a hardcore gamer is probably not gaming more than eight hours a day, with a few exceptions.

So your GPU is unused most of the time. And so you connect your GPU to the Render network. And so all of a sudden you create a distributed network of millions and millions of GPUs that companies like OpenAI and others can run their simulations on. And so that makes a lot of sense. And they’d say it’s a way to play the, the NVIDIA type boom with that, with that, despite being late in the party, if you want.

And so companies like that, I think, make a lot of sense. Now, the question that I received by email before from Jimmy that I didn’t answer is what are the AI tools that I currently use? Now, what’s interesting is I used to use a lot of tools. I used to use tools for presentations. I used to use tools., I don’t even remember the two, the two that I used to use to make, to make PowerPoints.

I used to use mid journey, you know, and encoded on discord. I used to use a Runway and honestly, I’ve stopped using all of them. I just use ChatGPT. I whatever I’m looking for research, coding help, images. I mean, GPT can do it. So right now I’m a ChatGPT power user. Every, I’ve stopped using Google. Basically I use GPT for everything and it’s my like advisor and research assistant and analyst.

I mean, you name it, it does it. I mean, I’ve, I’ve sometimes I’ve uploaded like, Oh, this is a fundamental problem I’m facing. What are the ideas and how to go about it? And like the level of the work, the output it puts. It’s extraordinary. Now, you need to have the right queries, give it the right data, but I’ve been beyond impressed.

So, GPT is definitely, ChatGPT is definitely the core product I use. I recommend everyone else to use it. Yeah, I think you’re under utilizing it for sure. Let’s see, what other questions I got by emails? I have a question on your AI thesis, question from class. Taking into consideration that you’re a contrarian AI and assume you’re likely to invest in AI focused now, what is your recommendation towards founders or technology enthusiasts about AI who want to explore technological solutions using AI or find funding?

So first of all, find funding I think is the easier part. The AI is in a boom right now. If you’re building an AI company, I suspect you will get funding. There are enough VCs that want to be investing in AI that there is money out there. So I wouldn’t worry about that. The contrarians in the room were far and few between.

I’m happy to be one of them, but everyone else in the other side of that equation. So you will find funding. In terms of playing with it, it’s easy. I mean, look, I coded my own AI because I want to understand how hard is it, how differentiated is it, how good is it? And. Many things are not as complex as you think.

I mean, coding in February’s AI took a couple hundred hours of work. And by the way, it would have taken a lot less if I just waited for GPT 4.0 to come out. But that’s what told me, okay, all these copilots, it’s not really that interesting. They’re easy to build. I can, I could probably build it myself, right?

Like, so understanding the new, what is possible and what is not possible by coding your own is a great way to go about it. And it’s easier than it’s ever been, right? Like you used to have, but yeah, we’re using a MongoDB database and you need to build an API to Whisper. I mean, there’s, you need some coding skills, but let’s say today you need significantly lost coding skills you need 12 months ago.

And by the way, Okay. I have the best coding teacher assistant possible. It’s called ChadGPT. The other day I wanted to take a YouTube video that I’m, it’s pretty easy to embed in my blog, but I wanted to, it was a vertical format, and I wanted to make sure that it was showing in vertical, not horizontal. I asked GBT how to do it.

It gave me four solutions. I then said, Hey, I’m lazy. Here’s a URL. Can you code it? Give me the exact code. I copied and pasted. Poof. It works. The GPT can do a lot of things for you. As I said, more than you think you can, but it’s pretty easy to get into the coding and understanding what you can build, what you cannot build.

By the way, FabriceAI is built only in Fabrice content, not the internet, by design, right? It’s to get my perspective, not the world’s perspective. What’s your take on the LATAM market? Any potential for growth in the second hand fashion industry, specifically the Vinted model? So maybe, but here’s the key for the Vinted model.

The Vinted model works because they’re using cross border liquidity. They’re using Items in France to sell them in Poland and whatever from Lithuania to sell in the UK And that requires that and you’re using AI to actually translate the listings and the conversation So you could be speaking Lithuanian and the other person is speaking Spanish and will all be in your native language on both sides That’s great.

But then shipping has to be super cheap and payments have to be super cheap. And in Europe today you can ship an item from whatever Lithuania to Paris and it cost two euros or two dollars to ship. And payments be cheap right and there’s no customs and etc right now. It’s this is not really easy to do in Latin America.

You can’t ship from Brazil to Argentina for two dollars anything and then their customs is complicated. So, the problem is more structural and it’s not something you can fix. It’s structural at the the government customs level than it is anywhere else LinkedIn user. I’m the founder of a small marketplace, SomasHome .

Three million year one, four million year two. The Netherlands. I want you to use AI to help customers directly find the right products. We noticed some sellers are against it because they fear they will turn to self fulfilling prophecy, making it harder to compete against other sellers. What is your opinion on this?

So look, whether or not you should be using AI for discovery, I think to me depends. There are there multiple types of marketplaces. You have marketplaces where people know exactly what they’re looking for. So then it’s a search, and you should give them exactly the item you’re looking for. That’s Amazon.

And I want this specific model. I get it. I get the best one. Use AI to give them the best one. Boom. Done. Number two, there are people that like to browse. They’re browsing marketplaces. Classified sites are like that. Or Vinted. Vinted. People don’t usually go knowing what they’re looking for. They’re just like It’s shopping as entertainment.

I’m browsing because it’s fun to see what’s available, etc. So it’s entertaining to be browsing once in a while I buy. Again, you should not use AI because that’s not what people are not looking for efficiency. They’re actually happy to be browsing. Number three, there’s considered purchases. Something’s more complicated and nuanced, right?

Like the right car, the car you want to buy, you just want to see it and buy it. You want to test it and know the units the specifications that compares to the other models or the house you buy and, and, or maybe if you want to buy high end sports equipment, you know, the right skis for you, there’s a company called Curated.

I think something like Curated probably gets disrupted by AI, or at least the people would get replaced by AI because AI could probably figure out where the right skis are for you better than having a human to be suggesting what is the right ski. So. I would put use AI in the right context.

So if it’s the context of like, this is a considered purchase where the decision tree is complex and AI can help, I would absolutely implement it there. Shikhar, do you have perspective which roles functions within large mid tech companies will be most impacted or replaced by AI? So by the way, impacted and replaced are two very different things.

Okay. I mean, they’ll all be impacted by AI, but often will be made better by AI. And, and the, it’s interesting. I can make an argument going both ways. So first of all, every programmer will use AI tools to be a more productive programmer. And maybe it’ll turn the average programmer into better programmers.

Or maybe it’ll, the best programmers will use it so much better. There’ll be even more productive programmers. I don’t know the answer to which of these two, or maybe both will happen. The average programmer will be a lot better than they used to be, and the best will be even better. So I suspect that will happen, but will the AI completely replace the people?

Probably not, right? So like, so human plus AI will be better. Now, are there frontline customer care functions that should be replaced? Yes. And by the way, this reason I invested in figure, There are a lot of jobs humans are not meant to be doing, right? Like, we’re not meant to be doing this a thousand times over, and this has largely been already automated in car factories.

And so, should we be, you know, carrying heavy boxes and doing whatever Amazon or UPS or FedEx deliveries? Probably not. This, probably better. Or flipping burgers, right? These are not jobs that are, like, allowing us to flourish as humans where there are empathy and emotional intelligence, etc. And so those jobs will partly be fully replaced, but many most other jobs a sec will be a combination of the two, and I don’t worry at all about.

Oh, there’s gonna be massive unemployment. I will replace all those jobs. It’s gonna be terrible for humanity. Let me drizzle in the history of humanity. The only thing technology has done is it’s improved productivity, made things cheaper, improve your purchasing power, allowed us to work less and have a better quality of life.

And so the Luddites who were against the, the introduction of the, of the automated loom, were wrong. And every Malthusian type constraint and, and concern people have had in the past have been wrong. And, but people may be like, oh, but this time is different. So let me tell you a story. Let me take you back to 1999, 25 years ago.

So we’re in 1999 right now. So you we’re teleported back magically and we’re having a conversation, and I’m telling you in 2024. The top four job categories of 20, of 1999 will have disappeared. There will be no more bank tellers. There will be no more travel agents. 500 billion of retail will have been decimated.

We will move it online. And so the local commerce will have been decimated and all of car manufacturing will have essentially been automated. And these were the top four job categories. Please now describe the economic conditions in 2024. And because it’s so easy to imagine the jobs lost and so hard to imagine the jobs created, people would have been like, Oh my God, Great Depression, 25 percent unemployment, it’s the end of the world.

And yet today we have lower unemployment, higher employment, lower unemployment, higher wealth, than we did 25 years, significantly in all categories. Despite these massive jobs, categories of job losses because of automation and the same thing will happen, you know, truck drivers will be replaced and a lot of things will be automated and it’ll be okay.

Many new jobs will be created. There’s always comparative advantage. Even if a computer or a robot was better than you at everything and cheaper than you at everything, there’s always a limited resource, which is like compute power. And so there’s still things or energy. And so there are things that will do and things we will do and new jobs will be created.

And I suspect in a world where more things automated, people will value the personalized human touch. So here’s a few examples of how I can imagine jobs changing right now when you go to the doctor, you’re treated really like a cog in the machine, like , I get a number, I wait, I’m seen in the most efficient, fastest way possible by a doctor that’s busy, gives me a diagnostic, you know, moves on to the next patient.

It’s pretty horrible and dehumanizing. Do I think that actually doctors, so doctors, whatever role they’re playing today, they’re a diagnostic machine. They’re looking at me, they’re getting, they’re based on the symptoms and their past experience, they guess what I have, or they make an assessment of what I have, they make a recommendation, and then they move on.

But it’s pretty dehumanizing. But are doctors really the best at diagnostic ing in the future? Can I imagine that the AI will look at every micron of my MRI, will be up to date on all the latest research, will have read all the PubMed articles, will know the pros and cons, will have looked at my specific genotypes and all my Apple Health data, and it’ll know better who I am and what’s right for me.

So will, can I imagine that the diagnostics will be done by the AI? Yes. It doesn’t mean the role of the doctor goes away, I actually think that it will be the opposite. The role of the doctor, he will be the warm, charming, empathetic person that will translate, okay, the AI says the following for the following reasons, and I’m sorry that you have to be going through this, but he will make sure that you comply, for instance, take your medicine, right, like, right now, no one’s they prescribe you a drug, they don’t prescribe, they don’t verify if you’re taking it or not.

That makes no sense. Or let’s think through the, the role of the teacher. Right now, if I take Socrates from 2500 years ago to the modern world, you would be amazed by the world we live in. We fly, we go to space, we have like these magical, invisible communications devices. It’s insane. And yet, the one thing you would recognize is the way we educate our kids.

We have a teacher of varying quality teaching, spewing facts. So the teacher is a fact spewing machine, spewing facts at students at varying quality. That makes no sense. The best students are bored. The worst students are lost. I can again imagine the world changing where the AI will be the teacher providing personalized education to each kid based on the level of where they are.

And the teacher will be a consultant, a coach. When someone’s struggling or having trouble understanding will help you guide you through to get to understanding what the AI is trying to teach you and get to you. And so it’ll be a profound shift, but will the role disappear? No, it’s just it will change in light of that.

Steven, do you know of an AI workflow that can help scale websites? We work in MedTech that can scan Google for keywords, search of databases and can help us generate lead, lead flow, Yeah. We just invested a company that is trying to do that. Of course, the name is escaping me right now. Shoot me an email and I’ll follow up with it.

I’d be actually surprised out of curiosity if you can ask him GPT to do it and see how good a work is. Spherio, just ask your friend or mutual friend ChatGPT what question it would ask you on AI. Here you go. If AI could amplify one quality of humanity, positive or negative, which do you think is most likely and why?

I’m an, I, I’m an optimist. , And I think actually history proves me right. The last 200 years have been so profoundly extraordinary, right? Like the quality of life that we have today would make the kings of yesteryear blush, right? Like 200 years ago, we lived to the age of 29. We worked 80 hours a week, seven days a week to barely make ends meet.

We would go hungry multiple times a year. And because the technology has made things so much cheaper that now everyone has running water and electricity and we’re going on vacation. I mean, like only the rich used to go on vacation. We’re going on vacation. We have all this magical information. We take it for granted, but we are so privileged and we should be so full of gratitude.

And so when I think of what is ultimately going to be the impact of AI, I think AI will continue to be deflationary, will continue to improve our quality of life, and it will give us time to do what we want. Now, humans can use this free time in whatever ways. We could play video games, we could, we could explore the world.

And that’s okay. The meaning of life is actually life itself. It’s to find your own purpose and joy in the things we do. And you’re not here to be the most productive that you can be. And it’s okay if you’re playing video games or going for a stroll in nature and being bored, etc. And I think we will rediscover the joys of that.

Now, I think part of the mental health crisis actually is coming from the fact that People used to get purpose from the job they did, and now they’re working fewer hours, they have more free time, and they’re not sure what defines them, what purpose they have. And I think it will be the challenge of the 21st century to figure out what our purpose is in a world where we need to work less.

So I’m profoundly optimistic that it’ll make our lives better and yeah, there will be a period of adjustment and there are moments that are going to be less great. And yes, you can use AI negatively, right? Those can happen. Wars where like robots or drones are controlled by AI, et cetera. But in the end, technology is moral.

It’s what humans, we do with it. And I think ultimately most people are good and, we’re going to figure out the right answer. Shikar. It says like AI’s deflationary effects are likely to impact healthcare and education at first. Whether they’re non obvious verticals or you hypothesize AI might act as a deflationary force.

So I’m actually not sure they’ll impact it there first. Because these are highly regulated industries, there is very, there, it’s hard, it’s hard to bring there to the full force of tech. So if you look at like things, prices of things over time, the things which have been touched by technology have been getting cheaper and cheaper and cheaper and cheaper.

And things that have been not touched by technology have been getting more and more and more expensive. And I would like AI to start impacting health care and education, but actually don’t think it will touch that first. I think it might touch that reasonably late. You have things like public unions or health insurance companies, et cetera, that are, the teachers unions that are probably going to be against a lot of the things I’m discussing.

And, and you need people to get comfortable with the idea that your diagnostic is done by AI and not a human, right? Like, it’s taken for a long time for people to get comfortable with the idea that cars will be better off driven by humans, by AI than by humans. Humans are terrible drivers, you know, not considering the fact that we get drunk or fall asleep.

On average, we don’t drive particularly well, and yet we all think we’re above average drivers. AI will do much better. We will number of death will decline dramatically but people are not yet comfortable with that. It will happen. It’s gonna take a while. So, I guess I answered a I was disagreed.

I think it was good. It’s gonna take longer for health care and education to actually be disrupted by, though, I think will be, but that’s gonna be in the more 10 year time frame than the two year time frame. That’s here. So it’s gonna happen. You’re gonna use it personally. Like, you need help with your math homework, use Khanmigo.

Khanmigo is the Khan Academy AI. It’s fantastic. Use the Socratic method. So, people that are motivated will be the first adopters of it. Same thing, you’re going to use AI for diagnostics personally before it is in the doctor’s office, before it is in school. It’ll happen, but that’s more on the later side.

What will happen first? Yeah, no, I think first is what I said before. The early adopters are gonna be startups and individuals. So startups are gonna use it, lower costs, get better programming, make their programs more productive, lower customer care costs, improve sales productivity, and individuals would use it to be better, but the rest will take longer.

If I ask a follow up question, I build the entire marketplace on WordPress, WooCommerce, we are generalistic like Amazon. We use no AI whatsoever now. I’m learning by trial and error, but you’ve already done what I’m doing. What would you recommend as a first AI step? Customer service, product search, or other?

Depends what people are, so I guess your name doesn’t show up. It depends what people, how people are searching or using your site. If they’re searching, Then just find, show them our product, they’re browsing, just let them browse. Now, if it’s, as I said, if it’s a consider purchase, then maybe you change the purchase flow.

I would probably not do any of that. I would use an, the first thing I do, would do first is I would use an AI bot on the, on the website that says, Hey, is there anything I can help you with? And like guide people through a purchase and/or customer care. So combination of like a guided help on purchase and customer care is where I would, I would use AI changing the flows and buying and selling more complicated.

if you’re a marketplace, maybe the sell side afterwards, where you can make it easier to list, where you pre fill title category description of even price for them. The buy side experience is, is the last thing I would touch. Start with like, start with customer care, maybe AI assistant bot for buying, and then self assist.

Diego, if you start a business from zero today, which kind of industry or model would you pick? The, so there are multiple ways to answer the question, right? One way to answer the question is like, what are the categories that need to be disrupted monetize them, right? And there’s many B2B industries where that’s true.

I think robotics is another, et cetera. But that’s only one side of the equation. It’s a big, attractive market is one part of the answer. The second part that matters just as much is what do you like to do? What is your expertise? What is the problem you want to solve? Like being a founder is like you’re all in and you need to be, do something that you’re going to love doing.

And ideally that you have a competency for doing. Right? Like would I like to cure, you know, find a, a, create a longevity recipe? Yes. But am I the best biotech guy in the world to go and like create the drug that is getting proof of longevity? Probably not. So love the idea of it existing. Want someone to do it.

Probably not going to be me. And you know what Brad is doing with Figure robots. Amazing! 10 trillion company to be built. Going to change the world. Probably not the right guy to do it. He is, I’m not. So you need to think through the Venn diagram intersection of the skill sets you have the interests that you have, and something that is monetizable and attract, and interesting.

And one thing to note, for instance, I said BD, digitizing BDB supply chains. Look, this is trillions and trillions and trillions, and we’re at like 1 percent penetration. But, probably helps to come from the industry, right? Like the average CEO over B2B marketplaces is like 45. Is someone, because if you want to convince whatever Dow Chemical to put their catalog online, it’s better, you’re going to have more credibility if you come from the industry than if you’re like a 23 year old computer scientist from Stanford that says it should exist, it should be more efficient.

Versus if you come in, you speak their language, you understand the pain points that they’re facing, you’re going to have the credibility. And so, I usually pick something that makes sense in that light. Now, what would I want to build today? You know, I thought about it. The reason I haven’t started a new business is it only makes sense for me to build something at this stage if I’m going to move, if it’s going to be massive.

It needs to be a 100 billion company plus. Otherwise, the option and cost of my time isn’t worth it. Especially given the leverage I get by helping so many founders, right? I’m an investor in companies. And I inflect each of them small, in a small way, but I think in a meaningful enough way. And so having like, it’s about 2000 founders that are like, I’m working through with them to make them better is, is massive, massive impact and leverage.

And I think I can really help them both on strategy and like fundraising, et cetera. So to give that up, it has to be something big. And the problem is many things, it’s not obvious that they’re big early, right? So when. Airbnb was started. It was like inflatable mattresses in people’s living rooms. Well, it’s not that big.

You know, it didn’t feel big. Of course, ultimately, it was, it was a new way of traveling and monetizing an asset that was underutilized. It became a ginormous category, but it wasn’t obvious it was going to be big at the beginning. Likewise, Uber, at the beginning, was really a black car, rich guy service. It didn’t feel very big.

In fact, Garrett chose to do stumble upon rather than to do Uber because he thought it was a bigger opportunity. It just turns out that when you create it for, with UberX for the masses, it is a ginormous opportunity and the quality improvement relative to taxi is so big that people are willing to do it.

And so the reason I’ve been starting something is like, it needs to be obvious from the get go that it’s very big and I need the right guy for it. So hasn’t happened to me since OLX, I’m actually not against the idea of doing it, but. TBD, right now, I’m pursuing a different entrepreneurial journey, like I’m, I didn’t join a VC fund, I’m creating a VC fund, which is like kind of a startup in its own.

You’re defining a strategy, you’re defining the culture, you’re hiring people, you’re raising money on a permanent basis, etc. Shecar, besides GPT, Cloud Gemini, what AI tools do you use in your personal and business workflows? Honestly, I just use GPT these days. And I combined that with an amazing virtual assistant in the Philippines that I hired in Your Remote Assistant.

But there’s a few you can look at, like Athena. And those two together are extraordinary. But no, it’s GPT is my, is the one I use for everything. As I said, in the past, I’ve used, I think, double. I’ve used, I’ve used Midjourney, I’ve used many. But yeah, I use GPT for everything. And Spherio, pretty sure French Open will continue to use live line judges.

You may be right. I think there were a few calls this year that were pretty bad where they looked at the wrong bounce. They may mix the two. They may have Hawkeye with a challenge system plus lines. And eventually, I mean the French are not the early adopters as we well know, but I think eventually might even the French Open might get there, but we’ll see.

I think, though, the other three are, have gone fully Akai AI. So I think Wimbledon, Australian Open, and US Open, but we shall see. But I think they’re going to start having Akai available on Central Core in France. Let me see if there were any other questions that were submitted that we haven’t covered.

Steve Drobny is like, oh, shocked Technobro agrees with me. Okay. And, I think, no, I think that’s kind of it. We’ve covered, , everything. So unless anyone has any more questions, , we’re gonna, we’re gonna end it here. So let me see if what’s coming in. Let’s see. End of meeting. What is one mistake you see in many marketplaces founders make?

The biggest mistake marketplace founders make is getting too much supply. And then you’re overwhelming your marketplace with infinite liquidity, infinite supply, but you have no buyers. And so the supply churns and they’re not happy and they leave. And so, imagine I want to build a locksmith marketplace.

I don’t how many locksmith there are in New York, but a couple thousand. I could probably call them all and say, Hey. Do you want to be in my locksmith marketplace? Don’t really have the man right now. It’s free. We’ll take a commission if we want to use someone. They’ll say yes, of course. But then, they’re gonna be in the marketplace.

You’re gonna have no one for them. To the point that one day when one person uses it, they’re gonna have forgotten you exist. They won’t reply and the user experience is gonna suck. So, get the very best supply. Highly curated for the marketplace. At the level, the amount that you need that is minimally viable.

Maybe it’s one neighborhood, maybe it’s one vertical, whatever. Then you delight them. You bring them a few buyers. You try to represent 25 percent of their revenues. Or if they’re selling items, you want 25 percent of the used items to sell. And I apologize, there’s background noise.

There’s a bit of construction that’s just restarting. So we’ll end this shortly. And once they’re happy, then you scale. Then you add another supply. So always scale supply and demand in parallel. It’s very easy because sellers are financially motivated to be a marketplace. So, it’s easy to get millions of sellers.

But if you have no buyers for them, it’s not very useful. So get the right seller, find them buyers, and get a few more, and keep scaling in parallel. Liquidity is when you have at least 25 percent of the items that are selling, that are, that, that are listed that are selling and use good marketplaces.

Ideally, it’s 60%, by the way. I’m just saying minimum, like, liquidity. It’s 20 25%. And I’m on labor marketplaces. Let’s say you represent 20 percent of the revenues, 25 percent of the revenues. I’m a web summit in Portugal. Just met Thomas from Vinted. Great guy. My startup, Vitrina, starting to build Vinted for LATAM.

Happy, send my way. you can contact me on LinkedIn or you can add my email. It’s [email protected]. It’s hard to do, but if you can figure a way to do shipping and payments and etc, all at very low cost and be a very low cost provider, it might work. It hasn’t been intuitive to me that you could do it in LATAM, but maybe the markets are improving and we’re getting there.

But yeah, happy to look at it. It’s definitely the type of thing we look at. Shikar, I’ve read about your amazing expedition to the South Pole. Any more adventures like that coming up? So in my 2024 adventure is being a father to a new daughter. I have a eight month old daughter, and that’s taking a lot of time and she’s amazing.

Probably in 25 I will continue to be that. I also have a one year old puppy, so that now I have a three year old son and his eight month old daughter and a one year old puppy. In 26 though I have an expedition plan. I want to, I want to snow kite From Western Greenland to Eastern Greenland. So, I’ll be pulling my sled with my tent, my sleeping bag, and all my gear.

And hoping that I can do, like at least 100 miles a day snowkiting across Greenland for, like, a week or two completely off grid. So, current next adventure, it’s in the planning stages, so we shall see. But if not, you know, I, and by the way, I don’t just do cold adventures. I’ve crossed Costa Rica from east to west on mountain bike. I’ve hiked in Guyana to like the gold mines to the Khyber falls, which is the largest single drop waterfall in the world. I’ve, I’ve done the animal migrations with the Maasai warriors living with the Maasai warriors in Tanzania. I mean, like, so I do a lot, I do adventure stuff, extreme adventure stuff for fun all the time.

Well, all the time, once a year, typically. Ah. So I think next one, 2026, yeah, crossing Greenland by Snowkite, but you know, TBD, lots to be figured out. Anyway, this was amazing. Thank you all for joining. So I think the next show I’ll do will be episode 47. We’ll cover latest marketplace trends hesitating between next week, or early December.

So we’ll see. We’ll see. But yeah, that’s it. Thank you all for joining. This has been super interactive and super fun, and I’ll see you in the next one.